LG 1999 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 1999 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0

2

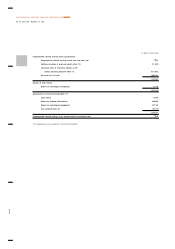

REPORT OF INDEPENDENT ACCOUNTANTS

Samil Accounting Corporation

Hanil Group Building 21st Flr. 191 Hangangro 2 ga, Yongsanku, Seoul 140-702, KOREA (C.P.O. Box 2170, 100-621)

Telephone + 82-2-709-0800 | Facsimile + 82-2-792-7001

To the Board of Directors and Shareholders of LG Electronics Inc.

We have audited the accompanying non-consolidated balance sheet of LG Electronics Inc. (the “Company”) as of December 31, 1999

and the related non-consolidated statements of income, appropriations of retained earnings and cash flows for the year then ended,

expressed in Korean Won. These financial statements are the responsibility of the Company’s management. Our responsibility is to

express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the Republic of Korea. Those standards

require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material

misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements.

An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the

overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of LG

Electronics Inc. as of December 31, 1999, and the results of its operations, the changes in its retained earnings and its cash flows for

the year then ended, in conformity with financial accounting standards generally accepted in the Republic of Korea.

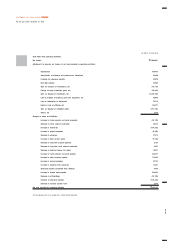

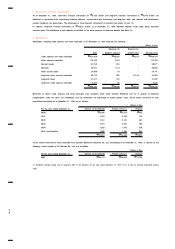

As discussed in Note 22 to the accompanying financial statements, during 1999 the Company entered into various transactions

with affiliated companies such as LG Electronics U.S.A. Inc., including sales of

₩

4,725,470 million and purchases of

₩

1,049,335

million. As of December 31, 1999, related accounts receivable and payable approximate

₩

372,491 million and

₩

275,529 million,

respectively.

As discussed in Note 7 to the accompanying financial statements, pursuant to a share transfer agreement dated May 20, 1999,

the Company transferred 61,512,076 shares of LG Semicon Co., Ltd. to Hyundai Electronics Industries Co., Ltd. in exchange for

₩

1,726,208 million and recognized a gain on disposal of investment of

₩

1,102,930 million. The price is subject to adjustment based

on certain factors.

As discussed in Note 7 to the accompanying financial statements, pursuant to a joint venture agreement with Koninklijke

Philips Electronics N.V. (“Philips”) dated July 24, 1999, the Company transferred certain of the Company’s stock rights in LG. Philips

LCD CO., Ltd. (formerly LG LCD Co., Ltd.) to Philips. As a result, the Company reduced its ownership of LG. Philips LCD Co., Ltd. to

50% and recognized a gain on disposal of investment of

₩

1,179,939 million.

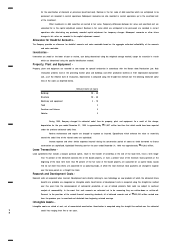

As discussed in Note 14 to the accompanying financial statements, Zenith Electronics Corporation (“Zenith”), a subsidiary, has

experienced significant financial difficulties resulting from continuous losses. Zenith filed a pre-packaged plan of reorganization under

Chapter 11 of the Bankruptcy Code of the United States of America on August 23, 1999, and the reorganization plan was approved by

the court on November 5, 1999. Under the approved reorganization plan, all outstanding common stock of Zenith was cancelled and

the holders of common stock received no distribution. The Company converted US$ 200 million of US$ 365 million of Zenith’s

obligations to the Company into common stock of Zenith which represents 100% of equity in the restructured Zenith. The remaining

portion of Zenith’s obligations was exchanged for senior secured notes issued by Zenith and an investment in an overseas subsidiary.

Without qualifying our opinion, we draw attention to Note 14 of the accompanying financial statements. The operations of the

Company have been significantly affected, and may continue to be affected for the foreseeable future, by the general adverse economic

conditions in the Republic of Korea and in the Asia Pacific region. The ultimate effect of these significant uncertainties on the financial

position of the Company as of the balance sheet date cannot presently be determined and accordingly, no adjustments have been made

in the accompanying financial statements related to such uncertainties.

The accompanying financial statements are not intended to present the financial position, results of operations and cash flows

in accordance with accounting principles and practices generally accepted in countries and jurisdictions other than the Republic of Korea.

The standards, procedures and practices used to audit such financial statements are those generally accepted and applied in the

Republic of Korea.

Seoul, Korea

February 2, 2000