Loreal 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 REGISTRATION DOCUMENT − L’ORÉAL 2011

3Comments on the2011 nancialyear

The Group's business activities in 2011

In the New Markets, L’Oréal Luxury is growing fast. Thanks to

Lancôme

,

Kiehl’s

and

Shu Uemura

, the Division is making

substantial market share gains in Asia; it is also continuing to

grow in Latin America, the Middle East and Eastern Europe.

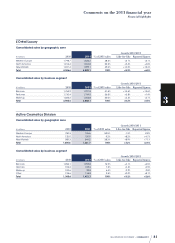

Active Cosmetics

In2011, the Active Cosmetics Division grew by +3.2% like-for-like

and +2.6% based on reported figures. With strong dynamism

in Latin America, the United States and Africa, Middle East,

the Division is strengthening its position as number one in the

worldwide dermocosmetics market.

♦The Division’s sales are increasing, thanks to the dynamism

not only of

La Roche-Posay

, but also of

SkinCeuticals

and

Roger&Gallet

.

La Roche-Posay

is growing on all continents, thanks in

particular to

Tolériane Ultra,

skincare for highly sensitive and

allergy-prone skin, and

Cicaplast Baume B5

in the scarring

segment.

Vichy

is maintaining its world number one position, and

carried out two major launches in Europe:

Lift Activ Sérum10

in anti-ageing skincare, and

Dercos Aminexil

in anti-hairloss

haircare.

The strong growth of

SkinCeuticals

is continuing, both in its

original market in the United States, and in Europe.

Finally, the internationalisation of

Roger&Gallet

is continuing,

with strong growth in the countries it is moving into, and the

highly successful launch of the fragrance

Fleur d’Osmanthus.

♦The Division’s growth is being boosted by good performances

in North America and in the New Markets, particularly Latin

America and the Africa, Middle East zone. The very good

scores of

Innéov

in Brazil, now the brand’s number one market

worldwide, are worth noting.

In Europe, the Division’s growth continues to reflect contrasting

trends in different countries: positive in France, but more difficult

in Southern Europe and in Eastern Europe, where difficulties in

the pharmacies channel are continuing.

The broadening of distribution and the conquest of new

health channels, such as drugstores and medispas, are an

important element in the Division’s worldwide strategy.

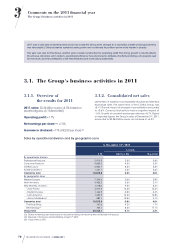

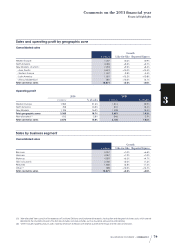

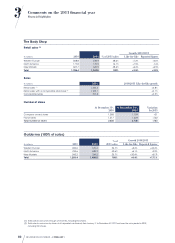

Multi-division summary by geographic zone

Western Europe

In a very slightly positive market, L’Oréal recorded a growth rate

of +0.6% like-for-like, with good growth rates in France, Germany

and the United Kingdom, and in travel retail. Sales have been

galvanised in this zone by

Maybelline

make-up and by L’Oréal

Luxury. The situation remains more difficult in Southern Europe,

and particularly in Greece and Portugal.

North America

In North America, L’Oréal grew faster than the market, and recorded

2011 growth of +5.5% like-for-like. The Luxury, Consumer Products

and Active Cosmetics Divisions all posted sustained growth. The

Consumer Products Division is significantly outperforming the

market trend, thanks in particular to

Maybelline

and

Garnier

.

The recently acquired

Essie

brand had a very good year. Growth

in the Professional Products Division is less substantial, but is

nevertheless ahead of the professional market trend.

New Markets

At December31st, 2011, the New Markets posted growth of +9.5%

like-for-like and +8.3% based on reported figures. Excluding Japan,

the New Markets recorded growth of +10.6% like-for-like, driven by

the constant dynamism of Asia.

♦Asia, Pacific: L’Oréal achieved annual growth in Asia-Pacific

of +13.0% like-for-like and +13.4% based on reported figures.

If Japan is excluded, growth in this zone amounted to +16.1%

like-for-like and +15.5% based on reported figures. Despite

the disasters which hit Japan, Australia, New Zealand and

Thailand during the year, the Group is continuing to improve

its positions throughout the zone, driven by markets whose

dynamism remains intact. The Group is advancing thanks to

the very good scores of L’Oréal Luxury in Greater China and

South Korea with

Lancôme

,

Kiehl’s

,

Shu Uemura

and

Biotherm

.

Consumer Products are also contributing to this dynamism

thanks to

L’Oréal Paris

and

Maybelline

. L’Oréal is thus asserting

its status as a skincare and make-up expert in all countries in

this zone. Haircare made a good start in the emerging markets

of South-East Asia.

♦Eastern Europe: At end-2011, the Group is at -2.8% like-for-

like in Eastern Europe. In a dismal economic context which is

affecting all the countries in this zone, the Group’s Divisions

recorded contrasting levels of performance. The Professional

Products Division and L’Oréal Luxury are improving their

penetration. In the Consumer Products Division, a programme

of carefully adapted initiatives is under way, for

Garnier

in

particular.

♦Latin America: In2011, L’Oréal achieved growth of +13.2%

like-for-like in Latin America. Argentina, Mexico and Central

America are the growth drivers in this zone. Brazil is still

posting a solid trend. All the Group’s Divisions recorded good

performances, particularly the Active Cosmetics Division. The

very good results of

Maybelline

make-up in the Consumer

Products Division are worth noting.

♦Africa, Middle East: At December31st, 2011, Africa - Middle East

achieved growth of +10.5% like-for-like. In this zone, growth is

being driven by the countries of the Levant, the Gulf and Turkey,

and by two recently created subsidiaries, Pakistan and Egypt.

However, the situation is more contrasted in South Africa. All

Divisions are contributing to the dynamism of this expansion.