Loreal 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 REGISTRATION DOCUMENT − L’ORÉAL 2011

42011 Consolidated Financial Statements

Notes to the consolidated nancial statements

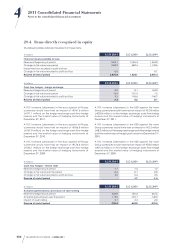

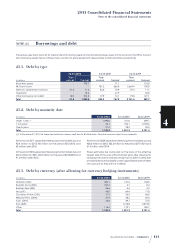

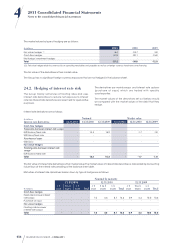

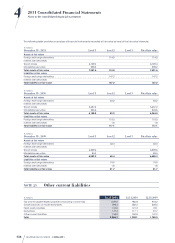

23.4. Breakdown of fixed rate and floating rate debt

(after allowing for interest rate hedging instruments)

€ millions

12.31.2011 12.31.2010 12.31.2009

Floating rate 1,094.0 1,517.3 3,052.2

Fixed rate 54.3 74.0 79.1

Total 1,148.3 1,591.3 3,131.3

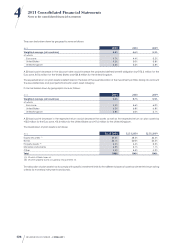

23.5. Effective interest rates

Effective interest rates on Group debt after allowing for hedging

instruments were 0.21% in2009, 0.21% in2010 and 1.47% in2011

for short-term paper, and 1.02% in2009 and 1.15% in2010

for bank loans. The Group no longer had any bank loans at

December31st, 2011.

23.6. Average debt interest rates

Average interest rates after allowing for hedging instruments

were 1.63% in2009, 0.99% in2010 and 1.39% in2011 on euro-

denominated debt and 0.53% in2009, 0.36% in2010 and 0.19%

in2011 on USD-denominated debt.

23.7. Fair value of borrowings and

debt

The fair value of fixed-rate debt is determined for each loan by

discounting future cash flows, based on bond yield curves at the

balance sheet date, after allowing for the spread corresponding

to the Group’s risk rating.

The net carrying amount of outstanding bank loans and other

floating-rate loans is a reasonable approximation of their fair

value.

The fair value of borrowings and debt amounted to €1,148.4million

at December31st, 2011. The fair value of borrowings and debt

amounted to €1,591.8million at December31st, 2010. The fair

value of borrowings and debt amounted to €3,131.7million at

December31st, 2009.

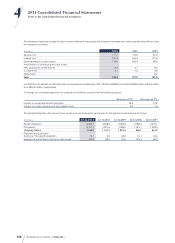

23.8. Debt covered by collateral

No debt was covered by material amounts of collateral at

December31st, 2011, 2010 or 2009.

23.9. Confirmed credit lines

At December31st, 2011, L’Oréal and its subsidiaries had

€2,438.6million of confirmed undrawn credit lines, compared

with €2,387million at December31st, 2010 and €2,425million

at December31st, 2009.

Credit lines fall due as follows:

♦€588.6million in less than 1year;

♦€1,850.0million between 1year and 4years.

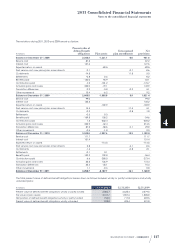

NOTE24 Derivatives and exposure to market risks

To manage its exposure to currency and interest rate risks arising

in the course of its normal operations, the Group uses derivatives

negotiated with counterparties rated investment grade.

In accordance with Group rules, currency and interest rate

derivatives are set up exclusively for hedging purposes.

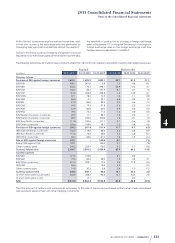

24.1. Hedging of currency risk

The Group is exposed to currency risk on commercial

transactions recorded on the balance sheet and on highly

probable future transactions.

The Group’s policy regarding its exposure to currency risk on

future commercial transactions is to hedge at the end of the

year a large part of the currency risk for the following year, using

derivatives based on operating budgets in each subsidiary.

All the Group’s future foreign currency flows are analysed in

detailed forecasts for the coming budgetary year. Any currency

risks identified are hedged by forward contracts or by options

in order to reduce as far as possible the currency exposure of

each subsidiary. The term of the derivatives is aligned with the

Group’s settlements. Exchange rate derivatives are negotiated

by REGEFI (the Group’s bank) or, in exceptional cases, directly

by the Group’s subsidiaries when required by local regulations.

Such operations are supervised by REGEFI.