Enom 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

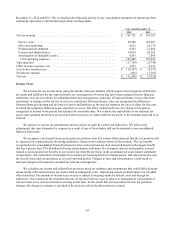

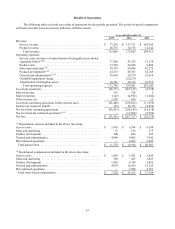

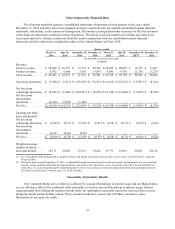

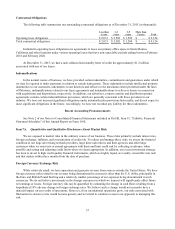

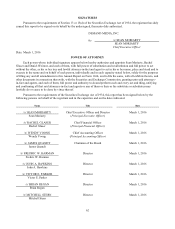

Selected Quarterly Financial Data

The following unaudited quarterly consolidated statements of operations for the quarters in the years ended

December 31, 2015 and 2014, have been prepared on a basis consistent with our audited consolidated annual financial

statements, and include, in the opinion of management, all normal recurring adjustments necessary for the fair statement

of the financial information contained in those statements. The period-to-period comparison of financial results is not

necessarily indicative of future results and should be read in conjunction with our consolidated annual financial

statements and the related notes included elsewhere in this Annual Report on Form 10-K.

Quarter ended

March 31,

June 30,

September 30,

December 31,

March 31,

June 30,

September 30,

December 31,

2014

2014

2014

2014

2015

2015

2015(2)

2015

(In thousands, except per share data)

Unaudited

Revenue:

Service revenue .....

$

38,264

$

36,397

$

33,712

$

29,338

$

23,225

$

20,067

$

16,755

$

17,207

Product revenue .....

6,792

6,680

7,603

13,643

9,985

9,701

11,750

17,279

Total revenue .......

$

45,056

$

43,077

$

41,315

$

42,981

$

33,210

$

29,768

$

28,505

$

34,486

Loss from operations .

$

(5,708)

$

(5,215)

$

(239,316)

$

(16,913)

$

(9,663)

$

(14,527)

$

(13,967)

$

(8,614)

Net loss from

continuing operations

$

(8,946)

$

(6,440)

$

(222,533)

$

(18,230)

$

(6,749)

$

(14,408)

$

(13,805)

$

(8,539)

Net loss from

discontinued

operations ..........

(2,010)

(7,892)

(1,306)

—

—

—

—

—

Net loss ............

$

(10,956)

$

(14,332)

$

(223,839)

$

(18,230)

$

(6,749)

$

(14,408)

$

(13,805)

$

(8,539)

Earnings per share -

basic and diluted

(1)

Net loss from

continuing operations

$

(0.49)

$

(0.35)

$

(11.62)

$

(0.93)

$

(0.34)

$

(0.73)

$

(0.69)

$

(0.42)

Net loss from

discontinued

operations ..........

(0.11)

(0.43)

(0.07)

—

—

—

—

—

Net loss ............

$

(0.60)

$

(0.78)

$

(11.69)

$

(0.93)

$

(0.34)

$

(0.73)

$

(0.69)

$

(0.42)

Weighted average

number of shares -

basic and diluted ....

18,171

18,286

19,151

19,622

19,773

19,841

20,021

20,114

(1) For a description of the method used to compute our basic and diluted net income (loss) per share, refer to note 7 in Part II, Item 6, “Selected

Financial Data.”

(2) During the quarter ended September 30, 2015, we identified through our internal processes that our property and equipment, net was overstated

because certain capitalized internally developed software costs had not been placed into service and certain write-offs were not identified on a

timely basis. As such, during the quarter ended September 30, 2015, we recorded an out of period adjustment which increased depreciation by

$0.6 million and decreased “Other income, net” by $0.5 million.

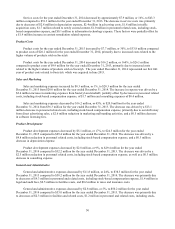

Seasonality of Quarterly Results

Our Content & Media service offering is affected by seasonal fluctuations in internet usage and our Marketplaces

service offering is affected by traditional retail seasonality as well as seasonal fluctuations in internet usage. Internet

usage generally slows during the summer months while our marketplaces generally experience increased sales activity

during the fourth quarter holiday season. These seasonal trends have caused, and will likely continue to cause,

fluctuations in our quarterly results.