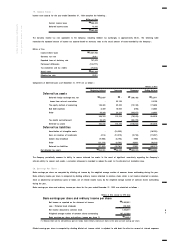

LG 1999 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 1999 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

3

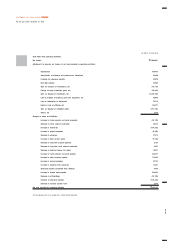

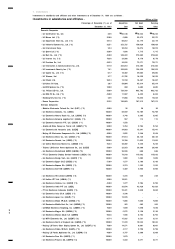

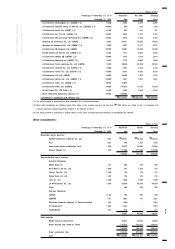

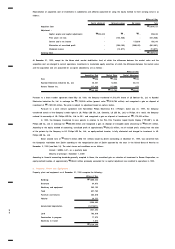

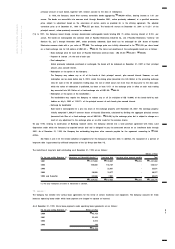

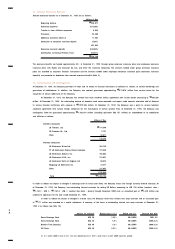

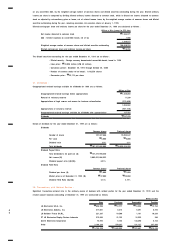

NOTES TO FINANCIAL STATEMENTS

For the year ended December 31, 1999

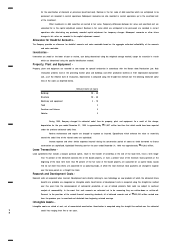

As of December 31, 1999, the value of the Company’s land, as determined by the local government in Korea for property

tax assessment purpose, approximates

₩

581,759 million.

As of December 31, 1999, property, plant and equipment, other than land and certain construction in progress,

are insured against fire and other casualty losses up to approximately

₩

4,009,987 million.

A substantial portion of property, plant and equipment as of December 31, 1999 is pledged as collateral for

various loans from banks, including Korea Development Bank, up to a maximum Won equivalent amount of

approximately

₩

583,009 million (see Notes 10 and 11).

9. Intangible Assets :

Intangible assets as of December 31, 1999 comprise the following :

Millions of Won

Development costs

₩

82,938

Industrial property rights 15,979

Other 7,192

₩

106,109

Details of research and development costs incurred for the year ended December 31, 1999 are as follows :

Millions of Won

Capitalized

₩

74,271

Expensed 179,697

₩

253,968

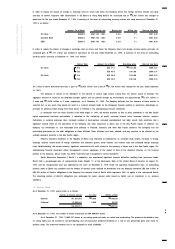

10. Short-Term Borrowings :

Short-term borrowings as of December 31, 1999 comprise the following :

Annual Interest Rates (% ) as of December 31, 1999 In Millions

Bank overdrafts 13.0

₩

16,957

Won currency loans :

General term loans 7.0 - 12.2 81,500

Loans from insurance companies 8.1 20,000

101,500

Foreign currency loans 3.2 11,324

US$ 1

¥

897

₩

129,781

See Notes 3 and 8 for collateral arrangements for these borrowings. Repayment of certain borrowings has been guaranteed by affiliated

companies of the LG Group (see Note 14).

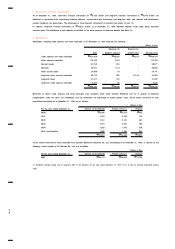

Current maturities of long-term debt as of December 31, 1999 comprise the following :

Millions of Won

Debentures

₩

1,154,450

Discount on debentures (6,158)

Long-term debt 217,800

₩

1,366,092

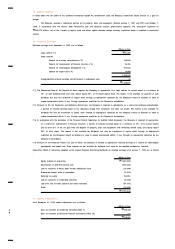

11. Long-Term Debt :

Long-term debt as of December 31, 1999 comprises the following :

Annual Interest Rate (% ) at December 31, 1999 In Millions

Debentures

Guaranteed, payable through 2001 11.0 - 25.0

₩

787,100

Non-guaranteed, payable through 2004 8.1 - 21.4 311,000

General, payable through 2002 8.0 - 12.0 1,320,000

Floating rate notes in foreign currency,

payable through 2000 (* 1) Libor+ 0.25~ 0.40 83,350

HK$ 550

US$ 2

2,501,450

Convertible Bonds (* 2)

Foreign currency, issued in 1991 3.25 40

(US$ - )

Foreign currency, issued in 1996 1.25 33,096

(US$ 40)