Energizer 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders:

Last year, we achieved substantial progress in our complementary

Energizer and Schick-Wilkinson Sword businesses, introducing innovative

new products and investing aggressively in our brands. We successfully

integrated the shaving business acquired in mid-2003, benefitting from our

compatible cultures and collective management depth. Entering fiscal

2005, we are confident of our strengths and comfortable with what we

are and where we are.

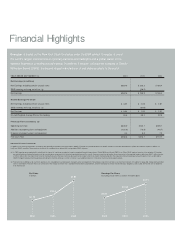

FY 2004 Financial Results

For our fiscal year ended September 30, 2004, Energizer’s net earnings

climbed to $267.4 million, a 17 percent increase over net earnings of

$228.2 million the previous year, and earnings per share reached $3.21,

an increase of 24 percent over $2.59 the year before.* Net sales, reflect-

ing the full-year inclusion of Schick-Wilkinson Sword and higher battery

sales, rose 26 percent to $2.8 billion from $2.2 billion the prior year.

Share Repurchase Progress

Energizer’s strong balance sheet and cash flow continue to provide the

resources to take advantage of opportunities.

In August 2004, the Board of Directors issued a new authorization for the

company to acquire up to 10 million shares of common stock, replacing

a similar authorization approved in January 2004. During fiscal 2004,

we repurchased a total of nearly 13.4 million shares, leaving 8.2 million

shares remaining under the current authorization at year-end.

Our 2004 fiscal year, Energizer Holdings’ fourth

as a stand-alone company, was a year of continued

growth and strong performance as we built on the

momentum from the prior year. As captured in the

theme of this report, it was certainly a year in which

we kept going … and kept growing.

During this past year, we have confirmed what we’re good at – managing relatively large international

brands, like

Energizer

®

and

Eveready

®

,like

Schick

®

and

Wilkinson Sword

®

.

We see ourselves as a quality

company doing its best with the businesses it manages. This is where we feel most comfortable and

confident.There’s no primer 101 for running a company like Energizer. We read the situation and

respond with appropriate action to maximize long-term shareholder value.

J. PATRI CK MULCAHY, CHIEF EXECUTIVE OFFICER, ENERGIZER HOLDINGS, INC.

ENR 2004 Annual Report

2

In the four fiscal years from October 2000 through September 2004, we

have repurchased a total of 26.0 million shares at an average price of

$33.20 – representing 27 percent of our outstanding shares at October

2000.We consider investing in ourselves and our company’s future to

be a sound financial strategy, one that rewards long-term shareholders

by increasing the value of remaining shares.

(See chart, below right.)

The use of cash flow for share repurchase remains situational. Acquisitions

of other businesses is an equally viable alternative for our cash flow, and

we continue to seek attractive opportunities to further leverage our global

distribution capabilities. Simply put, we would love to find another Schick-

Wilkinson Sword.

Complementary Businesses

With the acquisition of Schick-Wilkinson Sword (SWS) in March 2003,

Energizer today operates two strong, complementary global businesses,

each boasting a pair of widely recognized, world-class brands and compre-

hensive product portfolios.

While solidly positioned in separate categories of consumer packaged

goods, our battery and shaving operations share many striking similarities

– from manufacturing processes, distribution channels and common cus-

tomers to long-standing commitments to product quality and technological

innovation.We continue to leverage these capabilities and synergies, build-

ing on each business’ success.

Our battery and shaving businesses both achieved healthy top-line growth

in fiscal 2004, and segment profit improved nicely. However, there is

an ongoing negative price mix due to a channel shift from food and drug

stores to merchandisers selling larger pack sizes. Sales growth in our

Razors and Blades business came primarily from growing consumer

acceptance of our new men’s and women’s shaving systems, Schick-

Wilkinson Sword

QUATTRO

®

and

Intuition

®

, as well as expansion of the

SWS line in additional parts of Asia and Europe.