Loreal 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123REGISTRATION DOCUMENT − L’ORÉAL 2011

2011 Consolidated Financial Statements

4

Notes to the consolidated nancial statements

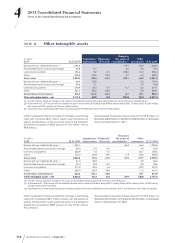

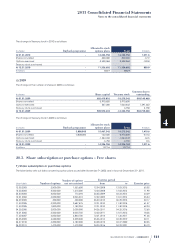

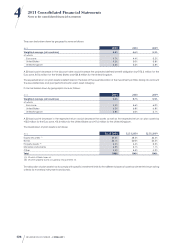

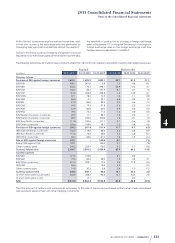

Data concerning all share option plans during fiscal years 2009, 2010 and 2011 are set out below:

12.31.2011 12.31.2010 12.31.2009

Number of

options

Weighted

average

exercise

price

Number of

options

Weighted

average

exercise

price

Number of

options

Weighted

average

exercise

price

Number of options not exercised at beginning

of period 37,296,504 71.55 40,051,000 70.86 39,166,092 72.39

♦Options granted 1,470,000 83.19 4,200,000 80.03 3,650,000 50.11

♦Options exercised -4,730,120 70.24 -4,920,243 68.40 -1,591,442 59.87

♦Options expired -1,511,952 -2,034,253 -1,173,650

Number of options not exercised at end of period 32,524,432 72.02 37,296,504 71.55 40,051,000 70.86

Of which:

number of exercisable options at end of period 19,450,832 69.63 18,299,654 67.61 19,083,150 71.32

expired options at end of period 214,750 326,750 571,000

The weighted average share price was €81.60million, €80.47million and €60.37million, respectively, for2011, 2010 and2009.

The total charge recorded in2011, 2010 and2009 amounted to €62.8million, €76.5million and €74.5million, respectively.

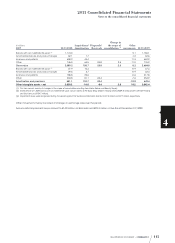

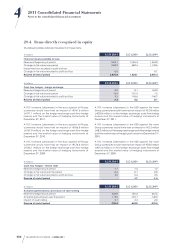

2) Free shares

On April22nd, 2011, April27th, 2010 and March25, 2009, the Board

of Directors decided to grant respectively 1,038,000, 450,000

and 270,000free shares.

Vesting conditions

For the conditional grant of shares, the plan provides for a 4-year

vesting period after which vesting is effective and final, subject

to meeting the conditions of the plan. After this vesting period,

a 2-year mandatory holding period applies for French residents,

during which the shares cannot be sold.

The performance conditions concern:

♦April22nd, 2011 plan:

− for 50% of shares granted, the increase in comparable

Cosmetic revenues for the 2012, 2013 and 2014 fiscal

years in relation to the growth in revenues for a panel of

competitors;

− for 50% of shares granted, the increase over the same

period in Group consolidated operating profit.

The calculation will be based on the arithmetic average of the

performance in the 2012, 2013 and 2014 fiscal years and will

use a predefined allocation scal based on the performance

percentage achieved. No performance condition applies below

a block of 200shares.

♦April27th, 2010 and March25th, 2009 plans:

− for 25% of shares granted under the 2010 plan and 50%

of shares granted under the 2009 plan, the increase in

comparable Cosmetic revenues for the 2011, 2012 and

2013 fiscal years for the 2010 plan and for the 2010, 2011

and 2012 fiscal years for the 2009 plan compared with

the growth of the cosmetics market;

− for 75% of shares granted under the 2010 plan and 50%

of shares granted under the 2009 plan, the percentage,

over the same period, resulting from the ratio between

operating profit and published Cosmetic revenues.

The calculation will be based on the arithmetic average of

performance in the 2011, 2012 and 2013 fiscal years for the

2010 plan and 2010, 2011 and 2012 fiscal years for the 2009

plan, and will use a predefined allocation scale based on the

performance percentage achieved.

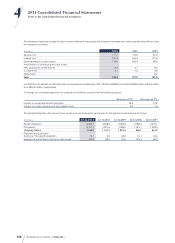

Fair value of free shares granted

The fair value corresponds to the value of the share at the

grant date, less dividends expected to be paid during the

vesting period. The cost of the additional 2-year holding period

applicable to French residents is determined based on the

interest rate granted to the employee, considered equivalent

to the rate which would be granted by a bank to a private

individual customer with an average financial profile. The cost

of the holding period amounts respectively to 8.54%, 8.64% and

8.47% of the share value at the grant date for the 2011, 2010

and 2009 plans.

On the basis of these assumptions, the fair values for the 2011,

2010 and 2009 plans amount to €70.36, €66.78 and €40.23

respectively for French residents, and to €77.67, €73.73 and

€44.55 respectively, for non-residents, compared to a share price

of €85.68, €80.50 and €50.94, respectively.

The expense recorded in2011, 2010 and 2009 amounted to

€24.0million, €8.4million and €2.2million, respectively.