LG 1999 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 1999 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

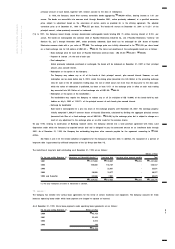

2

4

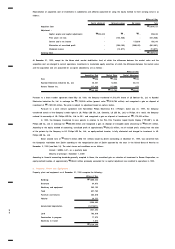

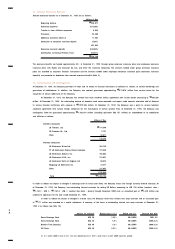

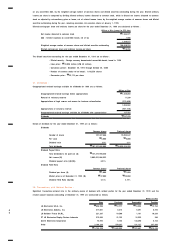

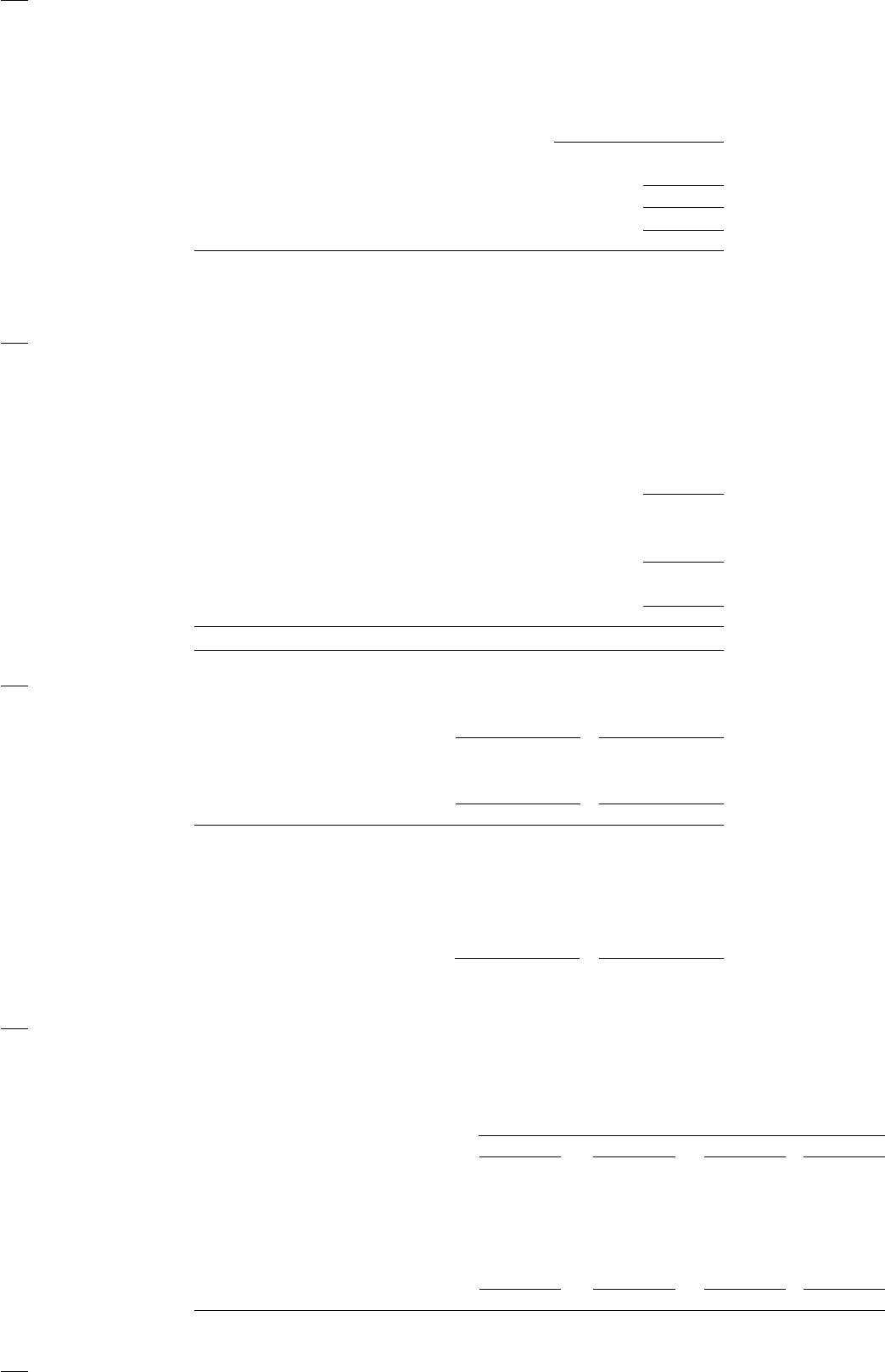

on any convertible debt, by the weighted average number of common shares and diluted securities outstanding during the year. Diluted ordinary

income per share is computed by dividing diluted ordinary income allocated to common stock, which is diluted net income allocated to common

stock as adjusted by extraordinary gains or losses, net of related income taxes, by the weighted average number of common shares and diluted

securities outstanding during the year, assuming conversion into common shares at January 1, 1999.

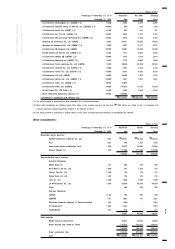

Diluted earnings per share and ordinary income per share for the year ended December 31, 1999 are calculated as follows :

Millions of Won (except for EPS data)

Net income allocated to common stock

₩

1,984,971

Add : Interest expenses on convertible bonds, net of tax 1,906

1,986,877

Weighted average number of common shares and diluted securities outstanding 108,820,224

Diluted earnings per share and ordinary income per share

₩

18,258

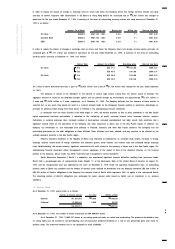

The diluted securities outstanding for the year ended December 31, 1999 are as follows :

- Diluted security : Foreign currency denominated convertible bonds, issued in 1996

- Issue price :

₩

33,096 million (US$ 40 million)

- Conversion period : December 26, 1996 through October 26, 2006

- Number of common stocks to be issued : 1,492,558 shares

- Conversion price :

₩

22,174 per share

21. Dividends :

Unappropriated retained earnings available for dividends for 1999 are as follows :

Millions of Won

Unappropriated retained earnings before appropriations

₩

1,266,092

Reversal of voluntary reserves 11,290

Appropriations of legal reserve and reserve for business rationalization (212,800)

1,064,582

Appropriations of voluntary reserves (937,160)

Unappropriated retained earnings available for dividends after appropriations 127,422

Dividends

₩

127,378

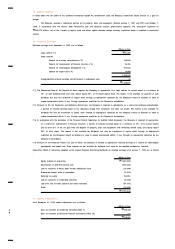

Details of dividends for the year ended December 31, 1999 are as follows :

Dividends

Common shares Preferred shares

Number of shares 107,327,666 19,095,547

Par value

₩

5,000

₩

5,000

Dividend ratio 20% 21%

Total dividends

₩

107,327,666,000

₩

20,050,324,350

Dividend Payout Ratio

Total dividends to be paid out (A)

₩

127,377,990,350

Net income (B) 2,005,021,086,932

Dividend payout ratio ((A)/ (B)) 6.35%

Dividend Yield Ratio

Common shares Preferred shares

Dividend per share (A)

₩

1,000

₩

1,050

Market price as of December 31, 1999 (B)

₩

47,000

₩

25,060

Dividend Yield Ratio ((A)/ (B)) 2.13% 4.19%

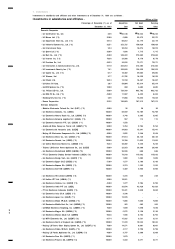

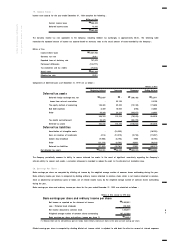

22. Transactions with Related Parties :

Significant transactions entered into in the ordinary course of business with related parties for the year ended December 31, 1999 and the

related account balances outstanding at December 31, 1999 are summarized as follows.

Millions of Won

Sales Purchases Receivables Payables

LG Electronics U.S.A., Inc.

₩

696,998

₩

12,777

₩

13,993

₩

12,754

LG Electronics Alabama, Inc. 317,061 8,415 6,491 8,794

LG Goldstar France S.A.R.L. 221,287 10,500 1,131 10,239

PT LG Electronics Display Devices Indonesia 215,896 41,193 16,259 286

Zenith Electronics Corporation 75,994 6,153 143,490 6,153

Other 3,198,234 970,297 191,127 237,303

₩

4,725,470

₩

1,049,335

₩

372,491

₩

275,529