Loreal 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246

|

|

125REGISTRATION DOCUMENT − L’ORÉAL 2011

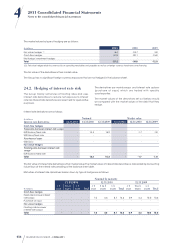

2011 Consolidated Financial Statements

4

Notes to the consolidated nancial statements

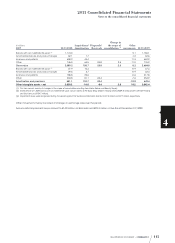

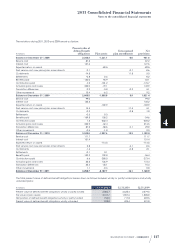

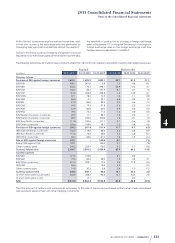

€ millions

12.31.2011 12.31.2010 12.31.2009

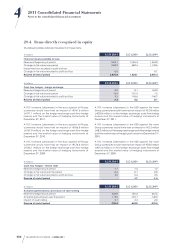

Total items recognised directly in equity

Gross reserve 1,872.0 998.6 2,072.4

Associated tax effect 182.7 189.5 97.5

Reserve net of tax 2,054.7 1,188.1 2,169.9

NOTE21

Post-employment benefits, termination benefits

andotherlong-term employee benefits

The Group operates pension, early retirement and other benefit

schemes depending on local legislation and regulations.

For obligatory state schemes and other defined-contribution

schemes, the Group recognises in the income statement

contributions payable when they are due. No provision has

been set aside in this respect as the Group’s obligation does

not exceed the amount of contributions paid.

The characteristics of the defined benefit schemes in force

within the Group are as follows:

♦French regulations provide for specific length-of-service

awards payable to employees on retirement. An early

retirement plan and a defined benefit plan have also been

set up. In some Group companies there are also measures

providing for the payment of certain healthcare costs for

retired employees.

These obligations are partially funded by an external

fund, except those relating to healthcare costs for retired

employees;

♦for foreign subsidiaries with employee pension schemes or

other specific obligations relating to defined benefit plans,

the excess of the projected benefit obligation over the

scheme’s assets is recognised by setting up a provision for

charges on the basis of the actuarial value of employees’

vested rights.

Pension obligations are determined and recognised in

accordance with the accounting principles presented in

note1.23. As from January1st, 2009, the Group decided to adopt

the IAS19 option allowing the direct recognition in equity of

actuarial gains and losses instead of the corridor method.

The actuarial assumptions used to calculate these obligations take into account the economic conditions specific to each country

or Group company. The weighted average assumptions for the Group are as follows:

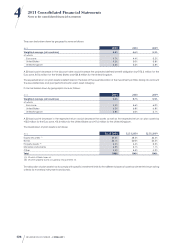

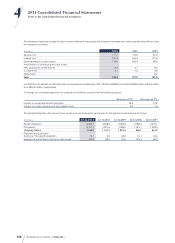

12.31.2011 12.31.2010 12.31.2009

Discount rate 4.5% 4.6% 5.3%

Salary increase 4.7% 4.7% 4.9%

Expected long-term return on plan assets 5.5% 5.7% 5.9%

12.31.2011 12.31.2010 12.31.2009

Initial rate Final rate

Application

of final rate Initial rate Final rate

Application

of final rate Initial rate Final rate

Application

of final rate

Expected rate of

health care inflation 5.4% 3.7% 2016 5.5% 3.6% 2016 6.3% 4.1% 2016

The discount rates are obtained by reference to market yields on

high quality corporate bonds having maturity dates equivalent

to those of the obligations. Bond quality is assessed by reference

to the AA-/Aa3 minimum rating provided by one of the three

main credit-rating agencies.