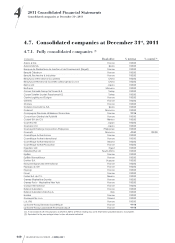

Loreal 2011 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150 REGISTRATION DOCUMENT − L’ORÉAL 2011

52011 parent company Financial Statements

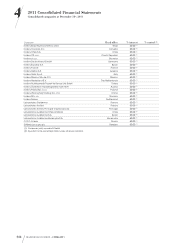

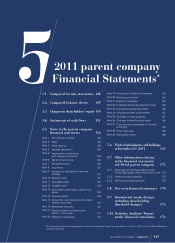

Changes in shareholders’ equity

5.3. Changes in shareholders’ equity

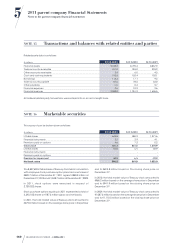

The share capital of €120,596,816.40 comprises 602,984,082 shares with a par value of €0.2 each following transactions carried out

in2011:

♦subscription to 1,991,097shares following the exercise of options;

♦subscription to 400shares following the free grant of shares.

Changes in shareholders’ equity are as follows:

€ millions

Share

capital

Additional

paid-in

capital

1976

revaluation

reserve

Reserves

and

retained

earnings Net profit

Regulated

provisions Total

Balance at December31st, 2008

before appropriation ofnet profit 120.5 965.5 45.4 4,215.8 1,552.1 53.8 6,953.1

Changes in share capital -0.7 31.0 -267.2 -236.9

Appropriation of 2008 net profit 712.4 -712.4 0.0

Dividends paid for 2008 -839.7 -839.7

2009 net profit 1,841.8 1,841.8

Other movements during

theperiod 6.4 6.4

Balance at December31st, 2009

before appropriation ofnet profit 119.8 996.5 45.4 4,661.0 1,841.8 60.2 7,724.7

Changes in share capital 0.4 151.8 -37.1 115.1

Appropriation of 2009 net profit 963.0 -963.0 0.0

Dividends paid for 2009 -878.8 -878.8

2010 net profit 1,995.3 1,995.3

Other movements during

theperiod 6.3 6.3

Balance at December31st, 2010

before appropriation ofnet profit 120.2 1,148.3 45.4 5,586.9 1,995.3 66.5 8,962.6

Changes in share capital 0.4 123.1 123.5

Appropriation of 2010 net profit 930.1 -930.1 0.0

Dividends paid for 2010 -1,065.2 -1,065.2

2011 net profit 2,169.8 2,169.8

Other movements during

theperiod 16,0 16,0

Balance at December31st, 2011

before appropriation of net profit 120.6 1,271.4 45.4 6,517.0 2,169.8 82.5 10,206.7

Reserves include an amount of €18.2million in 2011

corresponding to unpaid dividends on treasury shares,

compared with €20.1million in2010 and €22million in2009.

Regulated provisions consist mainly of the provision for

investments which amounted to €23.7million at December31st,

2011, compared with €18.4million at December31st, 2010

and €16.2million at December31st, 2009. In2011, a charge of

€6.1million was made to the provision for investments in respect

of employee Profit Sharing for 2011 (€5.7million in2010 and

€5.3million in2009). This provision includes the transfer to the

Company of some of the provisions set aside by our subsidiaries

under a Group agreement. In2011, an amount of €0.8million

set aside to the provision in2006 was reversed (compared with

€3.5million in2010 and €2.8million in2009).

Accelerated tax-driven depreciation at December31st, 2011

amounted to €58.4million compared with €47.6million at

December31st, 2010 and €44.0million at December31st, 2009.

Details of share subscription option and free share plans are

provided in note17 and in the Management Report.