Energizer 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2004 Annual Report 27

discounted cash flow method. Intangible assets with finite lives are

amortized on a straight-line basis over expected lives of three to 15

years. Such intangibles are also evaluated for impairment annually.

Impairment of Long-Lived Assets The Company reviews long-lived

assets for impairment whenever events or changes in business circum-

stances indicate that the remaining useful life may warrant revision or

that the carrying amount of the long-lived asset may not be fully recov-

erable. The Company performs undiscounted cash flow analyses to

determine if impairment exists. If impairment is determined to exist, any

related impairment loss is calculated based on fair value. Impairment

losses on assets to be disposed of, if any, are based on the estimated

proceeds to be received, less costs of disposal.

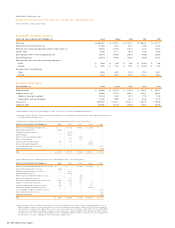

Share-Based Payments The Company accounts for stock options using

the intrinsic value method as prescribed by Accounting Principles Board

Opinion (APB 25). Pro forma disclosures required under Statement of

Financial Accounting Standards (SFAS) 123, “Accounting for Stock-

Based Compensation,” as if the Company had adopted the fair value-

based method of accounting for stock options, are presented below.

See Note 11 for additional details.

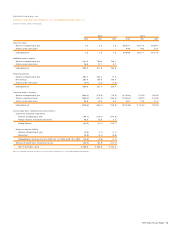

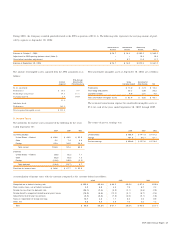

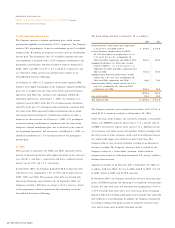

Charges to net earnings for stock-based compensation under APB 25

were $1.8, $1.9 and $2.6 for 2004, 2003 and 2002, respectively.

Had cost for stock-based compensation been determined based on the

fair value method set forth under SFAS 123, charges to net earnings

would have been an additional $6.4, $6.4 and $8.0 for 2004, 2003

and 2002, respectively. Pro forma amounts shown below are for disclo-

sure purposes only and may not be representative of future calculations.

2004 2003 2002

Net earnings:

As reported $ 267.4 $ 169.9 $ 186.4

Pro forma adjustments (6.4) (6.4) (8.0)

Pro forma $ 261.0 $ 163.5 $ 178.4

Basic earnings per share:

As reported $ 3.32 $ 1.98 $ 2.05

Pro forma adjustments (0.08) (0.08) (0.09)

Pro forma $ 3.24 $ 1.90 $ 1.96

Diluted earnings per share:

As reported $ 3.21 $ 1.93 $ 2.01

Pro forma adjustments (0.08) (0.08) (0.09)

Pro forma $ 3.13 $ 1.85 $ 1.92

Revenue Recognition The Company’s revenue is from the sale of its

products. Revenue is recognized when title, ownership and risk of loss

passes to the customer. Discounts are offered to customers for early pay-

ment and an estimate of such discounts is recorded as a reduction of net

sales in the same period as the sale. Our standard sales terms are final

and returns or exchanges are not permitted unless a special exception is

made; reserves are established and recorded in cases where the right of

return does exist for a particular sale. The Company offers a variety of

programs, primarily to its retail customers, designed to promote sales of its

products. Such programs require periodic payments and allowances based

on estimated results of specific programs and are recorded as a reduction

to net sales. The Company accrues at the time of sale the estimated total

payments and allowances associated with each transaction. Additionally,

the Company offers programs directly to consumers to promote the sale of

its products. Promotions which reduce the ultimate consumer sale prices

are recorded as a reduction of net sales at the time the promotional offer

is made, generally using estimated redemption and participation levels.

The Company continually assesses the adequacy of accruals for customer

and consumer promotional program costs not yet paid. To the extent total

program payments differ from estimates, adjustments may be necessary.

Historically, these adjustments have not been material.

Advertising and Promotion Costs The Company advertises and promotes

its products through national and regional media and expenses such

activities in the year incurred. Due to seasonality in the battery business

and heavy product launches in the razors and blade business, advertising

and promotion costs are expensed ratably to revenues in interim periods.

General advertising and promotion costs are expensed over the full year,

while product launch activities are expensed over the launch period.

Reclassifications Certain reclassifications have been made to the prior

year financial statements to conform to the current presentation.

Recently Adopted or Issued Accounting Pronouncements The Company

adopted SFAS 146, “Accounting for Exit or Disposal Activities” as of

October 1, 2003. SFAS 146 supercedes EITF Issue No. 94-3 and provides

direction for accounting and disclosure regarding specific costs related to

an exit or disposal activity. This standard requires companies to recognize

costs associated with exit or disposal activities when they are incurred

rather than at the date of a commitment to an exit or disposal plan.

Restructuring activities initiated in fiscal 2003 are recorded in accordance

with the requirements of SFAS 146. Restructuring plans initiated in 2002

and prior are recorded in accordance with EITF Issue 94-3 requirements.

The FASB issued SFAS 132 (revised 2003), “Employers’ Disclosures

about Pensions and Other Postretirement Benefits,” which requires addi-

tional disclosures to those in the original SFAS 132 about the assets,

obligations, cash flows and net periodic benefit cost of defined benefit

pension plans and other defined benefit postretirement plans in annual

financial statements. SFAS 132 also requires interim disclosures regarding