Enom 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

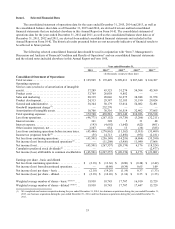

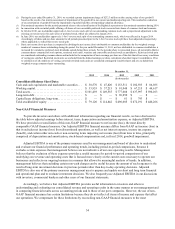

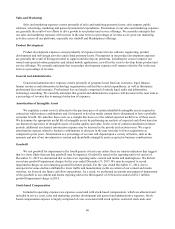

Item 6. Selected Financial Data

The consolidated statement of operations data for the years ended December 31, 2015, 2014 and 2013, as well as

the consolidated balance sheet data as of December 31, 2015 and 2014, are derived from our audited consolidated

financial statements that are included elsewhere in this Annual Report on Form 10-K. The consolidated statement of

operations data for the years ended December 31, 2012 and 2011, as well as the consolidated balance sheet data as of

December 31, 2013, 2012 and 2011, are derived from audited consolidated financial statements not included in this

Annual Report on Form 10-K. The historical results presented below are not necessarily indicative of financial results to

be achieved in future periods.

The following selected consolidated financial data should be read in conjunction with “Item 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements

and the related notes included elsewhere in this Annual Report on Form 10-K.

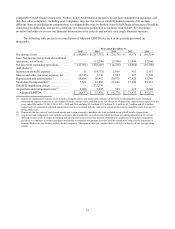

Year ended December 31,

2015

2014(1)

2013(1)

2012(1)

2011(1)

(In thousands, except per share data)

Consolidated Statement of Operations:

Total revenue ..................................

$

125,969

$

172,429

$

209,411

$

207,640

$

164,307

Operating expenses:

Service costs (exclusive of amortization of intangible

assets) ........................................

37,289

43,325

51,274

54,304

45,360

Product costs ..................................

33,769

26,058

9,882

—

—

Sales and marketing ............................

20,319

20,046

36,275

38,948

31,978

Product development ............................

24,313

29,387

32,185

31,190

29,024

General and administrative .......................

38,344

50,179

53,014

54,082

52,491

Goodwill impairment charge(2) ....................

—

232,270

—

—

—

Amortization of intangible assets ..................

18,706

38,316

36,519

32,402

37,665

Total operating expenses ........................

172,740

439,581

219,149

210,926

196,518

Loss from operations ............................

(46,771)

(267,152)

(9,738)

(3,286)

(32,211)

Interest income ................................

361

328

5

31

48

Interest expense ................................

(143)

(4,692)

(1,642)

(622)

(861)

Other income (expense), net ......................

3,107

654

13

(36)

(385)

Loss from continuing operations before income taxes .

(43,446)

(270,862)

(11,362)

(3,913)

(33,409)

Income tax (expense) benefit(2) ...................

(55)

14,713

(2,856)

(951)

(2,181)

Net loss from continuing operations ...............

(43,501)

(256,149)

(14,218)

(4,864)

(35,590)

Net income (loss) from discontinued operations(3) ....

—

(11,208)

(5,956)

11,040

17,066

Net income (loss)...............................

(43,501)

(267,357)

(20,174)

6,176

(18,524)

Cumulative preferred stock dividends(4) ............

—

—

—

—

(2,477)

Net income (loss) attributable to common stockholders

$

(43,501)

$

(267,357)

$

(20,174)

$

6,176

$

(21,001)

Earnings per share - basic and diluted

Net loss from continuing operations ...............

$

(2.18)

$

(13.66)

$

(0.80)

$

(0.28)

$

(2.42)

Net income (loss) from discontinued operations ......

—

(0.60)

(0.34)

0.65

1.09

Net income (loss) per share - basic ................

(2.18)

(14.26)

(1.14)

0.37

(1.33)

Net income (loss) per share - diluted ...............

$

(2.18)

$

(14.26)

$

(1.14)

$

0.35

$

(1.33)

Weighted average number of shares - basic (5)(6)(7) ....

19,938

18,745

17,707

16,910

15,729

Weighted average number of shares - diluted (5)(6)(7) ...

19,938

18,745

17,707

17,447

15,729

(1) We completed one business acquisition during the year ended December 31, 2014, two business acquisitions during the year ended December 31,

2013, one business acquisition during the year ended December 31, 2012, and four business acquisitions during the year ended December 31,

2011.