Enom 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-33

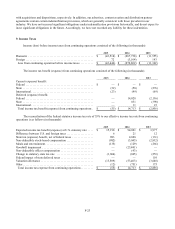

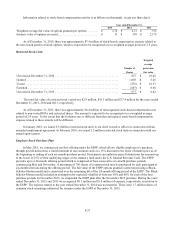

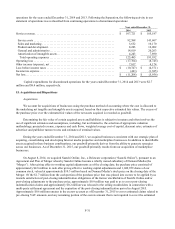

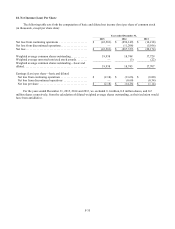

Supplemental Pro forma Information (unaudited)

Supplemental information on an unaudited pro forma basis, as if the 2014 and 2013 acquisitions had been

consummated as of January 1, 2013, is as follows (in thousands):

Year ended December 31,

2014

2013

Revenue ............................................................

$

174,691

$

222,790

Net loss .............................................................

$

(272,988)

$

(24,484)

The unaudited pro forma supplemental information is based on estimates and assumptions which we believe are

reasonable and reflect amortization of intangible assets as a result of the acquisitions. The pro forma results are not

necessarily indicative of the results that have been realized had the acquisitions been consolidated in the tables above as

of January 1, 2013.

Dispositions

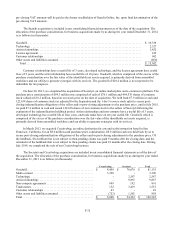

We sold our Creativebug business in July 2014 and received $10.0 million in cash, inclusive of $1.0 million held

in escrow for one year from the closing date as a holdback amount to cover indemnity claims, resulting in a gain on sale

of $0.2 million, recorded in other income, net. The holdback amount was received in 2015. We also sold our CoveritLive

business in July 2014 and received $4.5 million of cash and promissory note with a principal amount of $5.6 million,

resulting in a gain on sale of $0.6 million, recorded in other income, net. During the year ended December 31, 2015, we

agreed to an early repayment of the promissory note and received $5.1 million in cash, plus accrued and unpaid interest,

which satisfied all amounts owed to us under the promissory note.

In February 2015, we sold our Pluck social media business for $3.8 million in cash after working capital

adjustments, resulting in a gain of $2.1 million. During the year ended December 31, 2015, we also sold certain non-core

online properties for a total consideration of $1.2 million, resulting in a gain of $1.0 million, recorded in other income,

net.

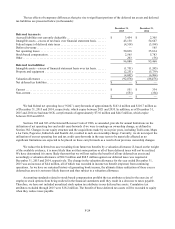

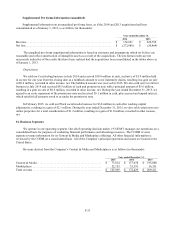

16. Business Segments

We operate in one operating segment. Our chief operating decision maker (“CODM”) manages our operations on a

consolidated basis for purposes of evaluating financial performance and allocating resources. The CODM reviews

separate revenue information for its Content & Media and Marketplace offerings. All other financial information is

reviewed by the CODM on a consolidated basis. All of the Company’s principal operations and assets are located in the

United States.

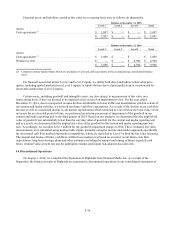

Revenue derived from the Company’s Content & Media and Marketplaces is as follows (in thousands):

Year ended December 31,

2015

2014

2013

Content & Media ..............................................

$

73,814

$

137,038

$

195,080

Marketplaces .................................................

52,155

35,391

14,331

Total revenue .................................................

$

125,969

$

172,429

$

209,411