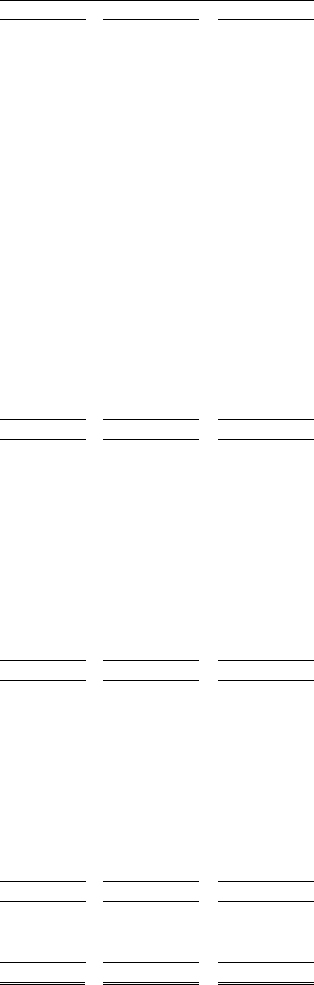

Enom 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-7

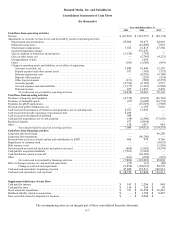

Demand Media, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

Year ended December 31,

2015

2014

2013

Cash flows from operating activities

Net loss .........................................................................

$

(43,501)

$

(267,357)

$

(20,174)

Adjustments to reconcile net loss to net cash provided by (used in) operating activities:

Depreciation and amortization .....................................................

29,884

59,473

64,910

Deferred income taxes ...........................................................

—

(14,409)

3,901

Stock-based compensation ........................................................

7,562

21,815

27,384

Goodwill impairment charge ......................................................

—

232,270

—

Gain on disposal of businesses and properties .........................................

(3,156)

(795)

—

Gain on other assets, net ..........................................................

—

(5,745)

(4,232)

Extinguishment of debt ..........................................................

—

1,656

—

Other ........................................................................

(105)

(1,650)

(861)

Change in operating assets and liabilities, net of effect of acquisition:

Accounts receivable, net .......................................................

3,840

10,844

12,393

Prepaid expenses and other current assets ..........................................

917

(145)

(375)

Deferred registration costs .....................................................

—

(8,876)

(9,780)

Deposits with registries ........................................................

—

(259)

(914)

Other long-term assets ........................................................

(131)

(585)

(2,572)

Accounts payable ............................................................

(2,794)

(2,192)

2,973

Accrued expenses and other liabilities ............................................

(1,177)

(1,341)

(5,960)

Deferred revenue .............................................................

223

11,957

9,470

Net cash (used in) provided by operating activities ................................

(8,438)

34,661

76,163

Cash flows from investing activities

Purchases of property and equipment ..................................................

(4,732)

(8,918)

(26,746)

Purchases of intangible assets ........................................................

(87)

(5,688)

(16,772)

Payments for gTLD applications ......................................................

—

(15,829)

(3,949)

Proceeds from gTLD withdrawals, net .................................................

—

6,105

5,616

Cash received from disposal of businesses and properties, net of cash disposed ..................

5,071

13,696

—

Cash received from early repayment of promissory note ...................................

5,100

—

—

Cash received from disposition holdback ...............................................

998

—

—

Cash paid for acquisitions, net of cash acquired ..........................................

(58)

(2,240)

(73,626)

Restricted deposits .................................................................

671

(3,064)

—

Other ...........................................................................

126

1,017

942

Net cash provided by (used in) investing activities ................................

7,089

(14,921)

(114,535)

Cash flows from financing activities

Long-term debt borrowings ..........................................................

—

—

96,250

Long-term debt repayments ..........................................................

—

(96,250)

—

Proceeds from exercises of stock options and contributions to ESPP ..........................

464

478

4,746

Repurchases of common stock .......................................................

—

—

(4,835)

Debt issuance costs ................................................................

—

—

(1,936)

Net taxes paid on restricted stock units and options exercised ...............................

(668)

(2,902)

(4,576)

Cash paid for acquisition holdback ....................................................

(7,561)

(1,945)

—

Cash distribution related to spin-off ...................................................

—

(24,145)

—

Other ...........................................................................

(121)

(654)

(619)

Net cash (used in) provided by financing activities ................................

(7,886)

(125,418)

89,030

Effect of foreign currency on cash and cash equivalents ....................................

(15)

(13)

(80)

Change in cash and cash equivalents ...........................................

(9,250)

(105,691)

50,578

Cash and cash equivalents, beginning of period ..........................................

47,820

153,511

102,933

Cash and cash equivalents, end of period ...............................................

$

38,570

$

47,820

$

153,511

Supplemental disclosure of cash flows

Cash paid for interest ...............................................................

$

143

$

2,296

$

849

Cash paid for taxes ................................................................

$

116

$

104

$

99

Stock issued for acquisitions .........................................................

$

731

$

10,258

$

16,281

Holdback liability related to acquisitions ...............................................

$

—

$

1,700

$

8,247

Note receivable related to disposal of a business ..........................................

$

—

$

4,946

$

—

The accompanying notes are an integral part of these consolidated financial statements.