Enom 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-30

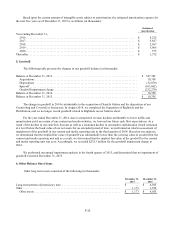

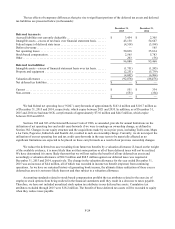

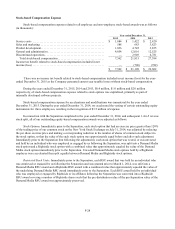

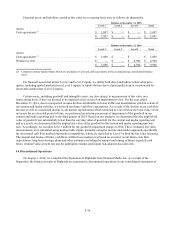

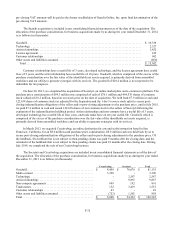

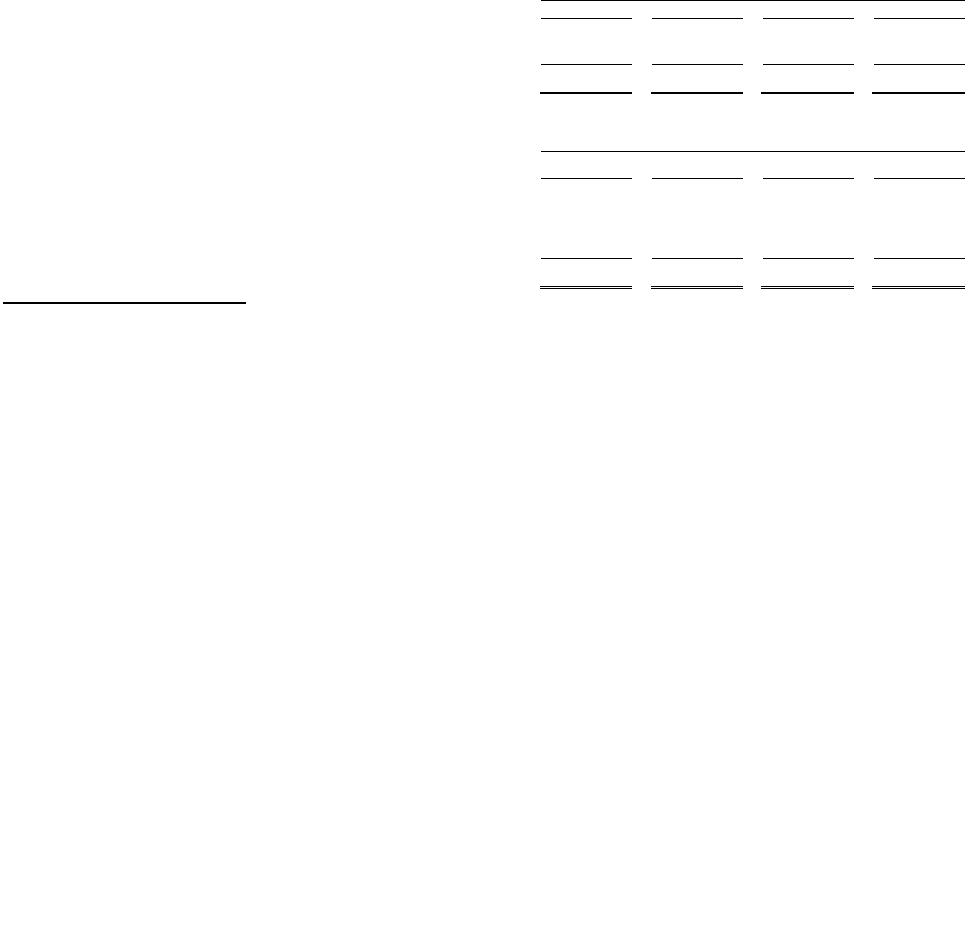

Financial assets and liabilities carried at fair value on a recurring basis were as follows (in thousands):

Balance at December 31, 2015

Level 1

Level 2

Level 3

Total

Assets:

Cash equivalents (1) .....................................

$

5,007

$

—

$

—

$

5,007

$

5,007

$

—

$

—

$

5,007

Balance at December 31, 2014

Level 1

Level 2

Level 3

Total

Assets:

Cash equivalents (1) .....................................

$

5,000

$

—

$

—

$

5,000

Promissory note ........................................

$

—

$

—

$

4,946

$

4,946

$

5,000

$

—

$

4,946

$

9,946

(1) Comprises money market funds which are included in Cash and cash equivalents in the accompanying consolidated balance

sheet.

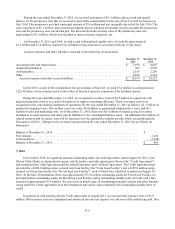

For financial assets that utilize Level 1 and Level 2 inputs, we utilize both direct and indirect observable price

quotes, including quoted market prices (Level 1 inputs) or inputs that are derived principally from or corroborated by

observable market data (Level 2 inputs).

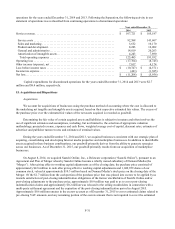

Certain assets, including goodwill and intangible assets, are also subject to measurement at fair value on a

nonrecurring basis, if they are deemed to be impaired as the result of an impairment review. For the year ended

December 31, 2014, due to unexpected revenue declines attributable to lower traffic and monetization yield on certain of

our content and media websites, we lowered our future cash flow expectations. As a result of the decline in our cash flow

forecast as well as a sustained decline in our market capitalization which remained at a level below the book value of our

net assets for an extended period of time, we performed an interim assessment of impairment of the goodwill in our

content and media reporting unit in the third quarter of 2014. Based on our analyses, we determined that the implied fair

value of goodwill was substantially lower than the carrying value of goodwill for the content and media reporting unit

and as a result, we determined that the implied fair value of the goodwill in the content and media reporting unit was

zero. Accordingly, we recorded $232.3 million for the goodwill impairment charge in 2014. These estimated fair value

measurements were calculated using unobservable inputs, primarily using the income and market approach, specifically

the discounted cash flow method and market comparables, which are classified as Level 3 within the fair value hierarchy.

The amount and timing of future cash flows within those analyses was based on our most recent future cash flow

expectations, long-term strategic plans and other estimates including the amount and timing of future expected cash

flows, terminal value growth rate and the appropriate market-participant risk-adjusted discount rates.

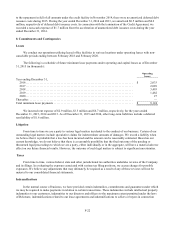

14. Discontinued Operations

On August 1, 2014, we completed the Separation of Rightside from Demand Media, Inc. As a result of the

Separation, the financial results of Rightside are presented as discontinued operations in our consolidated statements of