Home Depot 1999 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 1999 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Home Depot, Inc. and Subsidiaries

The amount of goodwill impairment, if any, is measured based on

projected discounted future operating cash flows using a discount

rate reflecting the Company’s average cost of funds.

Store Pre-Opening Costs

Non-capital expenditures associated with opening new stores are

expensed as incurred.

Impairment of Long-Lived Assets

The Company reviews long-lived assets for impairment when

circumstances indicate the carrying amount of an asset may not be

recoverable. An impairment is recognized to the extent the sum of

undiscounted estimated future cash flows expected to result from the

use of the asset is less than the carrying value. Accordingly, when the

Company commits to relocate or close a store, the estimated unre-

coverable costs are charged to selling and store operating expense.

Such costs include the estimated loss on the sale of land and build-

ings, the book value of abandoned fixtures, equipment and leasehold

improvements, and a provision for the present value of future lease

obligations, less estimated sub-lease income.

Stock Compensation

Statement of Financial Accounting Standards No. 123 (“SFAS 123”),

“Accounting for Stock-Based Compensation,” encourages the use

of a fair-value-based method of accounting. As allowed by SFAS 123,

the Company has elected to account for its stock-based compensation

plans under the intrinsic value-based method of accounting prescribed

by Accounting Principles Board Opinion No. 25 (“APB No. 25”),

“Accounting for Stock Issued to Employees.” Under APB No. 25,

compensation expense would be recorded on the date of grant if the

current market price of the underlying stock exceeded the exercise price.

The Company has adopted the disclosure requirements of SFAS 123.

Comprehensive Income

Comprehensive income includes net earnings adjusted for certain

revenues, expenses, gains and losses that are excluded from net earn-

ings under generally accepted accounting principles. Examples include

foreign currency translation adjustments and unrealized gains and

losses on investments.

Foreign Currency Translation

The assets and liabilities denominated in a foreign currency are trans-

lated into U.S. dollars at the current rate of exchange on the last day

of the reporting period, revenues and expenses are translated at the

average monthly exchange rates, and all other equity transactions are

translated using the actual rate on the day of the transaction.

Use of Estimates

Management of the Company has made a number of estimates and

assumptions relating to the reporting of assets and liabilities and the

disclosure of contingent assets and liabilities to prepare these financial

statements in conformity with generally accepted accounting princi-

ples. Actual results could differ from these estimates.

Reclassifications

Certain balances in prior fiscal years have been reclassified to conform

with the presentation in the current fiscal year.

>Note 2

Long-Term Debt

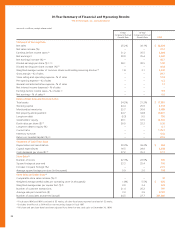

The Company’s long-term debt at the end of fiscal 1999 and 1998

consisted of the following (amounts in millions):

January 30, January 31,

2000 1999

31⁄4% Convertible Subordinated Notes,

due October 1, 2001; converted into

shares of common stock of the Company

at a conversion price of $15.3611 per

share in October 1999 $–$ 1,103

61⁄2% Senior Notes, due September 15, 2004;

interest payable semi-annually on March 15

and September 15 beginning in 2000 500 –

Commercial Paper; weighted average

interest rate of 4.8% at January 31, 1999 –246

Capital Lease Obligations; payable in varying

installments through January 31, 2027

(see note 5) 216 180

Installment Notes Payable; interest imputed

at rates between 5.2% and 10.0%; payable

in varying installments through 2018 45 27

Unsecured Bank Loan; floating interest rate

averaging 6.05% in fiscal 1999 and 5.90%

in fiscal 1998; payable in August 2002 15 15

Variable Rate Industrial Revenue Bonds;

secured by letters of credit or land; interest

rates averaging 2.9% during fiscal 1999

and 3.8% during fiscal 1998; payable in

varying installments through 2010 39

Total long-term debt 779 1,580

Less current installments 29 14

Long-term debt, excluding current installments $ 750 $ 1,566

27