Home Depot 1999 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1999 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

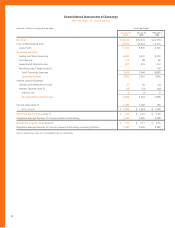

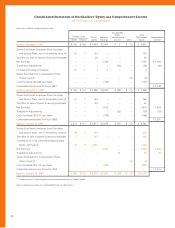

The Home Depot, Inc. and Subsidiaries

No valuation allowance was recorded against the deferred tax

assets at January 30, 2000 or January 31, 1999. Company manage-

ment believes the existing net deductible temporary differences

comprising the total gross deferred tax assets will reverse during periods

in which the Company generates net taxable income.

>Note 4

Employee Stock Plans

The 1997 Omnibus Stock Incentive Plan (“1997 Plan”) provides that

incentive stock options, non-qualified stock options, stock appreciation

rights, restricted stock and deferred shares may be issued to selected

associates, officers and directors of the Company. The maximum

number of shares of the Company’s common stock available for issu-

ance under the 1997 Plan is the lesser of 225 million shares or the

number of shares carried over from prior plans plus one-half percent of

the total number of outstanding shares as of the first day of each fiscal

year. In addition, restricted shares issued under the 1997 Plan may

not exceed 22.5 million shares. As of January 30, 2000, there were

128,623,884 shares available for future grants under the 1997 Plan.

Under the 1997 Plan and prior plans, incentive and non-qualified

options for 116,647,978 shares, net of cancellations (of which

48,228,638 had been exercised), have been granted at prices rang-

ing from $6.42 to $51.46 per share. Incentive stock options vest at

the rate of 25% per year commencing on the first anniversary date

of the grant and expire on the tenth anniversary date of the grant.

The non-qualified options have similar terms; however, vesting does

not generally begin until the second anniversary date of the grant.

As of January 30, 2000, 208,337 shares of restricted stock were

outstanding. The restricted shares vest over varying terms and are

generally based on the attainment of certain performance goals. The

expected fair value of the restricted shares on the vesting dates will be

charged to expense ratably over the vesting periods unless it is deter-

mined that the performance goals will not be met.

The per share weighted average fair value of stock options

granted during fiscal years 1999, 1998 and 1997 was $18.86, $9.94

and $4.20, respectively. These amounts were determined using the

Black-Scholes option-pricing model, which values options based on

the stock price at the grant date, the expected life of the option, the

estimated volatility of the stock, expected dividend payments, and the

risk-free interest rate over the expected life of the option. The dividend

yield was calculated by dividing the current annualized dividend by the

option price for each grant. Expected volatility was based on stock

prices for the fiscal year the grant occurred and the two previous fiscal

years. The risk-free interest rate was the rate available on zero coupon

U.S. government issues with a term equal to the remaining term for

each grant. The expected life of each option was estimated based on

the exercise history from previous grants.

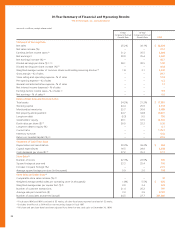

The assumptions used in the Black-Scholes model were as follows:

Stock Options

Granted in Fiscal Year

1999 1998 1997

Risk-free interest rate 5.1% 5.6% 6.1%

Expected volatility of common stock 51.6% 45.7% 30.0%

Dividend yield 0.3% 0.4% 0.5%

Expected option term 5 years 5 years 5 years

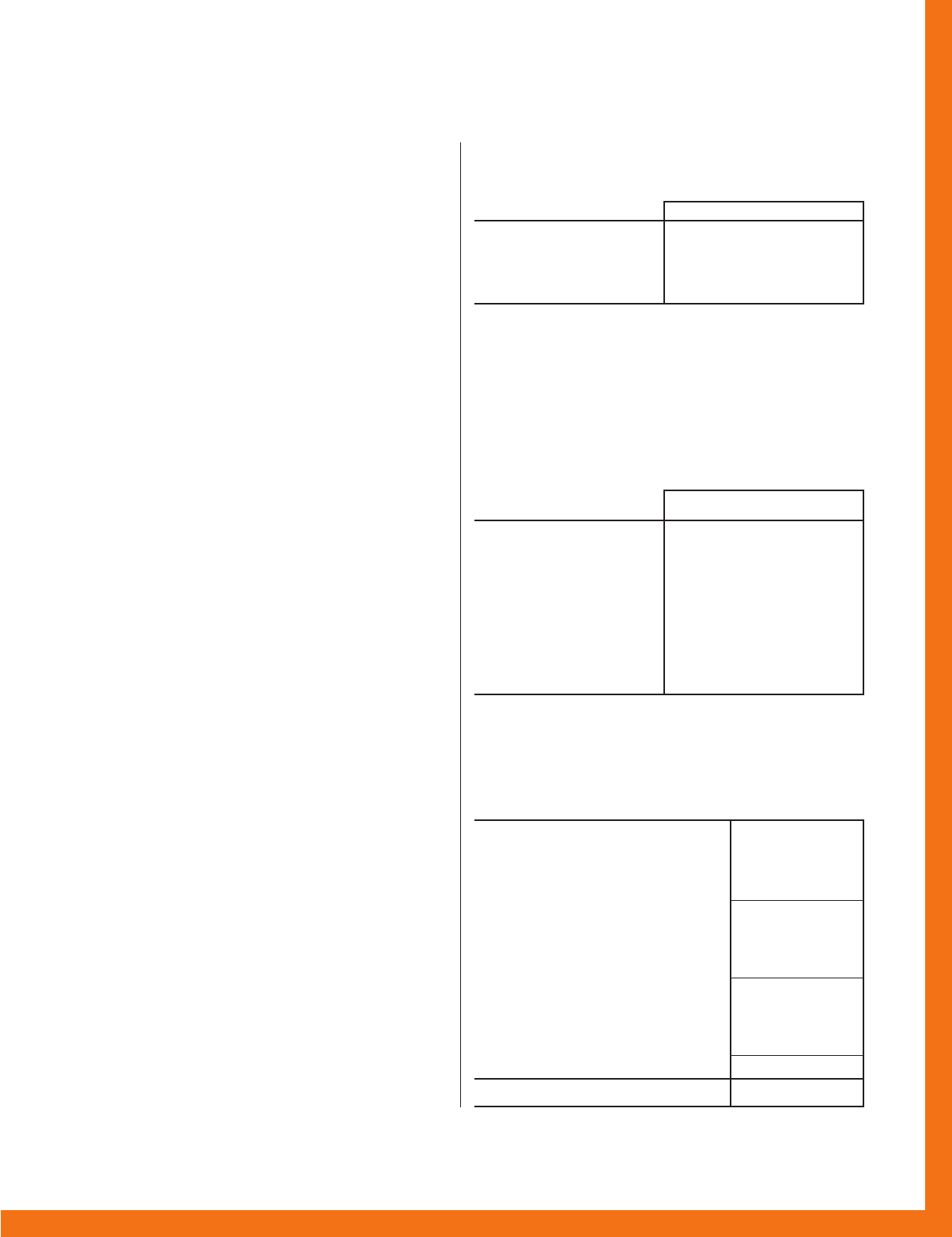

The Company applies APB No. 25 in accounting for its stock plans

and, accordingly, no compensation costs have been recognized in the

Company’s financial statements for incentive or non-qualified stock

options granted. If, under SFAS 123, the Company determined

compensation costs based on the fair value at the grant date for its

stock options, net earnings and earnings per share would have been

reduced to the pro forma amounts below (in millions, except per

share data):

Fiscal Year Ended

January 30, January 31, February 1,

2000 1999 1998

Net Earnings

As reported $ 2,320 $ 1,614 $ 1,160

Pro forma $ 2,186 $ 1,527 $ 1,118

Basic Earnings per Share

As reported $ 1.03 $ 0.73 $ 0.53

Pro forma $ 0.97 $ 0.69 $ 0.51

Diluted Earnings per Share

As reported $ 1.00 $ 0.71 $ 0.52

Pro forma $ 0.94 $ 0.67 $ 0.50

The following table summarizes options outstanding under the

various stock option plans at January 30, 2000, January 31, 1999 and

February 1, 1998 and changes during the fiscal years ended on these

dates (shares in thousands):

Number Average

of Shares Option Price

Outstanding at February 2, 1997 54,207 $ 8.77

Granted 25,857 14.58

Exercised (10,293) 8.82

Cancelled (4,044) 10.19

Outstanding at February 1, 1998 65,727 10.08

Granted 21,041 21.63

Exercised (11,640) 9.07

Cancelled (3,536) 13.89

Outstanding at January 31, 1999 71,592 13.45

Granted 14,006 37.81

Exercised (13,884) 10.88

Cancelled (3,295) 18.88

Outstanding at January 30, 2000

68,419 $ 18.79

Exercisable 22,330 $ 10.61

29