Enom 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-17

statement items are translated at the average exchange rate for the period. Gains and losses resulting from translation are

accumulated in accumulated other comprehensive earnings within stockholders’ equity.

Fair Value of Financial Instruments

The carrying amounts of our financial instruments, including cash and cash equivalents, accounts receivable,

restricted cash and accounts payable approximate fair value because of their short maturities. Certain assets, including

goodwill and intangible assets, are also subject to measurement at fair value on a nonrecurring basis, if they are deemed

to be impaired as the result of an impairment review.

Discontinued Operations

We report the results of operations of a business as discontinued operations if the disposal of a component

represents a strategic shift that has (or will have) a major effect on our operations and financial results. The results of

discontinued operations are reported in net income (loss) from discontinued operations in the consolidated statements of

operations for current and prior periods commencing in the period in which the business meets the criteria of a

discontinued operation, and include any gain or loss recognized on closing or adjustment of the carrying amount to fair

value less cost to sell. The financial results of Rightside are presented as discontinued operations in our accompanying

consolidated statements of operations for the years ended December 31, 2014 and 2013.

Assets Held-For-Sale

We report a business as held-for-sale when management has approved or received approval to sell the business and

is committed to a formal plan, the business is available for immediate sale, the business is being actively marketed, the

sale is probable and anticipated to occur during the ensuing year and certain other specified criteria are met. A business

classified as held-for-sale is recorded at the lower of its carrying amount or estimated fair value less cost to sell. If the

carrying amount of the business exceeds its estimated fair value, a loss is recognized. Depreciation is not recorded on

long-lived assets of a business classified as held-for-sale. Assets and liabilities related to a business classified as held-for-

sale are segregated in the consolidated balance sheet and may be included in an “other assets” or “other liabilities” line

item or, if material, presented as a separate line item on the balance sheet. Major classes are separately disclosed in the

notes to the consolidated financial statements commencing in the period in which the business is classified as held-for-

sale.

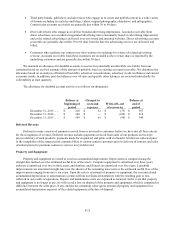

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”)

2014-09, Revenue from Contracts with Customers, which will supersede nearly all existing revenue recognition guidance

under U.S. GAAP. The core principle of the guidance is that an entity should recognize revenue when it transfers

promised goods or services to customers in an amount that reflects the consideration to which the company expects to be

entitled in exchange for those goods or services. Further, the guidance requires improved disclosures to help users of

financial statements better understand the nature, amount, timing and uncertainty of revenue that is recognized. The

original effective date for ASU 2014-09 would have required the Company to adopt this standard beginning in the first

quarter of 2017. In July 2015, the FASB voted to amend ASU 2014-09 by approving a one-year deferral of the effective

date as well as providing the option to early adopt the standard on the original effective date. Accordingly, the Company

may not adopt the standard until the first quarter of 2018. The new revenue standard may be applied retrospectively to

each prior period presented or retrospectively with the cumulative effect recognized as of the date of adoption. We are

currently evaluating the timing of its adoption and the impact of adopting the new revenue standard on our consolidated

financial statements.

In September 2015, the FASB issued an update to ASC 805, Business Combinations: Simplifying the Accounting

Measurement-Period Adjustments. This update simplifies the accounting for adjustments made to provisional amounts

recognized in a business combination by eliminating the requirement to retrospectively account for those adjustments.

Under this update, the adjustments are recognized in the reporting period in which the adjustment amounts are

determined. This update is effective for the Company commencing in the first quarter of fiscal year 2017 and should be