LG 1999 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 1999 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

3

NOTES TO FINANCIAL STATEMENTS

For the year ended December 31, 1999

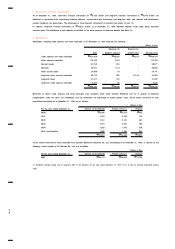

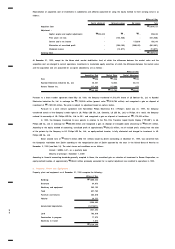

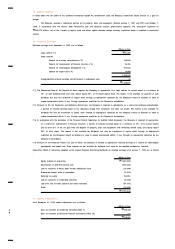

In order to reduce the impact of changes in exchange rates on future cash flows, the Company enters into foreign currency interest rate swap

contracts to convert long-term debt denominated in US Dollars to Hong Kong Dollars. An unrealized loss of

₩

3,051 million was charged to

operations for the year ended December 31, 1999. A summary of the terms of outstanding currency interest rate swap contracts at December 31,

1999 is as follows :

Amount (In millions) Exchange rate Buying rate Selling rate Contract due date

Citi Bank US$40.0 HK$7.765 : US$1 5.35% 7% 2001.8.30

Deutsche Bank US$40.0 HK$7.765 : US$1 5.35% 7% 2001.8.30

CSFB US$45.5 HK$7.765 : US$1 5.35% 7% 2001.8.30

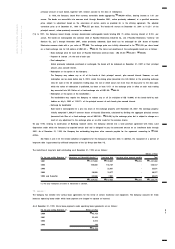

In order to reduce the impact of changes in exchange rates on future cash flows, the Company enters into foreign currency option contracts. An

unrealized gain of

₩

1,111 million was credited to operations for the year ended December 31, 1999. A summary of the terms of outstanding

currency option contracts at December 31, 1999 is as follows :

Option Type Amount (In millions) Exercising price Contract due date

Citi Bank Put US$ 21.5

₩

1,145.00 2000.3.31

Call US$ 43.0 1,145.00 2000.3.31

Citi Bank Put US$ 50.0 1,150.00 2000.5.16

Call US$ 50.0 1,182.50 2000.5.16

As a result of above derivatives contracts, a gain of

₩

28,825 million and a loss of

₩

61,720 million were realized for the year ended December

31, 1999.

The Company is named as the defendant or the plaintiff in various legal actions arising from the normal course of business. The

aggregate amounts of claims as the defendant brought against and the plaintiff brought by the Company are approximately

₩

21,271 million in

5 cases and

₩

14,226 million in 9 cases, respectively, as of December 31, 1999. The Company believes that the outcome of these matters is

uncertain but, in any event, they would not result in a material ultimate losses on the Company’s financial position or operations. Accordingly, no

provision for potential losses arising from these claims is reflected in the accompanying financial statements.

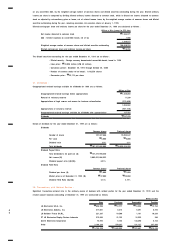

In connection with the Asian financial crisis which began in 1997, the Korean economy as well as other economies in the Asia Pacific

region experienced economic contractions, a reduction in the availability of credit, increased interest rates, increased inflation, negative

fluctuations in currency exchange rates, increased numbers of bankruptcies, increased unemployment and labor unrest. Such conditions had a

significant adverse effect on the operations of the Company and other companies in Korea and in the Asia Pacific region. In addition, the

Company has investments in, and receivables from affiliates in Thailand, Indonesia and other Asia Pacific countries. The Company also has

outstanding guarantees on the debt obligations of these affiliates. These affiliates have been affected, and may continue to be affected by the

unstable economic situation in the Asia Pacific region.

Recently, economic conditions in the Republic of Korea have improved as evidenced by an increased trade surplus, increases in foreign

exchange reserves, record levels of foreign investment and economic growth, lower inflation and interest rates and stabilized foreign exchange

rates. Notwithstanding the current recovery, significant uncertainties still exist related to the economy in Korea and in the Asia Pacific region. The

accompanying financial statements reflect management’s current assessment of the impact to date of the economic situation on the financial

position of the Company. Actual results may differ materially from management’s current assessment.

Zenith Electronics Corporation (“Zenith”), a subsidiary, has experienced significant financial difficulties resulting from continuous losses.

Zenith filed a pre-packaged plan of reorganization under Chapter 11 of the Bankruptcy Code of the United States of America on August 23,

1999, and the reorganization plan was approved by the court on November 5, 1999. Under the approved reorganization plan, all outstanding

common stock of Zenith was cancelled and the holders of common stock received no distribution and the Company converted US$ 200 million of

US$ 365 million of Zenith’s obligations to the Company into common stock of Zenith which represents 100% of equity in the restructured Zenith.

The remaining portion of Zenith’s obligations was exchanged for senior secured notes issued by Zenith and an investment in an overseas

subsidiary.

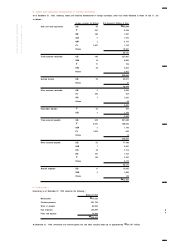

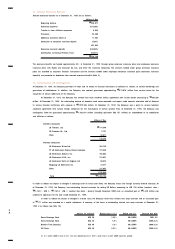

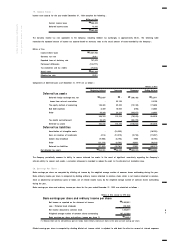

15. Capital Stock :

As of December 31, 1999, capital stock is as follows :

Number of issuance (shares) Par value Millions of Won

Common 107,327,666

₩

5,000

₩

536,638

Preferred 19,095,547 5,000 95,478

126,423,213

₩

632,116

As of December 31, 1999, the number of shares authorized are 500,000,000 shares.

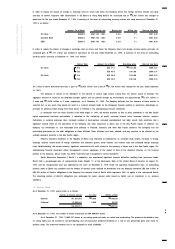

As of December 31, 1999, 19,095,547 shares of non-voting preferred stock are issued and outstanding. The preferred shareholders have

no voting rights and are entitled to non-participating and non-cumulative preferred dividends at a rate of one percentage point over those for

common stock. This preferred dividend rate is not applicable to stock dividends.