LG 1999 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1999 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

4

NOTES TO FINANCIAL STATEMENTS

For the year ended December 31, 1999

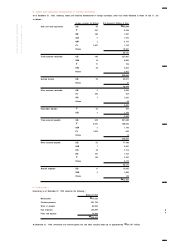

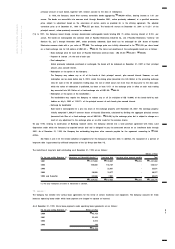

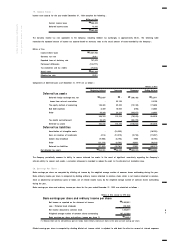

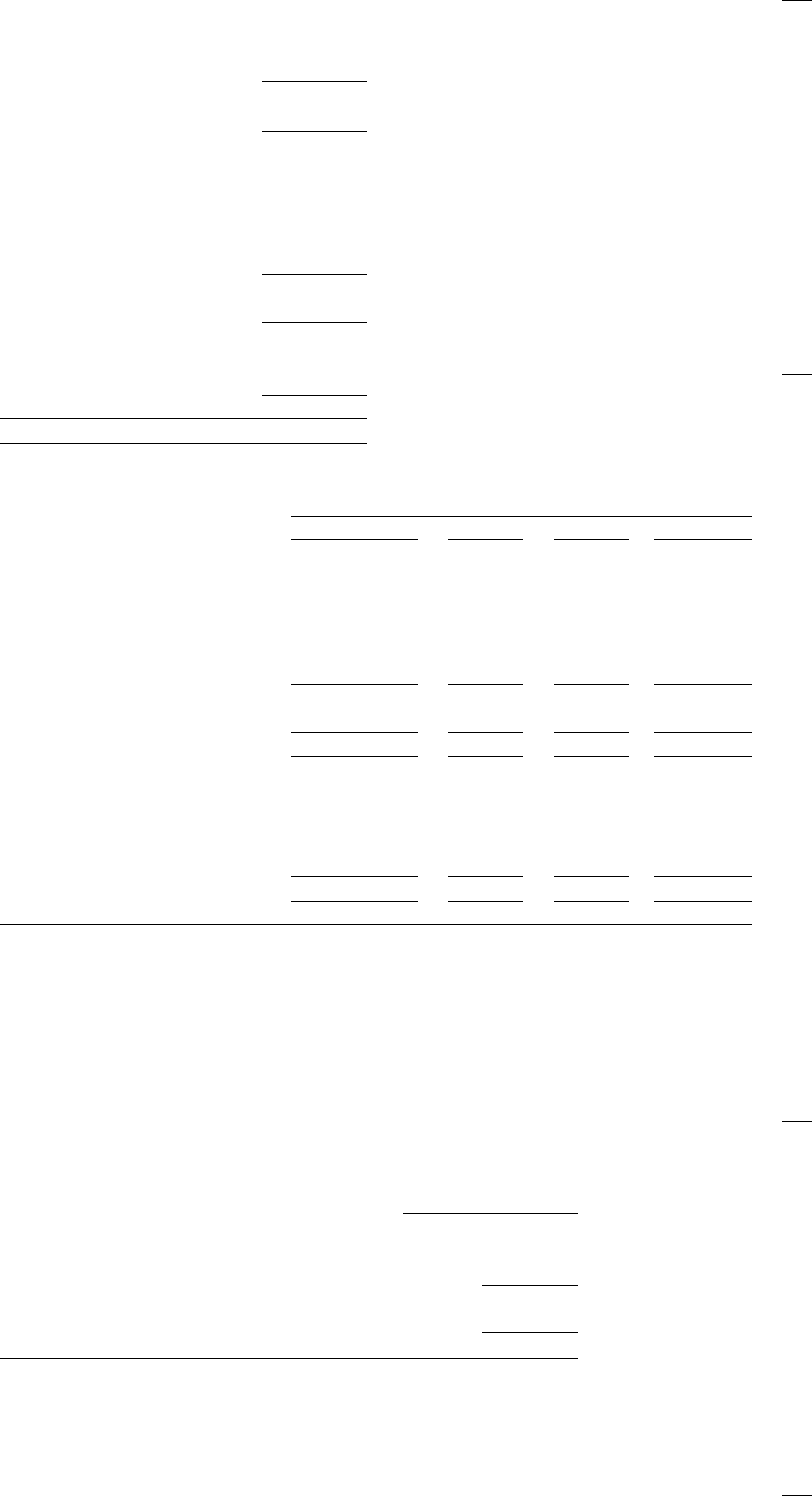

19. Income Taxes :

Income taxe expense for the year ended December 31, 1999 comprise the following :

Millions of Won

Current income taxes

₩

566,892

Deferred income taxes 15,992

₩

582,884

The statutory income tax rate applicable to the Company, including resident tax surcharges, is approximately 30.8%. The following table

reconciles the expected amount of income tax expense based on statutory rates to the actual amount of taxes recorded by the Company :

Millions of Won

Income before taxes

₩

2,587,905

Statutory tax rate 30.8%

Expected taxes at statutory rate 797,075

Permanent differences (134,777)

Tax exemption and tax credits (79,414)

Actual taxes

₩

582,884

Effective tax rate 22.5%

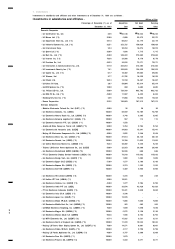

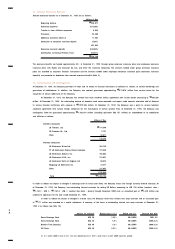

Components of deferred taxes as of December 31, 1999 are as follows :

Millions of Won

Beginning balance Increases Decreases Ending balance

Deferred tax assets

Deferred foreign exchange loss, net

₩

52,607

₩

-

₩

(30,196)

₩

22,411

Losses from sales of receivables - 33,130 - 33,130

The equity method of accounting 148,485 39,293 (12,120) 175,658

Bad debt expenses 8,409 16,663 (390) 24,682

Other 39,268 23,224 (33,857) 28,635

248,769 112,310 (76,563) 284,516

Tax credits carried-forward 33,479 - (33,479) -

Deferred tax assets 282,248 112,310 (110,042) 284,516

Deferred tax liabilities

Amortization of intangible assets - (18,299) - (18,299)

Gain on valuation of investments 4,158 (12,519) (2,736) (11,097)

Custom duty drawback (9,906) (8,198) 9,906 (8,198)

Other (22,219) (6,765) 20,351 (8,633)

Deferred tax liabilities (27,967) (45,781) 27,521 (46,227)

Net deferred tax assets

₩

254,281

₩

66,529

₩

(82,521)

₩

238,289

The Company periodically assesses its ability to recover deferred tax assets. In the event of significant uncertainty regarding the Company’s

ultimate ability to recover such assets, a valuation allowance is recorded to reduce the asset to its estimated net realizable value.

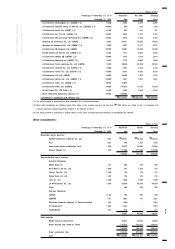

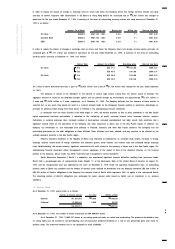

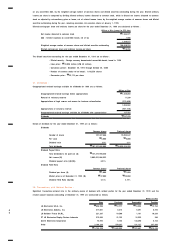

20. Earnings Per Share :

Basic earnings per share are computed by dividing net income by the weighted average number of common shares outstanding during the year.

Basic ordinary income per share is computed by dividing ordinary income allocated to common stock, which is net income allocated to common

stock as adjusted by extraordinary gains or losses, net of related income taxes, by the weighted average number of common shares outstanding

during the year.

Basic earnings per share and ordinary income per share for the year ended December 31, 1999 are calculated as follows :

Millions of Won (except for EPS data)

Basic earnings per share and ordinary income per share

Net income as reported on the statement of income

₩

2,005,021

Less : Preferred stock dividends (20,050)

Net income allocated to common stock 1,984,971

Weighted average number of common shares outstanding 107,327,666

Basic earnings per share and ordinary income per share (* )

₩

18,494

(* ) Because there are no extraordinary gains or losses, basic ordinary income per share is the same as basic earings per share.

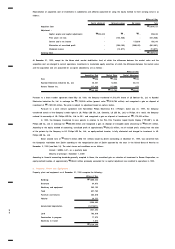

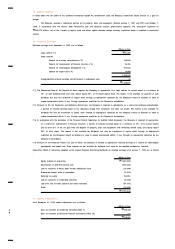

Diluted earnings per share is computed by dividing diluted net income, which is adjusted to add back the after-tax amount of interest expenses