Home Depot 1999 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1999 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

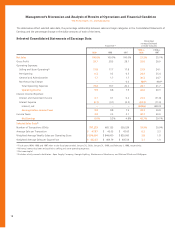

The Home Depot, Inc. and Subsidiaries

The cost of new stores to be constructed and owned by the

Company varies widely, principally due to land costs, and is currently

estimated to average approximately $13.2 million per location. The

cost to remodel and/or fixture stores to be leased is expected to aver-

age approximately $4.3 million per store. In addition, each new store

will require approximately $3.2 million to finance inventories, net of

vendor financing.

During fiscal 1999, the Company issued $500 million of 61⁄2% Senior

Notes (“Senior Notes”). The Senior Notes are due on September 15, 2004,

and pay interest semi-annually on March 15 and September 15 of each

year commencing March 15, 2000. The Senior Notes may be redeemed by

the Company at any time, in whole or in part, at a defined redemption

price plus accrued interest. The net proceeds from the offering were used

to finance a portion of the Company’s capital expenditure program, includ-

ing store expansions and renovations, for working capital needs and for

general corporate purposes.

During fiscal 1999, the Company redeemed its 31⁄4% Convertible

Subordinated Notes. A total principal amount of $1.1 billion was

converted into 72 million shares of the Company’s common stock. As

a result, the total principal amount converted, net of unamortized

expenses of the original debt issue, was credited to common stock

at par and to additional paid-in capital in the amount of $1.1 billion.

The Company has a commercial paper program that allows borrow-

ings up to a maximum of $800 million. As of January 30, 2000, there

were no borrowings outstanding under the program. In connection with

the program, the Company has a back-up credit facility with a consor-

tium of banks for up to $800 million. The credit facility, which expires in

September 2004, contains various restrictive covenants, none of which

is expected to impact the Company’s liquidity or capital resources.

As of January 30, 2000, the Company had $168 million in cash

and cash equivalents. Management believes that its current cash posi-

tion, the proceeds from short-term investments, internally generated

funds, funds available from its $800 million commercial paper pro-

gram, funds available from the operating lease agreements, and the

ability to obtain alternate sources of financing should enable the

Company to complete its capital expenditure programs, including

store openings and renovations, through the next several fiscal years.

Year 2000

During fiscal 1999, the Company addressed a universal situation

commonly referred to as the “Year 2000 Problem.” The Company

implemented extensive testing of its own systems and also assessed

the year 2000 compliance status of certain third parties, including

vendors and infrastructure providers. To date, the Company has not

experienced any material year 2000 system problems, nor does it

believe there will be any future material adverse impact to the

Company’s business, operations or financial condition related to

the Year 2000 Problem.

Quantitative and Qualitative Disclosures About

Market Risk

The Company has not entered into any transactions using derivative

financial instruments or derivative commodity instruments and

believes that its exposure to market risk associated with other finan-

cial instruments (such as investments and borrowings) and interest

rate risk is not material.

Impact of Inflation and Changing Prices

Although the Company cannot accurately determine the precise effect

of inflation on its operations, it does not believe inflation has had a

material effect on sales or results of operations.

Recent Accounting Pronouncements

In June 1998, the Financial Accounting Standards Board issued

Statement of Financial Accounting Standards No. 133 (“SFAS 133”),

“Accounting for Derivative Instruments and Hedging Activities,” effec-

tive for all fiscal quarters of fiscal years beginning after June 15, 1999.

In June 1999, the Financial Accounting Standards Board issued

Statement of Financial Accounting Standards No. 137, “Accounting

for Derivative Instruments and Hedging Activities – Deferral of the

Effective Date of FASB Statement No. 133,” which deferred imple-

mentation of SFAS 133 by one year. Consequently, SFAS 133 will

be effective for all fiscal quarters of fiscal years beginning after

June 15, 2000.

SFAS 133 requires all derivatives to be carried on the balance

sheet at fair value. Changes in the fair value of derivatives must be

recognized in the Company’s Consolidated Statements of Earnings

when they occur; however, there is an exception for derivatives that

qualify as hedges as defined by SFAS 133. If a derivative qualifies

as a hedge, a company can elect to use “hedge accounting” to

eliminate or reduce the income statement volatility that would

arise from reporting changes in a derivative’s fair value. Adoption of

SFAS 133 is not expected to materially impact the Company’s

reported financial results.

21