Home Depot 1999 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 1999 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

The Home Depot, Inc. and Subsidiaries

On September 27, 1999, the Company issued $500 million of

61⁄2% Senior Notes (“Senior Notes”). The Company, at its option, may

redeem all or any portion of the Senior Notes by notice to the holder.

The Senior Notes are redeemable at a redemption price, plus accrued

interest, equal to the greater of (1) 100% of the principal amount of

the Senior Notes to be redeemed or (2) the sum of the present values

of the remaining scheduled payments of principal and interest on the

Senior Notes to maturity. The Senior Notes are not subject to sinking

fund requirements.

During fiscal 1999, the Company redeemed its 31⁄4% Convertible

Subordinated Notes (“31⁄4% Notes”). A total principal amount of

$1.1 billion was converted into 72 million shares of the Company’s

common stock. As a result, the total principal amount converted, net

of unamortized expenses of the original debt issue, was credited to

common stock at par and to additional paid-in capital in the amount

of $1.1 billion.

The Company has a commercial paper program that allows

borrowings up to a maximum of $800 million. As of January 30, 2000,

there were no borrowings outstanding under the program. In connec-

tion with the program, the Company has a back-up credit facility with

a consortium of banks for up to $800 million. The credit facility, which

expires in September 2004, contains various restrictive convenants,

none of which is expected to materially impact the Company’s liquidity

or capital resources.

The restrictive covenants related to letter of credit agreements

securing the industrial revenue bonds are no more restrictive than

those referenced above.

Interest expense in the accompanying Consolidated Statements of

Earnings is net of interest capitalized of $45 million in fiscal 1999,

$31 million in fiscal 1998 and $19 million in fiscal 1997.

Maturities of long-term debt are $29 million for fiscal 2000,

$4 million for fiscal 2001, $19 million for fiscal 2002, $5 million for

fiscal 2003 and $506 million for fiscal 2004.

The estimated fair value of the 61⁄2% Senior Notes, which are

publicly traded, was approximately $485 million based on an imputed

market price at January 30, 2000. The estimated fair value of all other

long-term borrowings was approximately $441 million compared to

the carrying value of $279 million. These fair values were estimated

using a discounted cash flow analysis based on the Company’s incre-

mental borrowing rate for similar liabilities.

>Note 3

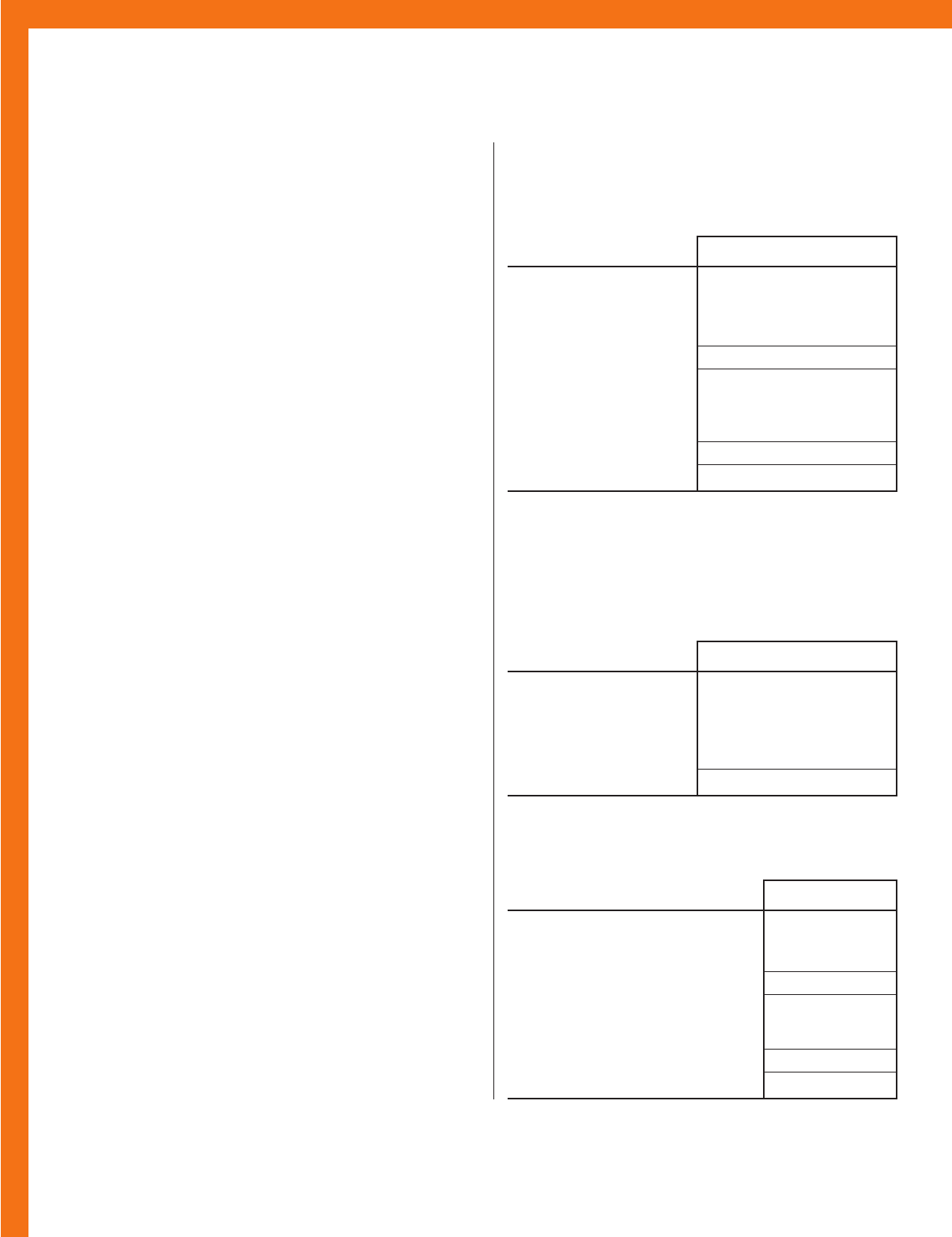

Income Taxes

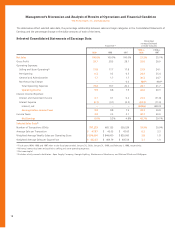

The provision for income taxes consisted of the following (in millions):

Fiscal Year Ended

January 30, January 31, February 1,

2000 1999 1998

Current:

U.S. $ 1,209 $ 823 $ 653

State 228 150 98

Foreign 45 20 15

1,482 993 766

Deferred:

U.S. 946 (31)

State (4) (1) 1

Foreign (3) 22

247 (28)

Total $ 1,484 $ 1,040 $ 738

The Company’s combined federal, state and foreign effective tax

rates for fiscal years 1999, 1998 and 1997, net of offsets generated

by federal, state and foreign tax incentive credits, were approximately

39.0%, 39.2% and 38.9%, respectively. A reconciliation of income

tax expense at the federal statutory rate of 35% to actual tax expense

for the applicable fiscal years follows (in millions):

Fiscal Year Ended

January 30, January 31, February 1,

2000 1999 1998

Income taxes at U.S. statutory rate $ 1,331 $ 929 $ 664

State income taxes, net of federal

income tax benefit 145 96 65

Foreign rate differences 2–2

Other, net 615 7

Total $ 1,484 $ 1,040 $ 738

The tax effects of temporary differences that give rise to significant

portions of the deferred tax assets and deferred tax liabilities as of

January 30, 2000 and January 31, 1999 were as follows (in millions):

January 30, January 31,

2000 1999

Deferred Tax Assets:

Accrued self-insurance liabilities $ 154 $ 110

Other accrued liabilities 142 97

Total gross deferred tax assets 296 207

Deferred Tax Liabilities:

Accelerated depreciation (321) (249)

Other (62) (43)

Total gross deferred tax liabilities (383) (292)

Net deferred tax liability $ (87) $ (85)

28