LG 1999 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1999 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

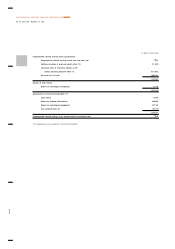

0

3

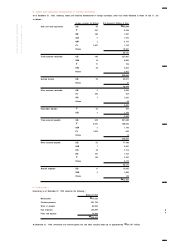

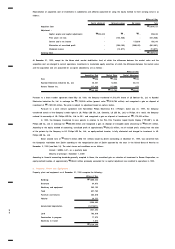

3. Restricted Financial Instruments :

As of December 31, 1999, short-term financial instruments of

₩

5,923 million and long-term financial instruments of

₩

6,846 million are

deposited in connection with maintaining checking accounts, various short-term borrowings and long-term debt, and research and development

projects funded by the government. The withdrawal of these financial instruments is restricted (see Notes 10 and 11).

In addition, long-term financial instruments of

₩

16,882 million as of December 31, 1999 represent deposits made under group severance

insurance plans. The withdrawal of such deposits is restricted to the actual payment of severance benefits (see Note 13).

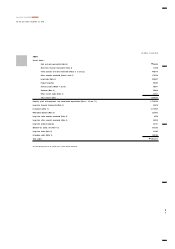

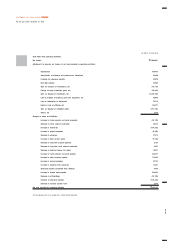

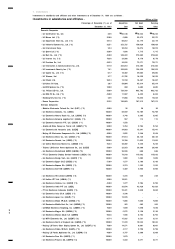

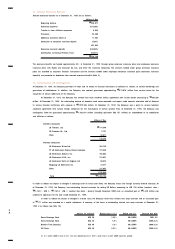

4. Receivables :

Receivables, including trade accounts and notes receivable, as of December 31, 1999 comprise the following :

Millions of Won

Allowance for Discounts for

Costs doubtful accounts present value Carrying value

Trade accounts and notes receivable

₩

521,656

₩

38,259

₩

2,679

₩

480,718

Other accounts receivable 175,702 2,974 - 172,728

Accrued income 81,789 818 - 80,971

Advances 62,011 1,173 - 60,838

Other current assets 24,800 59 - 24,741

Long-term other accounts receivable 60,174 602 14,133 45,439

Long-term loans 31,517 315 - 31,202

Long-term trade accounts receivable 8,642 86 - 8,556

₩

966,291

₩

44,286

₩

16,812

₩

905,193

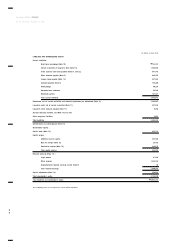

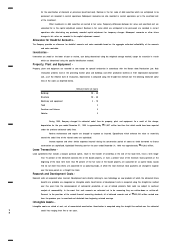

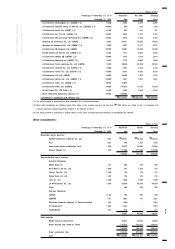

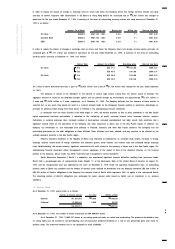

Maturities of certain trade accounts and notes receivable from customers which suffer financial difficulties and are in process of corporate

reorganization under the court are rescheduled and the receivables are discounted to record present value. Future annual maturities of such

receivables outstanding as of December 31, 1999 are as follows :

Millions of Won

For the year ending December 31, Amount to be collected Present value (* ) Discount

2000

₩

3,206

₩

2,973

₩

233

2001 2,359 2,220 139

2002 2,512 2,125 387

2003 2,913 2,207 706

2004 2,029 1,479 550

2005 and thereafter 2,000 1,336 664

₩

15,019

₩

12,340

₩

2,679

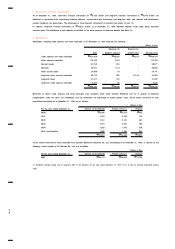

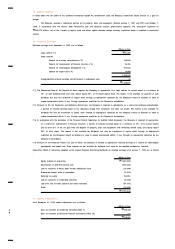

Future annual maturities of notes receivable from Hyundai Electronics Industries Co., Ltd. outstanding as of December 31, 1999, in relation to the

Company’s share transfer of LG Semicon Co., Ltd., are as follows :

Millions of Won

For the year ending December 31, Amount to be collected Present value (* ) Discount

2002

₩

60,174

₩

46,041

₩

14,133

(* ) Weighted average interest rate of long-term debt of the Company for the year ended December 31, 1999 (11% ) is used to calculate discounted present

value.