Loreal 2011 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

153REGISTRATION DOCUMENT − L’ORÉAL 2011

2011 parent company Financial Statements

5

Notes to the parent company nancial statements

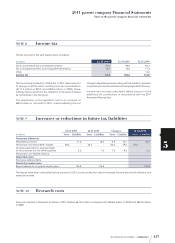

1.4. Income tax

The Company has opted for the French tax group regime.

French companies included in the scope of tax consolidation

recognise an income tax charge in their own accounts on the

basis of their own taxable profits and losses.

L’Oréal, as the parent company of the tax group, recognises as

tax income the difference between the aggregate tax charges

recognised by the subsidiaries and the tax due on the basis of

consolidated taxable profit or loss of the tax group.

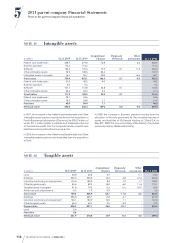

1.5. Intangible assets

Intangible assets are recorded in the balance sheet at purchase

cost.

The value of newly acquired trademarks is calculated based

on a multi-criteria approach taking into consideration their

reputation and their future contribution to profits.

In accordance with regulation no.2004-06 on assets, certain

trademarks have been identified as amortisable in accordance

with their estimated useful life.

Non-amortisable trademarks are tested for impairment at least

once a year on the basis of the valuation model used at the

time of their acquisition. A provision for impairment is recorded

where appropriate.

Initial trademark registration costs have been recorded as

expenses since2005.

Patents are amortised over a period ranging from two to ten

years.

Business goodwill is not amortised. It is written down whenever

the present value of future cash flows is less than the book value.

Software of material value is amortised using the straight-line

method over its probable useful life, generally between five

and seven years. It is also subject to accelerated tax-driven

amortisation, which is recognised over a 12-month period.

Other intangible assets are usually amortised over periods not

exceeding 20years.

1.6. Tangible assets

Tangible assets are recognised at purchase cost, including

acquisition expenses.

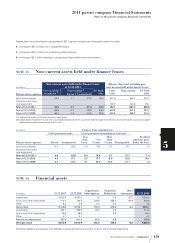

The useful lives of tangible assets are as follows:

Useful lives

Buildings 20-50years

Fixtures and fittings 5-10years

Industrial machinery and equipment 10years

Other tangible assets 3-10year

Both straight-line and declining-balance depreciation is

calculated over the actual useful lives of the assets concerned.

Exceptionally, industrial machinery and equipment is

depreciated using the straight-line method over a period of ten

years, with all additional depreciation classified as accelerated

tax-driven depreciation.

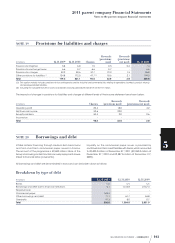

1.7. Financial assets

1.7.1. Investments and advances

These items are recognised in the balance sheet at purchase

cost excluding incidental expenses.

Their value is assessed annually by reference to their value in use,

which is mainly based on the current and forecast profitability

of the subsidiary concerned and the share of equity owned. If

the value in use falls below the purchase cost, a provision for

impairment is recognised.

1.7.2. Other financial assets

Loans and other receivables are valued at their nominal

amount. Loans and other receivables denominated in foreign

currencies are translated at the exchange rate prevailing at the

end of the financial year. If necessary, provisions are recognised

against these items to reflect their value in use at the end of

the financial year.

Treasury stock acquired in connection with buyback

programmes is recognised in other long-term investments.

At the end of the financial year, other long-term investments

are compared with their probable sale price and a provision

for impairment recognised where appropriate.

1.8. Inventories

Inventories are valued using the weighted average cost method.

A provision for impairment of obsolete and slow-moving

inventories is recognised by reference to their probable net

realisable value, which is measured on the basis of historical

and forecast data.

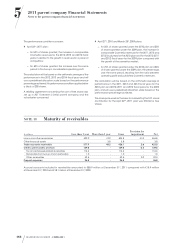

1.9. Trade accounts receivable

andother receivables

Trade accounts receivable and other receivables are recorded

at their nominal value. Where appropriate, a provision is

recognised based on an assessment of the risk of non-recovery.

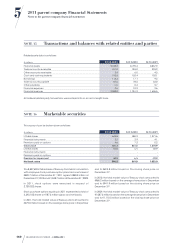

1.10. Marketable securities

Marketable securities are recognised at purchase cost and

are valued at the end of the financial year at their probable

sale price.

Treasury stock held that is specifically allocated to employee

stock option plans is recognised in marketable securities.