Energizer 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2004 Annual Report

14

ENERGI ZER HOLDINGS, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION Continued

(Dollars in millions, except per share and percentage data)

Special Pension Termination Benefits

During the fourth quarter of fiscal 2004, Energizer announced a

Voluntary Enhanced Retirement Option (VERO) offered to approximately

600 eligible employees in the U.S., of which 321 employees accepted.

A charge of $15.2, pre-tax, was recorded during the fourth quarter of

fiscal 2004 related to the VERO and certain other special pension

benefits and the estimated impact of such benefits on the Company’s

pension plan is reflected in the amounts shown in Note 12 to the

Consolidated Financial Statements. Future cost savings from the VERO

program are expected to be approximately $9 to $12 annually, with

about half that amount realized in 2005.

Intellectual Property Rights Income

The Company entered into agreements to license certain intellectual

property to other parties in separate transactions. Such agreements do

not require any future performance by the Company, thus all committed

consideration was recorded as income at the time each agreement was

executed. The Company recorded income related to such agreements of

$1.5 pre-tax, or $0.9 after-tax, and $8.5 pre-tax, or $5.2 after-tax, in

the years ended September 30, 2004 and 2003, respectively.

Interest and Other Financing Items

Interest expense was $2.6 higher for the year on higher average debt,

offset by lower interest rates. Higher average debt reflects the borrowings

for the SWS acquisition outstanding for a full year in 2004 compared to

six months in 2003. The lower effective interest rate for 2004 was a

result of paying off high fixed rate debt in September 2003 and generally

lower rates on variable rate debt. Interest expense increased $7.1 in

2003 reflecting incremental debt due to the acquisition of SWS, partially

offset by lower interest rates.

Other financing expense declined $13.7 for the year compared to the same

period last year, which included a $20.0 charge in 2003 related to early

repayment of debt. Additionally, 2004 experienced net currency exchange

losses compared to net gains in 2003. Other financing costs increased

$15.6 in 2003, primarily due to a $20.0 charge related to early payment

of long-term debt, partially offset by net currency exchange gains in 2003.

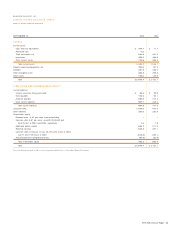

Income Taxes

Income taxes, which include federal, state and foreign taxes, were

25.3%, 28.5% and 33.1% of earnings before income taxes in 2004,

2003 and 2002, respectively. Earnings before income taxes and income

taxes include certain unusual items and adjustments to prior recorded

tax accruals in all years, which impact the overall tax rate. The most

significant of these are described below:

•In 2004, 2003 and 2002, $16.2, $12.2 and $6.7, respectively, of

tax benefits related to prior years’ losses were recorded.

•Adjustments were recorded in each of the three years to revise pre-

viously recorded tax accruals, which were based on estimates when

recorded. Such adjustments decreased the income tax provision by

$8.5, $7.0 and $5.1 in 2004, 2003 and 2002, respectively.

•The tax benefit related to the write-up of acquired SWS inventory of

$89.7, all of which was recorded to cost of products sold in 2003,

was higher than the overall tax rate for the remainder of the business,

and thus reduced the overall tax rate by 1.8 percentage points.

Excluding the items discussed above, the income tax percentage was

32.2% in 2004, 36.1% in 2003 and 37.3% in 2002. The improved

tax rate in 2004 reflects a significantly lower rate on foreign income due

to improved foreign earnings and overall country mix. Such improve-

ments reflect better battery results as well as a favorable impact from

the inclusion of SWS.

The Company’s effective tax rate is highly sensitive to country mix from

which earnings or losses are derived. To the extent future earnings levels

and country mix are similar to the 2004 level and excluding any unusual

or non-recurring tax items, future tax rates would likely be in the 31-33%

range. Declines in earnings in lower tax rate countries, earnings increase

in higher tax countries or operating losses in the future could increase

future tax rates.

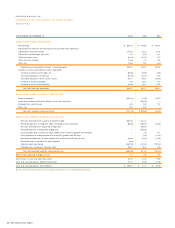

Special Purpose Entity

The Company routinely sells a pool of U.S. accounts receivable through

a financing arrangement between Energizer Receivables Funding

Corporation (the SPE), which is a bankruptcy-remote special purpose

entity subsidiary of the Company, and an outside party (the Conduit).

The terms of the arrangement were amended in April 2004 providing,

among other things, the ability of the Company to repurchase accounts

receivable sold to the Conduit if it so chooses. Under the amended

structure, funds received from the Conduit are treated as borrowings

rather than proceeds of accounts receivables sold for accounting purposes.

Prior to the amendment, this financing arrangement was required to be

accounted for as a sale of receivables, representing “off balance sheet

financing.” Under accounting required for the former agreement, reported

balance sheet captions were higher or lower than such amounts would

have been reported under the amended structure as presented below.

AS OF SEPTEMBER 30, 2003

Additional accounts receivable $ 175.7

Additional notes payable $ 75.0

Lower other current assets $ 100.7