Enom 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-9

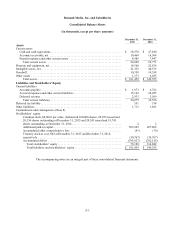

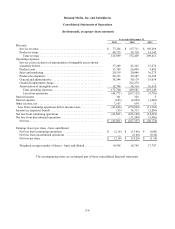

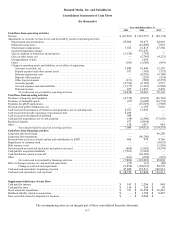

The financial results of Rightside are presented as discontinued operations in our accompanying consolidated

statements of operations for the years ended December 31, 2014 and 2013. Our statements of cash flows are presented on

a combined basis, including continuing and discontinued operations. Unless it is otherwise disclosed, all other

disclosures in our consolidated financial statements are related to our continuing operations.

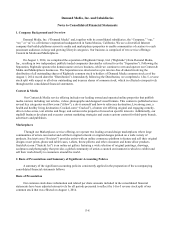

Principles of Consolidation

The consolidated financial statements include the accounts of Demand Media and its wholly owned subsidiaries.

Acquisitions are included in our consolidated financial statements from the date of the acquisition. Our purchase

accounting resulted in all assets and liabilities of acquired businesses being recorded at their estimated fair values on the

acquisition dates. All significant intercompany transactions and balances have been eliminated in consolidation.

Use of Estimates

The preparation of the consolidated financial statements in conformity with generally accepted accounting

principles (“GAAP”) in the United States requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenue and expenses during the reporting period. Significant items subject to

such estimates and assumptions include revenue, allowance for doubtful accounts, investments in equity interests, the

assigned value of acquired assets and assumed liabilities in business combinations, useful lives and impairment of

property and equipment, intangible assets, goodwill and other assets, the fair value of equity-based compensation

awards, and deferred income tax assets and liabilities. Actual results could differ materially from those estimates. On an

ongoing basis, we evaluate our estimates compared to historical experience and trends, which form the basis for making

judgments about the carrying value of our assets and liabilities.

Cash and Cash Equivalents

We consider all highly liquid investments with a maturity of 90 days or less at the time of purchase to be cash

equivalents. Cash and cash equivalents consist primarily of checking accounts, money market accounts, money market

funds, and short-term certificates of deposit.

Investments in Equity

We account for investments in companies that we do not control or account for under the equity method of

accounting either at fair value or using the cost method of accounting, as applicable. Investments in equity securities are

carried at fair value if the fair value of the security is readily determinable. Equity investments carried at fair value are

classified as marketable securities available-for-sale. Realized gains and losses for marketable securities available-for-

sale are included in other income (expense), net in our consolidated statements of operations. Unrealized gains and

losses, net of taxes, on marketable securities available-for-sale are included in our consolidated financial statements as a

component of other comprehensive income (loss) and accumulated other comprehensive income (loss) (“AOCI”), until

realized.

The cost of marketable securities sold is based upon the specific accounting method used. Any realized gains or

losses on the sale of equity investments are reflected as a component of interest income or expense. For the year ended

December 31, 2013, unrealized gains on marketable securities available-for-sale was $0.9 million. During the first

quarter of 2014, we sold all of these marketable securities, resulting in a reclassification from other comprehensive

income of $0.9 million of unrealized gains on marketable securities, which is recorded in discontinued operations. The

sale of these marketable securities resulted in total realized gains of $1.4 million for the year ended December 31, 2014,

which included in discontinued operations.

Revenue Recognition

We recognize revenue when four basic criteria are met: persuasive evidence of a sales arrangement exists;

performance of services has occurred; the sales price is fixed or determinable; and collectability is reasonably assured.