Enom 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-21

During the year ended December 31 2015, we received a payment of $5.1 million, plus accrued and unpaid

interest, on the promissory note that we received as part of the consideration for the sale of our CoveritLive business in

July 2014. This promissory note had a principal amount of $5.6 million and was originally due in full by July 2016. The

early repayment of $5.1 million, plus accrued and unpaid interest, satisfied all amounts owed to us under the promissory

note and the promissory note was discharged. The discount from the carrying value of the promissory note was

approximately $0.1 million, which was recorded as interest income (expense), net.

At December 31, 2015 and 2014, we had a cash collateralized standby letter of credit for approximately

$1.2 million and $1.4 million, respectively, included in long-term assets, associated with one of our leases.

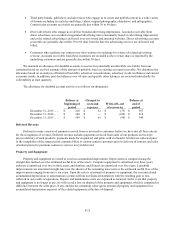

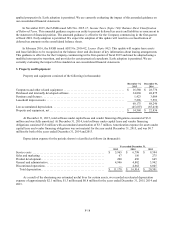

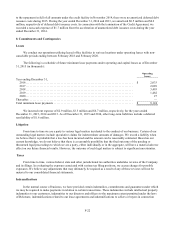

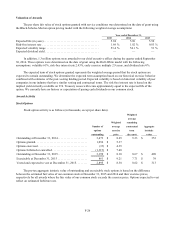

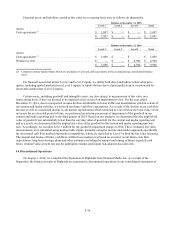

Accrued expenses and other liabilities consisted of the following (in thousands):

December 31,

December 31,

2015

2014

Accrued payroll and related items ..............................................

$

5,916

$

4,693

Acquisition holdback.........................................................

607

8,958

Artist payables ..............................................................

2,816

2,250

Other ......................................................................

5,830

8,324

Accrued expenses and other current liabilities ..................................

$

15,169

$

24,225

In July 2015, as part of the consideration for our purchase of Society6, we paid $7.4 million in cash and issued

122,638 shares of our common stock to the sellers of Society6 upon the expiration of the holdback period.

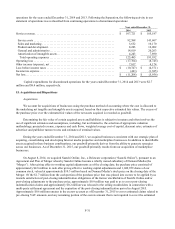

During the year ended December 31, 2015, we recognized severance costs of $2.2 million in connection with

targeted reductions in force as a result of initiatives to improve operating efficiency. These severance costs were

recognized in the consolidated statements of operations for the year ended December 31, 2015 as follows: $1.1 million in

product development costs, $0.6 million in service costs, $0.4 million in general and administrative costs, and $0.1

million in sales and marketing costs. As of December 31, 2015, there was $0.5 million of related accrued severance

included in accrued expenses and other current liabilities in the consolidated balance sheet. An additional $0.2 million of

related retention and severance costs will be expensed over the applicable retention periods, which extend through the

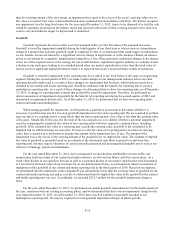

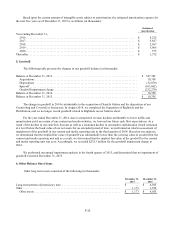

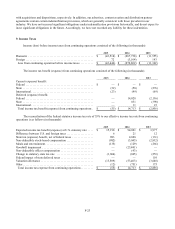

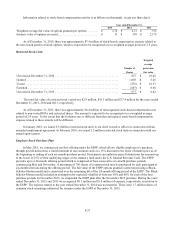

first quarter of 2016. Changes to the severance accrual during the year ended December 31, 2015 are as follows (in

thousands):

Balance at December 31, 2014 .............................................................

$

—

New charges ............................................................................

2,183

Cash payments ..........................................................................

(1,698)

Balance at December 31, 2015 .............................................................

$

485

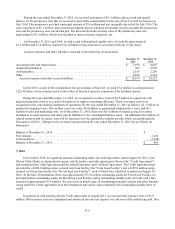

7. Debt

In November 2014, we repaid all amounts outstanding under our credit agreement, dated August 29, 2013, with

Silicon Valley Bank, as administrative agent, and the lenders and other agents party thereto (the “Credit Agreement”)

and terminated the Credit Agreement and the related Guarantee and Collateral Agreement. The Credit Agreement had

provided for a $100.0 million senior secured term loan facility (the “Term Loan Facility”) and a $125.0 million senior

secured revolving loan facility (the “Revolving Loan Facility”), each of which was scheduled to mature on August 29,

2018. At the time of termination, there was approximately $73.8 million outstanding under the Term Loan Facility, no

principal balance outstanding under the Revolving Loan Facility and an outstanding standby letter of credit with a face

amount of approximately $1.4 million. We used cash on hand to pay all outstanding principal, interest and other amounts

owing under the Credit Agreement as of the termination date and to cash collateralize the outstanding standby letter of

credit.

In connection with entering into the Credit Agreement in August 2013, we incurred debt issuance costs of $1.9

million. Debt issuance costs are capitalized and amortized into interest expense over the term of the underlying debt. Due