National Grid 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid USA and Subsidiaries

Consolidated Financial Statements

For the years ended March 31, 2012 and March 31, 2011

Table of contents

-

Page 1

National Grid USA and Subsidiaries Consolidated Financial Statements For the years ended March 31, 2012 and March 31, 2011 -

Page 2

NATIONAL GRID USA AND SUBSIDIARIES TABLE OF CONTENTS Page No. Report of Independent Auditors ...2 Consolidated Balance Sheets...March 31, 2012 and March 31, 2011 3 Consolidated Statements of Income...5 Years Ended March 31, 2012 and March 31, 2011 Consolidated Statements of Cash Flows...6 Years ... -

Page 3

... onal Grid USA and Subsidiaries at March 31, 2012 2 and March 31, 2011, and the results of their ir o operations and their cash flows for the years then the ended in conformity with accounting principles les generally accepted in the United States of Americ erica. These financial statements are... -

Page 4

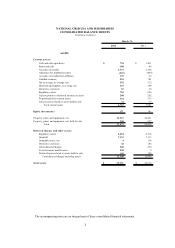

NATIONAL GRID USA AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions of dollars) March 31, 2012 ASSETS Current assets: Cash and cash equivalents Restricted cash Accounts receivable Allowance for doubtful accounts Accounts receivable from affiliates Unbilled revenues Gas in storage, at ... -

Page 5

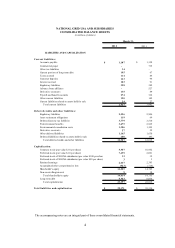

... retirement obligations Deferred income tax liabilities Postretirement benefits Environmental remediation costs Derivative contracts Other deferred liabilities Deferred liabilities related to assets held for sale T otal deferred credits and other liabilities Capitaliz ation: Common stock (par value... -

Page 6

NATIONAL GRID USA AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (in millions of dollars) Ye ars Ende d March 31, 2012 2011 O pe rating re ve nue s: Gas distribution Electric services Other T otal operating revenues O pe rating e xpe nse s: Purchased gas Purchased electricity Contract ... -

Page 7

NATIONAL GRID USA AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions of dollars) Ye ars Ende d March 31, 2012 2011 O pe rati ng acti vi ti e s: Net income $ Adjustments to reconcile net income t o net cash provided by operating activities: Depreciat ion and amortization Amortization... -

Page 8

-

Page 9

... share and number of shares data) March 31, 2012 T otal shareholder's equity Non-controlling interest in subsidiaries Long-term debt: Medium and long-term debt: European Medium Term Note Notes Payable T otal Gas Facilities Revenue Bonds Gas Facilities Revenue Bonds T otal Promissory Notes to LIPA... -

Page 10

... New York subsidiaries include: Niagara Mohawk Power Corporation ("Niagara Mohawk"), National Grid Generation, LLC ("National Grid Generation"), The Brooklyn Union Gas Company ("Brooklyn Union"), and KeySpan Gas East Corporation ("KeySpan Gas East"). At March 31, 2012 and March 31, 2011, the assets... -

Page 11

...FERC"), the New York State Public Service Commission ("NYPSC"), the Massachusetts Department of Public Utilities ("DPU"), the New Hampshire Public Utilities Commission ("NHPUC"), and the Rhode Island Public Utility Commission ("RIPUC") provide the final determination of the rates the Company charges... -

Page 12

... of these operations. The Revenue Decoupling Adjustment Factor ("RDAF") requires Narragansett, Massachusetts Electric, Nantucket, Boston Gas, Colonial Gas, Niagara Mohawk, Brooklyn Union, and KeySpan Gas East to adjust semi-annually its base rates to reflect the over or under recovery of the Company... -

Page 13

... defined its reporting units as its gas distribution, electric distribution, and transmission operations. The resulting fair value of the annual analyses determined that no adjustment of the goodwill carrying value was required for our continuing operations at March 31, 2012 and March 31, 2011. 12 -

Page 14

..., plant and equipment and finite-lived intangibles, when events or changes in circumstances indicate that the carrying value of such assets may not be recoverable. In evaluating long-lived assets for recoverability, the Company uses its best estimate of future cash flows expected to result from... -

Page 15

... benefits other than pensions ("PBOP") assets using the year-end market value of those assets. Benefit obligations are also measured at year-end. N. Supplemental Executive Retirement Plans The Company has corporate assets included in other deferred charges in the accompanying consolidated balance... -

Page 16

... fluctuations in firm gas sales prices to our regulated firm gas sales customers in our New York and New England service territories. The accounting for these derivative instruments is subject to the current accounting guidance for rate-regulated enterprises. Therefore, the fair value of these... -

Page 17

... guidance to have an impact on the Company' s consolidated financial position, results of operations, or cash flows. Goodwill Impairment In September 2011, the FASB issued accounting guidance related to goodwill impairment testing whereby, an entity has the option to first assess qualitative factors... -

Page 18

... three long-term power supply contracts. The cost of power purchased pursuant to the contracts is fully recoverable from customers and, therefore offsetting current and non-current regulatory assets were recorded in 2011 to reflect the regulatory impacts of the contracts. The Company has determined... -

Page 19

...2011: March 31, 2011 2012 (in millions of dollars) Regulatory assets Current: Stranded costs Renewable energy credits Rate adjustment mechanis ms Derivative contracts Pens ion and postretirement benefit plans Deferred gas costs Revenue decoupling Yankee nuclear decommis sioning costs Other Total Non... -

Page 20

... expenditures, the Company will record the appropriate level of carrying charges. The following table presents the carrying charges that were recognized in the accompanying consolidated statements of income during the years ended March 31, 2012 and March 31, 2011: March 31, 2011 2012 (in millions... -

Page 21

...31, 2012 and March 31, 2011: March 31, 2012 Regulatory assets Stranded costs Renewable energy credits Rate adjustment mechanisms Derivative contracts Pension and postretirement benefit plans Revenue decoupling Deferred environmental restoration costs Regulatory tax asset Storm cost recoveries Merger... -

Page 22

... 30, 2011, several state and municipal parties in New England, including the Massachusetts Attorney General's Office, the Connecticut Public Utilities Regulatory Authority and the DPU, filed with the FERC a complaint under Section 206 of the Federal Power Act against certain Transmission Owners... -

Page 23

...the FERC resolving all issues raised by the Massachusetts Attorney General in this proceeding. On July 8, 2011, the FERC accepted the settlement without modification. Niagara Mohawk Electric Rate Case Filing In January 2010, Niagara Mohawk filed an application with the NYPSC for new electricity base... -

Page 24

... calculation of the Long-Term Debt Cost of Capital Rate submitted in the 2009 Annual Update. In January 2011, the FERC accepted in an unpublished letter order Niagara Mohawk' s negotiated settlement of the limited issues raised by the parties on the 2010 Annual Update filing, including removal from... -

Page 25

...Delivery Long Island", issued in Case 06-M-0878, the NYPSC authorized the merger of KeySpan Corporation and National Grid subject to the adoption of various financial and other conditions. One of the conditions was the requirement that Niagara Mohawk issue a class of preferred stock having one share... -

Page 26

..., and in March 2011, the DPU opened a proceeding, as requested by the Massachusetts Attorney General' s Office ("Attorney General"), for an independent audit of Massachusetts Electric' s 2009 capital investments which, in part, formed the basis for Massachusetts Electric' s RDM rate adjustment. The... -

Page 27

... the general rate case involving Massachusetts Electric' s Massachusetts gas distribution affiliates, the DPU opened an investigation to address the allocation and assignment of costs to the gas affiliates by the National Grid service companies. In June 2011, the Attorney General' s Office requested... -

Page 28

... to a December 2010 winter storm. The DPU has the authority to issue fines not to exceed approximately $0.3 million for each violation for each day that the violation persists. On September 22, 2011, the DPU approved a settlement between Massachusetts Electric and the Attorney General that included... -

Page 29

... 1, 2011. The new law also provides for submission and approval of an annual infrastructure spending plan without having to file a full general rate case. In December 2011, Narragansett filed its fiscal year 2013 gas and electric annual infrastructure spending plans requesting a revenue requirement... -

Page 30

... In 2009, Rhode Island passed a law promoting the development of renewable energy resources through long-term contracts for the purchase of capacity, energy, and attributes. In March 2010, Narragansett filed its proposed timetable and method of solicitation and execution of annual long-term contract... -

Page 31

... Delivery Long Island", issued in Case 06-M-0878, the NYPSC authorized the merger of KeySpan Corporation and National Grid subject to the adoption of various financial and other conditions. One of the conditions was the requirement that the Companies issue a class of preferred stock having one share... -

Page 32

... remains pending at the DPU. Associated with its general rate case, the DPU opened an investigation to address the allocation and assignment of costs to the Gas Companies by the National Grid service companies. In June 2011, the Attorney General' s Office requested that the DPU expand the scope... -

Page 33

...will be returned to firm sales customers. On June 1, 2011, in conjunction with the DPU' s annual investigation of Boston Gas' s calendar year 2009 pension and PBOP rate reconciliation mechanism, the Massachusetts Attorney General argued that Boston Gas be obligated to provide carrying charges to the... -

Page 34

...359 million to the Pension Plans during fiscal year 2013. PBOP Plans PBOP Plans provide health care and life insurance coverage to eligible retired employees. Eligibility is based on age and length of service requirements and, in most cases, retirees must contribute to the cost of their coverage. We... -

Page 35

...PBOP costs during the years ended March 31, 2012 and March 31, 2011: Pension Plans M arch 31, 2 011 2012 Service cost, benefits earned during the year Interest cost Expected return o n plan assets Net amortization and deferra l Settlements/curtailments Special termination b enefits Total cost $ 1 18... -

Page 36

..., 2013 $ 368 19 387 $ $ $ $ $ $ $ Changes in Benefit Obligations and Assets The following table summarizes the change in the benefit obligation plans' funded status: Pension Plans March 31, 2011 2012 Change in benefit obligation: Benefit obligation at beginning of year Service cost Interest cost... -

Page 37

... in the accompanying consolidated balance sheets as follows: Pension Plans March 31, 2012 Nantucket Massachusetts Electric New England Power Company Narragansett (Gas) Niagara Mohawk Power Corporation KeySpan Corporation and Subsidiaries Total $ $ 2 232 67 51 376 317 1,045 $ $ 2011 2 195 58 34 338... -

Page 38

... of return for each asset class are then weighted in accordance with the actual asset allocation, resulting in a long-term return on asset rate for each plan. The assumed health care cost trend rates are as follows: PBOP Plans March 31, Ultimate rate to which cost trend rate gradually declines Year... -

Page 39

... asset class parameters established by the asset allocation study. Investment risk and return are reviewed by NGUSA' s investment committee on a quarterly basis. The target asset allocations for the Pension Plan and PBOP Plans as of March 31, 2012 and March 31, 2011 are as follows: Pension Plans... -

Page 40

... hierarchy, the plan assets as of March 31, 2012 and March 31, 2011: March 31, 2012 Level 1 Pension Plan: Cash and cash equivalents Accounts receivable Accounts payable Equity Global tactical asset allocation Fixed income securities Preferred securities Private equity Real estate Total $ 4 179 (220... -

Page 41

... of securities issued by public companies in domestic and foreign markets plus investments in funds, which are valued on a daily basis. The Company can exchange shares of the publicly traded securities and the fair values are primarily sourced from the closing prices on stock exchanges where... -

Page 42

... bonds, and state and local bonds) convertible securities, and investments in securities lending collateral (which include repurchase agreements, asset backed securities, floating rate notes and time deposits) are valued with an institutional bid valuation. A bid valuation is an estimated price... -

Page 43

... Purchases Sales Balance at end of year Other Benefits The Company has accrued $58.4 million at March 31, 2012 regarding workers compensation, auto and general insurance claims which have been incurred but not yet reported. Note 4. Property, Plant and Equipment At March 31, 2012 and March 31, 2011... -

Page 44

... impairment charges have reduced the carrying value of the power generating units located in Glenwood and Far Rockaway to their net recoverable value as determined by use of discounted cash flows and estimated salvage value. The electric generation subsidiary of the Company has a legal obligation to... -

Page 45

... gas purchases associated with our New York, Long Island and New England gas service territories. Our strategy is to minimize fluctuations in gas sales prices to our regulated customers. The accounting for these derivative instruments is subject to current guidance for rate-regulated enterprises... -

Page 46

.... At present, the Company uses fair value hedges, consisting of interest rate and cross-currency swaps that are used to protect against changes in the fair value of fixed-rate, long-term financial instruments due to movements in market interest rates. For qualifying fair value hedges, all changes in... -

Page 47

... balance sheets for the above contracts: Asset Derivatives March 31, 2012 2011 Liability Derivatives March 31, 2012 2011 (in millions of dollars) Current assets: Regulated contracts: Gas swaps contracts Gas futures contracts Gas options contracts Gas purchase contracts Electric swaps contracts... -

Page 48

... consolidated balance sheets and statements of income for the years ended March 31, 2012 and March 31, 2011: Years Ended March 31, 2012 (in millions of dollars) Regulatory assets: Gas swaps contracts Gas futures contracts Gas options contracts Gas purchase contracts Electric swaps contracts Electric... -

Page 49

...If the Company' s credit rating were to be downgraded by three levels, it would be required to post $88.4 million additional collateral to its counterparties. Note 7. Fair Value Measurements Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly... -

Page 50

... for sale securities are included in other deferred charges in the accompanying consolidated balance sheets and primarily include equities and investments based on quoted market prices (Level 1) and municipal and corporate bonds based on quoted prices of similar traded assets in open markets (Level... -

Page 51

... 2011. Other Fair Value Measurement Long-term debt is based on quoted market prices where available or calculated prices based on remaining cash flows of the underlying bond discounted at the Company' s incremental borrowing rate. The Company' s consolidated balance sheets reflect the long-term debt... -

Page 52

... Years Ended March 31, 2011 2012 (in millions of dollars) $ 306 Computed tax Change in computed taxes resulting from: State income tax, net of federal benefit Audit and related reserve movements Outside basis differential in investment subsidiary Investment tax credit Other items, net Total Federal... -

Page 53

...issuance of Revenue Procedure 2011-43, the Company has written off prior year valuation allowance related to New York State net operating losses that are no longer believed to be realizable. The Company is a member of the NGHI and subsidiaries consolidated federal income tax return. The Company has... -

Page 54

... its results of operations, financial position, or liquidity. In September 2011 the Internal Revenue Service issued Revenue Procedure 2011-43 to provide a safe harbor method of accounting that taxpayers may use to determine whether expenditures to maintain, replace, or improve electric transmission... -

Page 55

...The State of New York is in the process of examining the Niagara Mohawk Holdings Inc. and subsidiaries combined returns for fiscal years ended March 31, 2006 through March 31, 2008. Note 9. Debt European Medium Term Note Program At March 31, 2012, the Company had a Euro Medium Term Note program (the... -

Page 56

Gas Facilities Revenue Bonds Brooklyn Union issued tax-exempt bonds through the New York State Energy Research and Development Authority. There are no sinking fund requirements for any of the Company' s Gas Facilities Revenue Bonds ("GFRB"). At March 31, 2012 and March 31, 2011, $641 million of ... -

Page 57

...Company had $53 million of tax exempt Electric Revenue Bonds in commercial paper mode with varying maturity dates from 2016 through 2042 and variable interest rates ranging from 0.35% to 0.90% during the year ended March 31, 2012. The bonds were issued by the Massachusetts Development Finance Agency... -

Page 58

...requirements at March 31, 2012: (in millions of dollars) Years Ended March 31, 2013 2014 2015 2016 2017 Thereafter Total Commercial Paper and Revolving Credit Agreem ents Commercial Paper At March 31, 2012, the Company had two commercial paper programs totaling $4 billion; a $2 billion US commercial... -

Page 59

... 2014 2015 2016 2017 Thereafter Total Asset Retirement Obligations The Company has various asset retirement obligations primarily associated with its gas distribution and electric generation activities. Generally, the Company' s largest asset retirement obligations relate to: (i) legal requirements... -

Page 60

... Development Authorities for the construction of two electric-generation peaking plants on Long Island. The face value of these notes is included in long-term debt on the consolidated balance sheet. The Company had guaranteed all payment and performance obligations of a former subsidiary (KeySpan... -

Page 61

... on its results of operations, financial condition, or cash flows. MGP Sites Since July 12, 2006, several lawsuits have been filed which allege damages resulting from contamination associated with the historic operations of a former manufactured gas plant located in Bay Shore, New York. KeySpan has... -

Page 62

... from LIPA of these investments has been established. We are currently developing a compliance strategy to address anticipated future requirements. At this time, we are unable to predict what effect, if any, these future requirements will have on our financial condition, results of operation, and... -

Page 63

...supplies for LIPA to fuel KeySpan' s Long Island based generating facilities. In exchange for these services, KeySpan earns an annual fee of $750,000. Decommissioning Nuclear Units New England Power has minority interests in three nuclear generating companies: Yankee Atomic Electric Company ("Yankee... -

Page 64

...a return, in accordance with settlement agreements approved by the FERC in May 1999 and July 2000, respectively. The Yankees collect the approved costs from their purchasers, including New England Power. New England Power' s share of the decommissioning costs is accounted for in contract termination... -

Page 65

... of services required from third parties. Such charges are currently recovered from utility customers as gas costs. In addition, Company has various capital commitments related to the construction of property, plant, and equipment. The Company' s commitments under these long-term contracts for years... -

Page 66

... receives charges from National Grid Commercial Holdings Limited, an affiliated company in the UK, for certain corporate and administrative services provided by the corporate functions of National Grid plc to its US subsidiaries. For the years ended March 31, 2012 and March 31, 2011, the estimated... -

Page 67

... common stock of Granite State and EnergyNorth. The parties received FERC approval in July 2011 and NHPUC approval in May 2012. The Company was sold on July 3, 2012 as discussed in Note 14, "Subsequent Event." On September 23, 2011, National Grid Development Holdings Corp., a wholly-owned subsidiary... -

Page 68

... as discussed in Note 10, "Commitments and Contingencies." Note 14. Subsequent Event On July 3, 2012, the Company announced the completion of the sale of Granite State and EnergyNorth to Liberty Energy. Gross proceeds of the sales were $309 million which includes a working capital adjustment of $27...