Loreal 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135REGISTRATION DOCUMENT − L’ORÉAL 2011

2011 Consolidated Financial Statements

4

Notes to the consolidated nancial statements

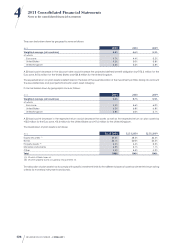

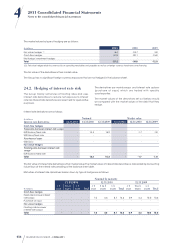

24.3. Sensitivity to changes

ininterest rates

An increase of 100basis points in interest rates would have

a direct positive impact of €5.6million on the Group’s net

finance costs at December31st, 2011, compared with a

positive impact of €0.5million at December31st, 2010 and a

negative impact of €18.6million at December31st, 2009. This

calculation allows for cash, cash equivalents and derivatives,

and assumes that total net debt/net cash remains stable

and that fixed-rate debt at maturity is replaced by floating-

rate debt.

The impact of a 100basis point rise in interest rates on

the fair value of the Group’s fixed-rate financial assets and

liabilities, after allowing for derivatives, can be estimated

at €0.2million at December31st, 2011 compared with

€1.3million at December31st, 2010 and €1.2million at

December31st, 2009.

24.4. Counterparty risk

The Group has financial relations with international banks rated

investment grade. The Group thus considers that its exposure

to counterparty risk is low.

Furthermore, the financial instruments used to manage

exchange rate and interest rate risk are issued by leading

international banking counterparties.

24.5. Liquidity risk

The Group’s liquidity risk can be assessed on the basis of its

outstanding short-term debt under its paper programme

totalling €795.7million. If these bank facilities were not renewed,

the Group had confirmed undrawn credit lines of €2,438.6million

at December31st, 2011. The availability of these credit lines is

not dependent on financial covenants.

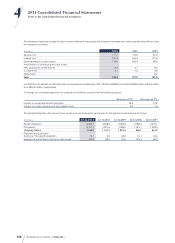

24.6. Shareholding risk

No cash has been invested in shares.

Available cash is invested with top-ranking financial institutions

in the form of non-speculative instruments which can be drawn

in very short periods. At December31st, 2011, cash was invested

exclusively in Euro-zone government bonds through mutual

funds (note19).

At December31st, 2011, the Group holds 118,227,307 Sanofi

shares for an amount of €6,709.4million (note15). A change

of plus or minus 10% in the market price of these shares relative

to the market price of €56.75on December31st, 2011 would

have an impact of plus or minus €670.9million before tax on

Group equity.

If the share price were to fall significantly below €34.12 (the initial

cost of the Sanofi shares), or fall below that price for a prolonged

length of time, L’Oréal may have to recognise an impairment

loss on its asset through profit or loss.

At December31st, 2010, the Group held 118,227,307 Sanofi

shares for an amount of €5,657.2million (note15). A change

of plus or minus 10% in the market price of these shares relative

to the market price of €47.85on December31st, 2010 would

have an impact of plus or minus €565.7million before tax on

Group equity.

At December31st, 2009, the Group held 118,227,307 Sanofi

shares for an amount of €6,509.6million (note15). A change

of plus or minus 10% in the market price of these shares relative

to the market price of €55.06on December31st, 2009 would

have an impact of plus or minus €651.0million before tax on

Group equity.

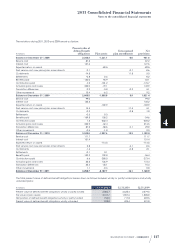

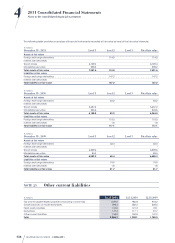

24.7. Fair value hierarchy

IFRS7 as amended in2009 requires financial assets and liabilities

recognised at fair value in the balance sheet to be classified

according to three levels:

♦level 1: quoted prices on an active market;

♦level 2: valuation techniques using observable inputs;

♦level 3: valuation techniques using unobservable inputs.