National Grid 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

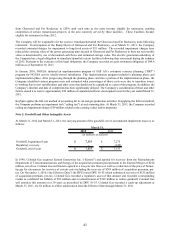

Service Company Audits

In February 2011, the NYPSC selected Overland Consulting Inc., a management consulting firm, to perform an audit of

the Company's service company cost allocations, policies and procedures. A report of this review to the NYPSC is

expected by September 2012. Management is not aware of any material misallocation of costs from the service company

to the New York utilities and we do not expect the audit to result in any material adjustment to the consolidated financial

statements.

In November 2008, the FERC commenced an audit of NGUSA, including its service companies and other affiliates in

the National Grid holding company system. The audit evaluated our compliance with: 1) cross-subsidization restrictions

on affiliate transactions; 2) accounting, recordkeeping and reporting requirements; 3) preservation of records

requirements for holding companies and service companies; and 4) Uniform System of Accounts for centralized service

companies. The final audit report from the FERC was received in February 2011. In April 2011, NGUSA replied to the

FERC and outlined its plan to address the findings in the report, which we are currently in the process of implementing.

None of the findings had a material impact on the consolidated financial statements of the Company.

Note 3. Employee Benefits

The Company sponsors several non-contributory defined benefit pension plans (the “Pension Plans”) and several

postretirement benefit other than pension plans (the “PBOP Plans”). In general, we calculate benefits under these plans

based on age, years of service and pay using March 31 as a measurement date. In addition, the Company also sponsors

defined contribution plans for eligible employees. The Company participates in the following Plans: The Final Average

Pay Pension Plan (FAPP), National Grid USA Companies' Executive SERP (Version I-FAPP) (ESRP), National Grid

Deferred Compensation Plan, National Grid Executive Life Insurance Plan, National Grid Directors' Retirement Plan

Eastern Utilities Associates (EUA) Retirement Plans, National Grid Retirees Health and Life Plan I (Non-union),

National Grid Retirees Health and Life Plan II (Union), The KeySpan Retirement Plan, Retirement Income plan of

KeySpan Corporation, National Grid USA Companies’ Executive SERP, Excess Benefit Plan of KeySpan Corp.,

Supplemental Retirement of KeySpan Corp., KeySpan Executive Supplement Pension Plan, Retirement Income

Restoration Plan, Supplemental Death and Retirement Plan, Supplemental Death and Retirement Plan, Eastern

Enterprises Supplemental Executive Retirement Plan, Eastern Enterprises Supplemental Retirement Plan for Certain

Officers, Eastern Enterprises Trustees' SERP, Colonial Gas Company SERP, Transgas SERP, Essex Gas SERP,

KeySpan Benefit Plan for Retired (West) Union Employees, KeySpan Benefit Plan for Retired (West) Management

Employees, KeySpan Benefit Plan for Retired (East) Union Employees, KeySpan Benefit Plan for Retired (East)

Management Employees, KeySpan Benefit Plan for Retired Boston Gas Company Union Employees, KeySpan Benefit

Plan for Retired Eastern Enterprises Employees, KeySpan Benefit Plan for Retired Essex Gas Union Employees,

KeySpan Benefit Plan for Retired Essex Gas Management Employees, KeySpan Benefit Plan for Retired Colonial Gas

Management and Union Employees, KeySpan Benefit Plan for Retired EnergyNorth Hourly Employees, and KeySpan

Benefit Plan for Retired EnergyNorth Salaried Employees.

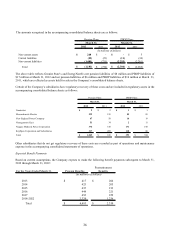

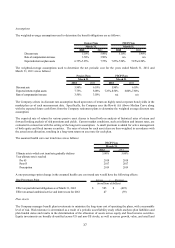

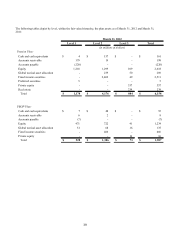

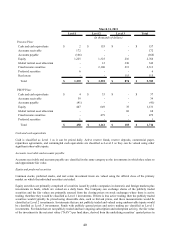

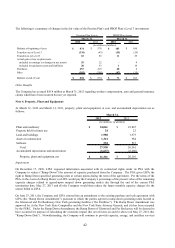

Pension Plans

The Pension Plans are comprised of both qualifying and non-qualifying plans. The qualified pension plans provide

union employees and non-union employees hired before January 1, 2011 with a retirement benefit. Supplemental, non-

qualified, non-contributory executive retirement programs provide additional defined pension benefits for certain

executives. We fund the qualified plans by contributing at least the minimum amount required under IRS regulations.

The Company expects to contribute approximately $359 million to the Pension Plans during fiscal year 2013.

PBOP Plans

PBOP Plans provide health care and life insurance coverage to eligible retired employees. Eligibility is based on age and

length of service requirements and, in most cases, retirees must contribute to the cost of their coverage. We fund these

plans based on the requirements of the various regulatory jurisdictions which the Company operates. The Company

expects to contribute approximately $396.5 million to the PBOP Plans during fiscal year 2013.