Enom 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-31

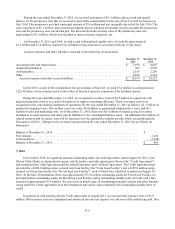

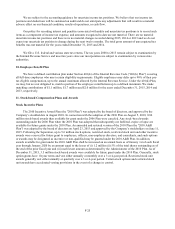

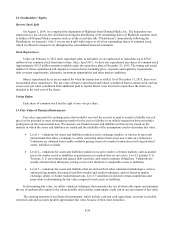

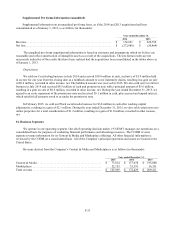

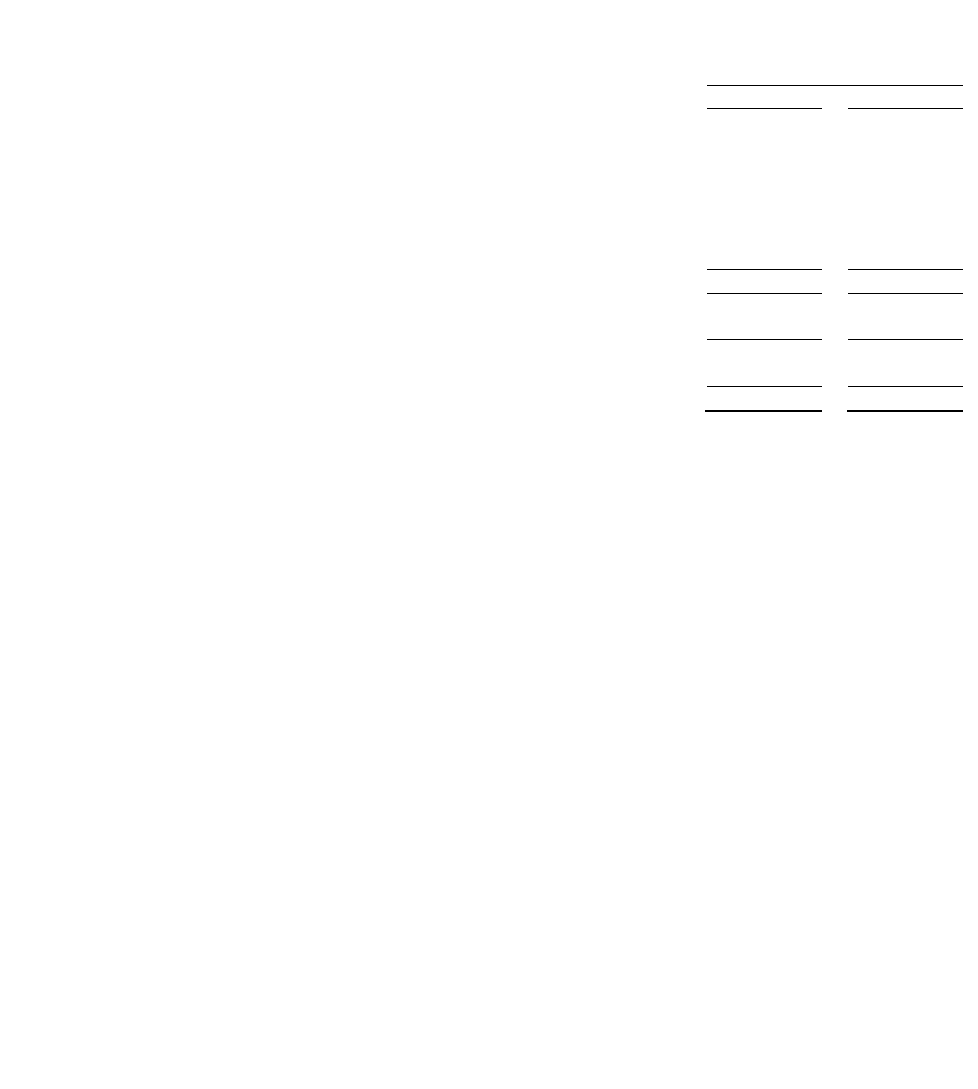

operations for the years ended December 31, 2014 and 2013. Following the Separation, the following activity in our

statement of operations was reclassified from continuing operations to discontinued operations:

Year ended December 31,

2014

2013

Service revenue ........................................................

$

107,721

$

185,187

Service costs .........................................................

92,588

143,607

Sales and marketing ...................................................

5,632

10,170

Product and development ...............................................

8,203

12,002

General and administrative ..............................................

14,819

20,263

Amortization of intangible assets .........................................

4,243

7,890

Total operating expenses ..............................................

125,485

193,932

Operating loss .........................................................

(17,764)

(8,745)

Other income (expense), net ..............................................

7,017

4,174

Loss before income taxes ................................................

$

(10,747)

$

(4,571)

Income tax expense .....................................................

(461)

(1,385)

Net loss ...............................................................

$

(11,208)

$

(5,956)

Capital expenditures for discontinued operations for the years ended December 31, 2014 and 2013 were $2.7

million and $8.4 million, respectively.

15. Acquisitions and Dispositions

Acquisitions

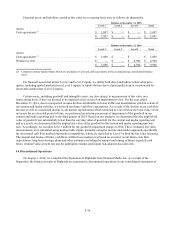

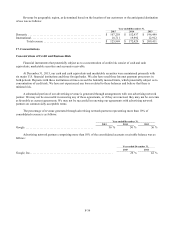

We account for acquisitions of businesses using the purchase method of accounting where the cost is allocated to

the underlying net tangible and intangible assets acquired, based on their respective estimated fair values. The excess of

the purchase price over the estimated fair values of the net assets acquired is recorded as goodwill.

Determining the fair value of certain acquired assets and liabilities is subjective in nature and often involves the

use of significant estimates and assumptions, including, but not limited to, the selection of appropriate valuation

methodology, projected revenue, expenses and cash flows, weighted average cost of capital, discount rates, estimates of

advertiser and publisher turnover rates and estimates of terminal values.

During the years ended December 31, 2014 and 2013, we acquired businesses consistent with our strategic plan of

acquiring, consolidating and developing Internet media properties and marketplace businesses. In addition to identifiable

assets acquired in these business combinations, our goodwill primarily derives from the ability to generate synergies

across our businesses. As of December 31, 2015, our goodwill primarily results from our acquisition of marketplace

businesses.

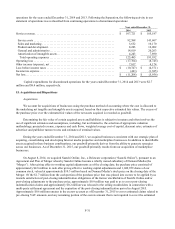

On August 8, 2014, we acquired Saatchi Online, Inc., a Delaware corporation (“Saatchi Online”), pursuant to an

Agreement and Plan of Merger whereby Saatchi Online became a wholly owned subsidiary of Demand Media (the

“Merger”). After giving effect to working capital adjustments as of the closing date, the purchase price consisted of

approximately $4.8 million in cash after giving effect to working capital adjustments and 1,049,959 shares of our

common stock, valued at approximately $10.3 million based on Demand Media’s stock price on the closing date of the

Merger. Of the $1.7 million from the cash portion of the purchase price that was placed into escrow to be applied by us

towards satisfaction of post-closing indemnification obligations of the former stockholders of Saatchi Online and/or

post-closing adjustments to the purchase price, approximately $0.9 million was paid to us to cover post-closing

indemnification claims and approximately $0.2 million was released to the selling stockholders in connection with a

multi-party settlement agreement and the expiration of the post-closing indemnification period in August 2015.

Approximately $0.6 million remains in the escrow account as of December 31, 2015 to cover estimated claims related to

pre-closing VAT amounts, and any remaining portion of the escrow amount that is not required to cover the estimated