Home Depot 1999 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1999 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

The Home Depot, Inc. and Subsidiaries

>Note 8

Lawsuit Settlements

During fiscal 1997, the Company, without admitting any wrongdoing,

entered into a settlement agreement with plaintiffs in the class action

lawsuit Butler et. al. v. Home Depot, Inc., in which the plaintiffs had

asserted claims of gender discrimination. The Company subsequently

reached agreements to settle three other lawsuits seeking class action

status, each of which involved claims of gender discrimination.

As a result of these agreements, the Company recorded a pre-tax

non-recurring charge of $104 million in fiscal 1997 and, in fiscal 1998,

made payments to settle these agreements. The payments made in

fiscal 1998 included $65 million to the plaintiff class members and

$22.5 million to the plaintiff’s attorneys in Butler, and approximately

$8 million for other related internal costs, including implementation or

enhancement of certain human resources programs, as well as the

settlement terms of the three other lawsuits. Payments made in

fiscal 1999 totaled $3.4 million primarily related to internal costs

for human resources staffing and training for store associates. The

Company expects to spend the remaining $5 million for additional

training programs.

>Note 9

Commitments and Contingencies

At January 30, 2000, the Company was contingently liable for

approximately $419 million under outstanding letters of credit issued

in connection with purchase commitments.

The Company is involved in litigation arising from the normal

course of business. In management’s opinion, this litigation is not

expected to materially impact the Company’s consolidated results of

operations or financial condition.

>Note 10

Acquisitions

During the first quarter of fiscal 1998, the Company purchased,

for $261 million, the remaining 25% partnership interest held by

The Molson Companies in The Home Depot Canada. The excess

purchase price over the estimated fair value of net assets of $117 million

as of the acquisition date was recorded as goodwill and is being

amortized over 40 years. As a result of this transaction, the Company

now owns all of The Home Depot’s Canadian operations. The Home

Depot Canada partnership was formed in 1994 when the Company

acquired 75% of Aikenhead’s Home Improvement Warehouse for

approximately $162 million. The terms of the original partnership

agreement provided for a put/call option, which would have resulted

in the Company purchasing the remaining 25% of The Home Depot

Canada at any time after the sixth anniversary of the original agree-

ment. The companies reached a mutual agreement to complete the

purchase transaction at an earlier date.

During fiscal 1999, the Company acquired Apex Supply Company,

Inc. and Georgia Lighting, Inc. Both acquisitions were recorded under

the purchase method of accounting.

32

>Note 11

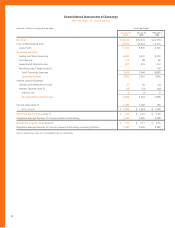

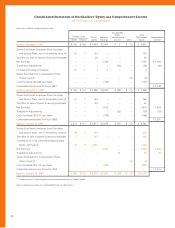

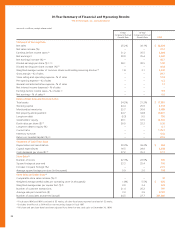

Quarterly Financial Data (unaudited)

The following is a summary of the quarterly results of operations for the fiscal years ended January 30, 2000 and January 31, 1999 (dollars

in millions, except per share data):

Increase Basic Diluted

In Comparable Gross Net Earnings Earnings

Net Sales Store Sales Profit Earnings Per Share Per Share

Fiscal year ended January 30, 2000:

First quarter

$ 8,952 9% $ 2,566 $ 489 $0.22 $0.21

Second quarter

10,431 11% 3,029 679 0.30 0.29

Third quarter

9,877 10% 2,894 573 0.26 0.25

Fourth quarter

9,174 9% 2,922 579 0.25 0.25

Fiscal year

$ 38,434 10% $ 11,411 $ 2,320 $1.03 $1.00

Fiscal year ended January 31, 1999:

First quarter $ 7,123 7% $ 1,968 $ 337 $0.15 $0.15

Second quarter 8,139 7% 2,263 467 0.21 0.21

Third quarter 7,699 7% 2,177 392 0.18 0.17

Fourth quarter 7,258 9% 2,197 418 0.19 0.18

Fiscal year $ 30,219 7% $ 8,605 $ 1,614 $0.73 $0.71