Loreal 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71REGISTRATION DOCUMENT − L’ORÉAL 2011

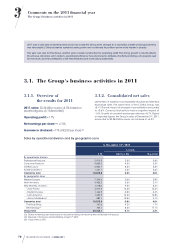

Comments on the2011 nancialyear

3

The Group's business activities in 2011

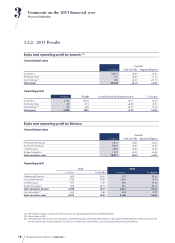

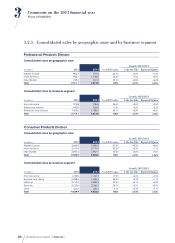

Professional Products

In a generally sluggish market, the Professional Products Division

achieved 2011 growth of +2.5% like-for-like and +3.6% based

on reported figures. Growth based on constant exchange

rates, including the impact of acquisitions, came out at +5.1%.

Initiatives in hair colourants and haircare enabled the Division

to win market share in all zones.

♦Haircare growth was driven by the success of hair oils,

with

Mythic Oil

from

L’Oréal Professionnel

,

Elixir Ultime

from

Kérastase

and

Argan-6 oil

by

Redken

.

Fusio-Dose

by

Kérastase

,

the ultra-personalised made-to-measure salon haircare, and

Total Results

by

Matrix

, the accessible professional haircare

range, are also contributing to growth.

In hair colourants,

L’Oréal Professionnel

is continuing to roll

out INOA, and is reinventing tone-on-tone colour with

Dialight

and

Diarichesse

.

Redken

has created

Color Fusion Extra Lift,

a

formula with unique lightening power, and

Matrix

is expanding

in Asia thanks to

SoColor

(90ml) and

Wonderbrown

.

♦The Division is continuing to improve its positions in the

developed markets, with significant market share gains

in Germany and the United Kingdom. The conquest of the

luxury haircare segment is continuing with

Kérastase

and

Shu

Uemura

Art of Hair.

In the United States, the Division posted

positive growth, bolstered by the SalonCentric network.

In the New Markets, the Division is growing fast, particularly

in Asia, Latin America and the Middle East. It is increasing its

presence in all zones by investing in hairdresser training and

rolling out innovations attuned to local beauty rituals and

expectations, as exemplified by the launches of

Oilthérapie

in India and

X-Tenso Care

in

Brazil.

Consumer Products

The Consumer Products Division achieved growth of +4.5%

like-for-like and +3.2% based on reported figures at end-2011.

Maybelline posted another year of strong growth and L’Oréal

Paris is accelerating.

♦

L’Oréal Paris

is launching strong initiatives in all categories.

The renewal of the

Elvive

range and the success of

Elvive Triple

Resist enriched with Arginine,

are galvanising the haircare

segment in Europe. In make-up, the brand is standing out

from the competition with

Lash Architect

mascara and

Color

Riche

lipstick. The new hair colourant

Sublime Mousse

and

the strong growth of skincare in China are also contributing

to the brand’s acceleration.

Maybelline

is performing extremely well on all continents,

with its

Falsies Flared

and

Colossal Cat Eyes

mascaras,

Fit Me

foundation, and

Color Stay

lipsticks.

Garnier

is continuing its initiatives, particularly in skincare with

its BB cream,

Miracle Skin Perfector

, in Europe, and

Dark Spot

Corrector

in the United States.

♦In Western Europe, the Division is winning market share in

France, Germany and the Nordic countries. The situation is

more difficult in the countries of the South.

In North America, the Division is improving its positions thanks

to haircare, make-up and skincare.

In the New Markets, the Division is performing well in all zones,

with the exception of Eastern Europe. In Asia, the Division is

continuing to grow strongly, particularly in facial skincare for

both women and men. In Latin America, the Division had a

good year, particularly in Mexico, Argentina and Chile, thanks

to the success of its deodorants and hair colourants.

L’Oréal Luxury

Bolstered by a lively market trend and the dynamism of its major

brands, L’Oréal Luxury recorded 2011 sales up by +8.2% like-

for-like and +6.5% based on reported figures. In all regions, the

Division has major stand-out innovations, with Visionnaire

from

Lancôme taking pride of place.

♦

Lancôme

posted a year of strong growth, with the high-

profile launch of

Visionnaire

, the first-ever fundamental skin

corrector, protected by 20 patents and the winner of the

Prix

d’Excellence Marie-Claire

. Meanwhile, the brand is continuing

to grow thanks to its flagship products,

Génifique, Rénergie

and

Teint Miracle.

The new mascara

Hypnôse Doll Eyes

and

the launch of the fragrance

Trésor Midnight Rose

also reflect

the brand renewal now under way.

L’Oréal Luxury enjoyed an excellent year in facial skincare,

with strong performances from

Lancôme

, the rapid

expansion of

Kiehl’s

on all continents, and the introduction

of

Régénessence

skincare by

Giorgio Armani

, along with the

initiatives of

Biotherm

.

Yves Saint Laurent

is bringing out its new skincare line,

Forever

Youth Liberator.

Its store sales are increasing thanks to

Opium,

L’Homme

men’s fragrances and the make-up lines.

The

Giorgio Armani

brand is being driven by the healthy trends

of

Acqua di Gio

and

Code Homme

, and by the growing

success of the women’s fragrance

Acqua di Gioia.

Loverdose

by

Diesel

was ranked in Europe one of the best

women’s fragrance launches of the year.

The instrumental cosmetics brand

Clarisonic

, acquired in

December, has joined the L’Oréal Luxury brand portfolio; it is

the market leader in sonic technology skincare applications.

♦In Western Europe, L’Oréal Luxury ended the year well,

particularly in France, driven by the dynamism of

Lancôme

,

Kiehl’s

and

Diesel

.

In North America, the Division recorded strong growth with its

brands

Lancôme

,

Yves Saint Laurent

,

Kiehl’s

,

Giorgio Armani

and

Viktor & Rolf

.