Home Depot 1999 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 1999 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

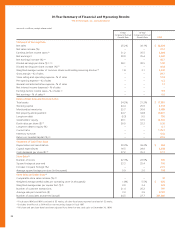

The Home Depot, Inc. and Subsidiaries

The approximate future minimum lease payments under capital

and operating leases at January 30, 2000 were as follows (in millions):

Capital Operating

Fiscal Year Leases Leases

2000 $ 35 $ 466

2001 35 462

2002 35 415

2003 36 384

2004 36 359

Thereafter 505 3,969

682 $ 6,055

Less imputed interest (466)

Net present value of capital

lease obligations 216

Less current installments (3)

Long-term capital lease obligations,

excluding current installments $ 213

Short-term and long-term obligations for capital leases are included

in the Company’s Consolidated Balance Sheets in Current Installments

of Long-Term Debt and Long-Term Debt, respectively. The assets

under capital leases recorded in Net Property and Equipment, net of

amortization, totaled $208 million and $180 million, at January 30,

2000 and January 31, 1999, respectively.

>Note 6

Employee Benefit Plans

During fiscal 1996, the Company established a defined contribution

plan (“401(k)”) pursuant to Section 401(k) of the Internal Revenue

Code. The 401(k) covers substantially all associates that meet certain

service requirements. The Company makes weekly matching cash

contributions to purchase shares of the Company’s common stock, up

to specified percentages of associates’ contributions as approved by

the Board of Directors.

During fiscal 1988, the Company established a leveraged Employee

Stock Ownership Plan and Trust (“ESOP”) covering substantially all

full-time associates. At January 30, 2000, the ESOP held a total of

32,208,550 shares of the Company’s common stock in trust for plan

participants’ accounts. The ESOP purchased the shares in the open

market with contributions received from the Company in fiscal 1998 and

1997, and from the proceeds of loans obtained from the Company

during fiscal 1992, 1990 and 1989 totaling approximately $81 million.

All loans payable to the Company in connection with the purchase of

such shares have been paid in full.

During February 1999, the Company made its final contribution to

the ESOP plan and amended its 401(k) plan. In the amendment, the

Company elected to increase its percentage contribution to the 401(k)

in lieu of future ESOP contributions.

The Company adopted a non-qualified ESOP Restoration Plan in

fiscal 1994. The Company also made its final contribution to the

ESOP Restoration Plan in February 1999 and established a new 401(k)

Restoration Plan. The primary purpose of the new plan is to provide

certain associates deferred compensation that they would have

received under the 401(k) matching contribution if not for the maxi-

mum compensation limits under the Internal Revenue Code of 1986,

as amended. The Company has established a “rabbi trust” to fund the

benefits under the 401(k) Restoration Plan. Compensation expense

related to this plan for fiscal years 1999, 1998 and 1997 was not mate-

rial. Funds provided to the trust are primarily used to purchase shares

of the Company’s common stock in the open market.

The Company’s combined contributions to the 401(k) and ESOP

were $57 million, $41 million and $33 million for fiscal years 1999,

1998 and 1997, respectively.

>Note 7

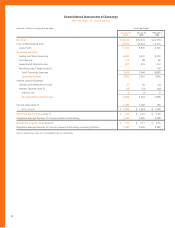

Basic and Diluted Earnings Per Share

The calculations of basic and diluted earnings per share for fiscal years

1999, 1998 and 1997 were as follows (amounts in millions, except

per share data):

Fiscal Year Ended

January 30, January 31, February 1,

2000 1999 1998

Calculation of Basic Earnings

Per Share:

Net earnings $ 2,320 $ 1,614 $ 1,160

Weighted average number of

common shares outstanding 2,244 2,206 2,188

Basic Earnings Per Share

$ 1.03 $ 0.73 $ 0.53

Calculation of Diluted Earnings

Per Share:

Net earnings $ 2,320 $ 1,614 $ 1,160

Tax-effected interest expense

attributable to 31⁄4% Notes 17 23 23

Net earnings assuming dilution $ 2,337 $ 1,637 $ 1,183

Weighted average number of

common shares outstanding 2,244 2,206 2,188

Effect of potentially

dilutive securities:

31⁄4% Notes 51 72 72

Employee stock plans 47 42 27

Weighted average number of

common shares outstanding

assuming dilution 2,342 2,320 2,287

Diluted Earnings Per Share

$ 1.00 $ 0.71 $ 0.52

Employee stock plans represent shares granted under the

Company’s employee stock purchase plan and stock option plans, as

well as shares issued for deferred compensation stock plans. For fiscal

years 1999, 1998 and 1997, shares issuable upon conversion of the

Company’s 31⁄4% Notes, issued in October 1996, were included in

weighted average shares assuming dilution for purposes of calculat-

ing diluted earnings per share. To calculate diluted earnings per share,

net earnings are adjusted for tax-effected net interest and issue costs

on the 31⁄4% Notes (prior to conversion to equity in October 1999)

and divided by weighted average shares assuming dilution.

31