National Grid 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

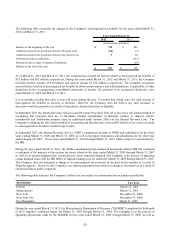

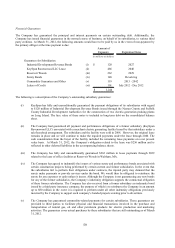

Debt Maturity

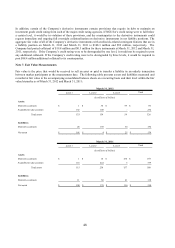

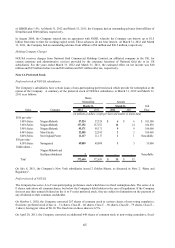

The following table reflects the maturity schedule for our debt repayment requirements at March 31, 2012:

(in millions of dollars)

Years Ended March 31,

2013 195$

2014 565

2015 579

2016 1,026

2017 511

Thereafter 5,901

Total 8,777$

The Company is obligated to meet its non-financial covenants for these notes payable and during the years ended March

31, 2012 and March 31, 2011 the Company was in compliance with all of such covenants.

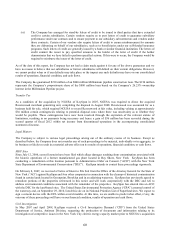

The following table reflects the sinking fund repayment requirements at March 31, 2012:

(in millions of dollars)

Years Ended March 31,

2013 7$

2014 7

2015 7

2016 4

2017 1

Thereafter 11

Total 37$

Commercial Paper and Revolving Credit Agreements

Commercial Paper

At March 31, 2012, the Company had two commercial paper programs totaling $4 billion; a $2 billion US commercial

paper program and a $2 billion Euro commercial paper program. In support of these programs, the Company was a

named borrower under National Grid plc credit facilities with $850 million of the facilities being available to the

Company. These facilities support both the Parent’ s and the Company’ s commercial paper programs for ongoing

working capital needs. The facilities expire in 2012 to 2015.

The credit facilities allow both the Parent and the Company to borrow in Pounds Sterling or US Dollars. The current

annual fees range from 0.21% to 0.30%. We do not anticipate borrowing against these facilities; however, if for any

reason we were not able to issue sufficient commercial paper or source funds from other sources, this facility could be

drawn upon to meet cash requirements. The facility contains certain affirmative and negative operating covenants,

including restrictions on the Company's utility subsidiaries' ability to mortgage, pledge, encumber or otherwise subject

their utility property to any lien, as well as financial covenants that require the Company and the Parent to limit the total

indebtedness in US and non-US subsidiaries to pre-defined limits. Violation of these covenants could result in the

termination of the facilities and the required repayment of amounts borrowed thereunder, as well as possible cross

defaults under other debt agreements. At March 31, 2012, the Company was in compliance with all covenants.

At March 31, 2012 and March 31, 2011, there was $0 and $735 million of borrowings outstanding on the US commercial

paper program, respectively, and no borrowings outstanding on the Euro commercial paper program.