LG 1999 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 1999 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

3

NOTES TO FINANCIAL STATEMENTS

For the year ended December 31, 1999

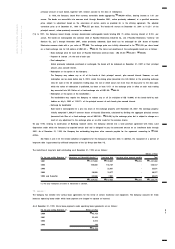

principal amount of such bonds, together with interest accrued to the date of redemption.

In 1998, the Company issued Won currency convertible bonds aggregating

₩

100,000 million, bearing interest at 1.0% per

annum. The bonds are convertible into common stock through November 2001, unless previously redeemed, at a specified conversion

price, subject to adjustment based on the occurrence of certain events as provided for in the offering agreement. The adjusted

conversion price as of December 31, 1999 is

₩

20,555 per share. The bonds will mature on December 31, 2001 at 112.5% of the

principal amount, unless previously converted or redeemed.

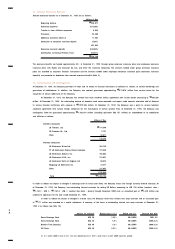

(* 3) In 1997, the Company issued foreign currency denominated exchangeable bonds totaling US$ 75 million bearing interest at 0.25% per

annum. The bonds are exchangeable into common stock of Hyundai Electronics Industries Co., Ltd. (“Hyundai Electronics,” formerly “LG

Semicon Co., Ltd.”) through November 2007, unless previously redeemed. Each bond can be exchanged for 250 shares of Hyundai

Electronics common stock with a par value of

₩

5,000. The exchange price was initially determined to be

₩

35,430 per share based

on a fixed exchange rate for U.S. dollars of US$1.00 =

₩

888.30. The terms and conditions of the exchangeable bonds are as follows :

- Basic exchange price for each share of Hyundai Electronics common stock : US$ 39.88 (

₩

35,430 /

₩

888.30)

- Payment of interest : At the end of each year

- Final redemption :

Unless previously redeemed, purchased or exchanged, the bonds will be redeemed on December 31, 2007 at their principal

amount, plus accrued interest.

- Redemption at the option of the Company :

The Company may redeem any or all of the bonds at their principal amount, plus accrued interest. However, no such

redemption can be made before July 9, 2002, unless the closing price (converted into U.S. Dollars at the prevailing exchange

rate) for each of the 30 consecutive trading days, the last of which occurs not more than 30 days prior to the date upon

which the notice of redemption is published, has been at least 135% of the exchange price in effect on each such trading

day converted into U.S. Dollars at a fixed exchange rate of US$1.00:

₩

888.30.

- Redemption at the option of the bondholders :

The bondholders may require the Company to redeem any or all (in multiples of US$ 10,000) of the bonds held by such

holders on July 8, 2002 at 133.67% of the principal amount of such bonds, plus accrued interest.

- Exchange by bondholder

Each bond is exchangeable for a pro rata share of the exchange property until November 30, 2007. The exchange property

initially comprised 1,880,397 common shares of Hyundai Electronics, calculated by dividing the aggregate principal amount

(converted into Won at a fixed exchange rate of US$1.00 :

₩

888.30) by the exchange price, but is subject to change as a

result of any adjustment to the exchange price or an offer made for the common shares.

On July 1996, relating to construction of Bundang research center, the Company entered into a land purchase agreement with Korea Land

Corporation under which the Company has acquired certain land and is obligated to pay the contracted amount on an installment basis through

2001. As of December 31, 1999, the Company has outstanding long-term other accounts payable for the agreement amounting to

₩

5,205

million.

See Notes 3 and 8 for the related collateral arrangements for the Company’s long-term debt. In addition, the repayment of a portion of

long-term debt is guaranteed by affiliated companies of the LG Group (see Note 14).

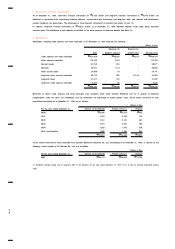

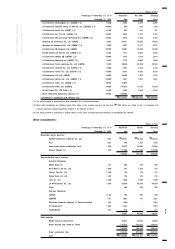

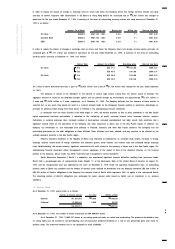

The maturities of long-term debt outstanding as of December 31, 1999 are as follows :

Millions of Won

For the year ending December 31, Debentures and Convertible bonds (* ) Long-term debt Long-term other accounts payable Total

2001

₩

1,217,000

₩

199,097

₩

5,205

₩

1,421,302

2002 100,000 158,187 - 258,187

2003 - 22,631 - 22,631

2004 30,000 10,977 - 40,977

2005 and thereafter 82,588 7,091 - 89,679

₩

1,429,588

₩

397,983

₩

5,205

₩

1,832,776

(* ) No early redemption of bonds or debentures is assumed.

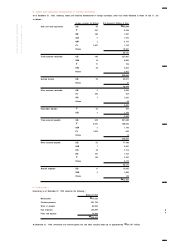

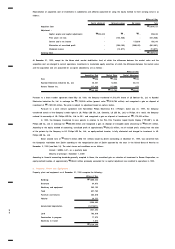

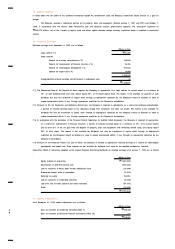

12. Leases :

The Company has entered into various lease agreements for the rental of certain machinery and equipment. The Company accounts for these

leases as operating leases under which lease payment are charged to expense as incurred.

As of December 31, 1999, future lease payments under operating lease agreements are as follows :

For the year ending December 31, Millions of Won

2000

₩

45,759

2001 23,842

2002 3,018

2003 140

₩

72,759