Loreal 2011 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246

|

|

157REGISTRATION DOCUMENT − L’ORÉAL 2011

2011 parent company Financial Statements

5

Notes to the parent company nancial statements

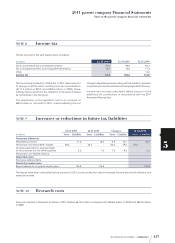

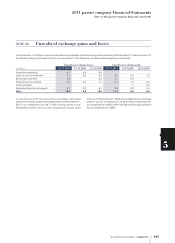

NOTE8 Income tax

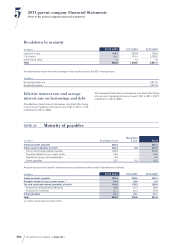

The tax income for the year breaks down as follows:

€ millions

12.31.2011 12.31.2010 12.31.2009

Tax on profit before tax and exceptional items 37.6 90.0 95.2

Tax on exceptional items and employee Profit Sharing 13.7 14.6 11.3

Other - - 8.4

Income tax 51.3 104.6 114.9

NOTE9 Increases or reductions in future tax liabilities

€ millions

12.31.2009 12.31.2010 Changes 12.31.2011

Asset Liability Asset Liability Asset Liability Asset Liability

Temporary differences

Regulated provisions - 17.0 - 18.4 6.9 10.7 - 22.2

Temporarily non-deductible charges 58.6 - 44.4 - 26.4 19.5 51.3 -

Charges deducted (or revenue taxed)

fortax purposes but not yet recognised - 2.3 - 1.3 7.3 8.3 - 2.3

Temporarily non-taxable revenue

Deductible items

Tax losses, deferred items

Potentially taxable items

Special reserve for long-term capital gains - 176.8 - 176.8 - - - 176.8

The figures have been calculated taking account of 3.3% social contribution which increases income tax at both statutory and

reduced tax rates.

NOTE10 Research costs

Amounts invested in Research activities in2011 totalled €619.4million compared with €596.0million in2010 and €537.5million

in2009.

The tax income booked by L’OréalS.A. in2011 takes account

of savings of €72.8million resulting from tax consolidation

(€117.9million in2010 and €128.5million in2009). These

savings mainly result from the utilisation of tax losses booked

by companies in the tax group.

The application of tax legislation led to an increase of

€50.3million in net profit for 2011, mainly reflecting the net

charge to regulated provisions along with tax credits on research,

corporate sponsorship activities and employee Profit Sharing .

Income tax has been calculated taking account of the

additional 5% contribution, in accordance with the 2011

Amended Finance law.