LG 1999 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 1999 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

3

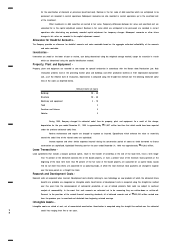

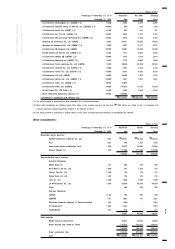

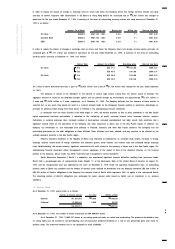

Annual Interest Rate (% ) at December 31, 1999 In Millions

Won currency, issued in 1998 1.00 100,000

133,136

Exchangeable Bonds (* 3)

Foreign currency, issued in 1997 0.25 66,623

(US$ 75)

2,701,209

Less : treasury debentures (117,171)

current maturities (1,154,450)

discount on debentures (38,170)

premium on debentures 7,589

₩

1,399,007

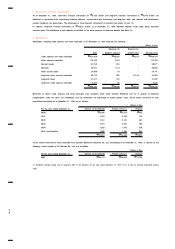

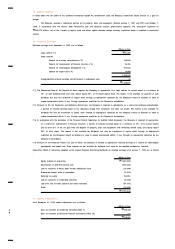

Won currency loans

Korea Development Bank 5.5 - 10.1

₩

91,266

Kookmin Bank 5.0 - 11.8 4,439

Korea Technology Banking Corporation 6.5 - 8.5 6,104

Housing and Commercial Bank 3.0 - 9.5 853

Hana Bank 7.0 920

Hanvit Bank 8.5 30,000

133,582

Foreign currency loans

Korea First Bank Libor + 0.625 10,205

Korea Development Bank 8.9 12,022

Korea Development Bank Libor + 0.5 45,816

Hanvit Bank Libor + 0.4 66,386

Chohung Bank Libor + 0.4 96,848

Korea Exchange Bank Libor + 0.4 171,810

Kookmin Bank Libor + 1.25 1,987

Export-Import Bank of Korea Libor + 0.625 4,503

Citi Bank Libor + 0.9 13,678

Banque Paribas Libor + 0.7 9,384

Bank of Tokyo-Mitsubishi Libor + 0.8 1,626

Societe General Libor + 0.6 21,561

Sumitomo Bank Libor + 0.65 14,903

Bank One Libor + 2.5 11,472

482,201

US$ 415

¥

646

Less : current maturities (217,800)

₩

397,983

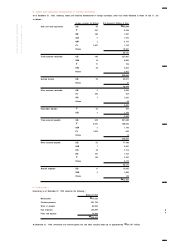

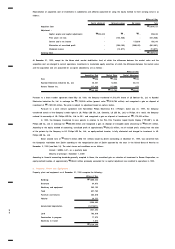

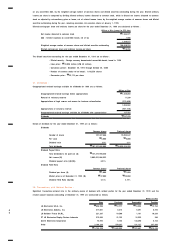

In relation to guaranteed debentures, the Company pays guarantee fees of 0.1% ~ 0.5% per annum.

Treasury debentures of

₩

117,171 million held by the Company as of December 31, 1999 are Won currency convertible bonds and a

portion of exchangeable bonds.

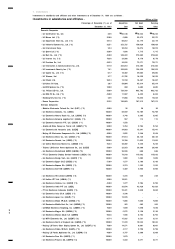

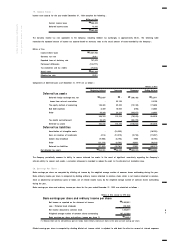

(* 1) In 1985 and 1995, the Company issued foreign currency denominated floating rate notes aggregating US$ 2 million and Hong Kong $550

million, which are due on April 25, 2000 and May 25, 2000, respectively. Early redemption may be called for at the option of the

noteholders or the Company under the terms of issuance. LG Chemical Ltd., an affiliated company, has guaranteed repayment of the

notes issued in 1985.

(* 2) In 1991, the Company issued foreign currency denominated convertible bonds aggregating US$ 70 million, bearing interest at 3.25% per

annum. The bonds are convertible into non-voting preferred stock through November 2006, unless previously redeemed, at a specified

conversion price, subject to adjustment based on the occurrence of certain events as provided for in the offering agreement. The

adjusted conversion price as of December 31, 1999 is

₩

16,343 per share. The fixed rate of exchange applicable to the exercise of the

conversion rights is

₩

726.50 per US$ 1.00. The bonds will mature on December 31, 2006 at par value, unless previously converted or

redeemed. Any bondholder may redeem all or some of the bonds held on June 24, 1999 at 144.926% of the principal amount of such

bonds, together with interest accrued to the date of redemption.

In 1996, the Company issued foreign currency denominated convertible bonds aggregating US$ 40 million, bearing interest at

1.25% per annum. The bonds are convertible into common stock through October 2006, unless previously redeemed, at a specified

conversion price, subject to adjustment based on the occurrence of certain events as provided for in the offering agreement. The

adjusted conversion price as of December 31, 1999 is

₩

22,174 per share. The fixed rate of exchange applicable to the exercise of

the conversion rights is

₩

827.4 per US$ 1.00. The bonds will mature on November 26, 2006 at par value, unless previously

converted or redeemed. Any bondholder may redeem all or some of the bonds held on November 26, 2001 at 133.20% of the