Loreal 2011 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

187REGISTRATION DOCUMENT − L’ORÉAL 2011

Corporate social, environmental and societal responsibility

6

Social information

Employees Benefit schemes in France

In addition to the compulsory Lump Sum Death Benefit for

executives under Articles4 and 4bis of the French National

Collective Bargaining Agreement of1947 (1.5% of Bracket A

of income as defined by the French Social Security) and the

guarantees accorded under the French National Collective

Bargaining Agreement for the Chemical Industries, L’Oréal has set

up, in France, under an agreement, an E mployee B enefit scheme

providing additional collective guarantees to its employees.

All these guarantees are based on the gross income up to

eight times the Social Security ceiling, except for the education

annuity which is limited to up to four times the ceiling. They are

generally financed on BracketsA, B and C of income as defined

by the French Social Security, except for the Education Annuity

which is based on BracketsA and B, and the surviving Spouse

Pension which is based on BracketsB and C.

This Employee Benefit scheme provides guarantees in the event

of:

♦temporary disability: for all employees, 90% of their gross

income limited to eight times the French Social Security ceiling,

net of all deductions, after the first 90days off work;

♦permanent disability: for all employees, a fraction, depending

on the extent of the disability, ranging up to 90% of their gross

income, limited to eight times the French Social Security

ceiling, net of all deductions;

♦death:

a) for all employees, the payment of a Lump Sum Death Benefit,

increased depending on the employee’s family status. The

amount of this Benefit is doubled in the event of accidental

death,

b) for executives and comparable categories of employees,

the payment of a Spouse Pension to the surviving spouse.

This ensures the spouse has an income similar to the Spouse

Pension that would have been paid by AGIRC if death had

occurred at the age of65,

c) for executives, comparable categories of employees,

and sales representatives, the payment of an Education

Annuity to each dependent child, according to an age-

based schedule. For the other employees, this guarantee

is optional and, if chosen, replaces part of the Lump Sum

Death Benefit.

The total amount of the Lump Sum Equivalent for these guarantees

may not exceed €2.3million per event.

The capital for the Spouse Pension is the first to be applied,

followed by the Education Annuity; the balance of the basic

scheme is then used to calculate the Lump Sum Death Benefit,

possibly increased by the minimum guaranteed Lump Sum

Death Benefit.

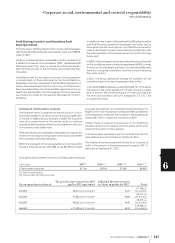

€ thousands

12.31.2009 12.31.2010 12.31.2011

Net E mployee B enefit C ontributions 9,340.5 9,877.1 10,170.0(1)

(1) Estimated.

Minimum guaranteed Lump Sum Death Benefits

Since December1st, 2004, and January1st, 2005 for sales

representatives, L’Oréal has put in place an additional

guaranteed Lump Sum Death Benefit that supplements, where

applicable, for all employees, the Lump Sum Death Benefits to

the extent of three years’ average income. A maximum limit is

set for this guarantee.

The total amount of the capital needed to fund the surviving

Spouse Pension and Education Annuity, the Lump Sum Death

Benefits and the minimum guaranteed Lump Sum Death Benefit

is also subject to a ceiling.

Healthcare expenses

The employees of L’Oréal parent company and its French

subsidiaries benefit from additional schemes covering healthcare

costs.

The healthcare scheme is compulsory for all the employees of

L’Oréal and its French subsidiaries.

Employees have the option of including their family members

in these schemes.

Contributions are generally individual. The contribution by the

employee is partly financed by the Company.

Retirees can generally continue to benefit from the healthcare

scheme, with a contribution by L’Oréal, subject to a membership

duration clause.

The scheme for L’Oréal parent company retirees has been

specified in the regulations for the additional defined benefit

pension scheme applicable as from January1st, 2008. The

financial management of this scheme was outsourced to

insurance companies in July2011.