LG 1999 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 1999 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

3

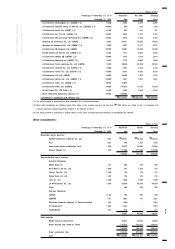

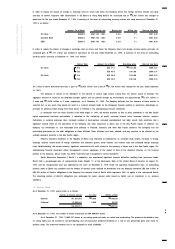

13. Accrued Severance Benefits :

Accrued severance benefits as of December 31, 1999 are as follows :

Millions of Won

Beginning balance

₩

456,071

Severance payments (135,293)

Transfer-in from affiliated companies 8,854

Provisions 99,300

Additional provisions (Note 2) 11,907

Conversion to severance insurance deposit (5,997)

434,842

Severance insurance deposits (265,835)

Contribution to National Pension Fund (40,277)

₩

128,730

The severance benefits are funded approximately 65% at December 31, 1999 through group severance insurance plans and employees severance

insurance plans with Kyobo Life Insurance Co, Ltd. and other life insurance companies. The amounts funded under group severance insurance

plans are recorded as long-term financial instruments and the amounts funded under employees severance insurance plans (severance insurance

deposits) are presented as deduction from accrued severance benefits (Note 3).

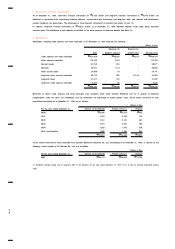

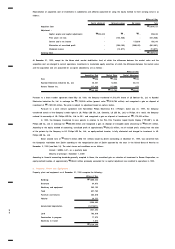

14. Commitments and Contingencies :

At December 31, 1999, the Company provided 34 notes and 13 checks to financial institutions as collateral in relation to various borrowings and

guarantees of indebtedness. In addition, the Company has received guarantees approximating

₩

874,078 million from various banks for the

repayment of certain debentures of the Company.

At December 31, 1999, the Company has entered into bank overdraft facility agreements with various banks amounting to

₩

336,200

million. At December 31, 1999, the outstanding balance of domestic trade notes receivable and export trade accounts receivable sold at discount

to various financial institutions with recourse is

₩

2,279,388 million. At December 31, 1999, the Company was a party to various technical

assistance agreements with various foreign companies for the manufacture of certain product lines. At December 31, 1999, the Company was

contingently liable for guarantees approximating

₩

1,492,126 million (including equivalent US$ 757 million) on indebtedness of its subsidiaries

and affiliates as follows :

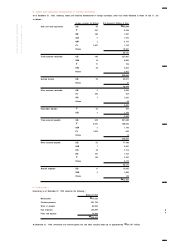

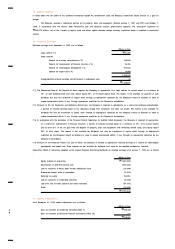

Millions of Won

Domestic companies

LG Telecom, Ltd.

₩

114,540

LG Precision Co., Ltd. 5,727

Other 26,011

146,278

Overseas companies

LG Electronics Wales Ltd. 264,759

PT LG Electronics Display Device Indonesia 127,630

LG Electronics Alabama Inc. 166,083

LG Electronics U.S.A., Inc. 116,831

LG Electronics North of England Ltd. 80,873

Shuguang LG Electronics Inc. 74,577

Other 515,095

1,345,848

Total

₩

1,492,126

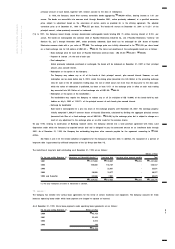

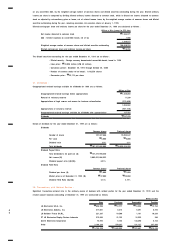

In order to reduce the impact of changes in exchange rates on future cash flows, the Company enters into foreign currency forward contracts. As

of December 31, 1999, the Company has outstanding forward contracts for selling US Dollars amounting to US$ 130 million (contract rates :

₩

1,134.1 : US$ 1~

₩

1,187.6 : US$ 1, contract due dates : January through November 2000) and an unrealized gain of

₩

1,490 million was

credited to operations for the year ended December 31, 1999.

In order to reduce the impact of changes in interest rates, the Company enters into interest rate swap contracts and an unrealized gain

of

₩

171 million was recorded as a capital adjustment. A summary of the terms of outstanding interest rate swap contracts at December 31,

1999 is as follows (see Note 18) :

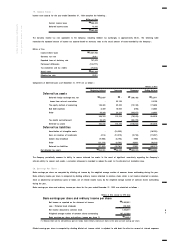

Amount (In millions) Buying rate (% ) (* ) Selling rate (%) Contract due date

Korea Exchange Bank US$ 50 5.45% 6M LIBOR 2001.6.5

Korea Exchange Bank US$ 40 5.9% 6M LIBOR 2000.8.24

Bankers Trust Company US$ 40 5.9% 6M LIBOR 2000.8.24

Citi Bank US$ 20 5.91% 6M LIBOR 2000.8.24

(* ) If 6 month LIBOR is over 6.25%, the rate deducting 0.34 or 0.35% point from 6 month LIBOR would be applied.