Energizer 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2004 Annual Report 17

developing countries in which the Company operates, there has not been

significant governmental regulation relating to the environment, occupational

safety, employment practices or other business matters routinely regulated

in the U.S. As such economies develop, it is possible that new regulations

may increase the risk and expense of doing business in such countries.

Accruals for environmental remediation are recorded when it is probable that

a liability has been incurred and the amount of the liability can be reasonably

estimated, based on current law and existing technologies. These accruals

are adjusted periodically as assessments take place and remediation efforts

progress, or as additional technical or legal information becomes available.

Accrued environmental costs at September 30, 2004 were $7.5, of

which $1.8 is expected to be spent in fiscal 2005. This accrual is not

measured on a discounted basis. It is difficult to quantify with certainty

the cost of environmental matters, particularly remediation and future cap-

ital expenditures for environmental control equipment. Nevertheless, based

on information currently available, the Company believes the possibility of

material environmental costs in excess of the accrued amount is remote.

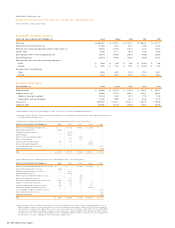

Market Risk Sensitive Instruments and Positions

The market risk inherent in the Company’s financial instruments and

positions represents the potential loss arising from adverse changes in

interest rates, foreign currency exchange rates and stock price. The fol-

lowing risk management discussion and the estimated amounts generated

from the sensitivity analyses are forward-looking statements of market

risk assuming certain adverse market conditions occur.

Interest Rates

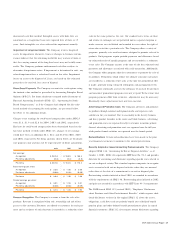

At September 30, 2004 and 2003, the fair market value of the

Company’s fixed rate debt is estimated at $358.4 and $336.9, respec-

tively, using yields obtained from independent pricing sources for similar

types of borrowing arrangements. The fair value of debt is lower than

the carrying value of the Company’s debt at September 30, 2004 and

2003 by $16.6 and $38.1, respectively. A 10% adverse change in

interest rates on fixed-rate debt would have decreased the fair market

value by $1.7 and $3.8 at September 30, 2004 and 2003, respectively.

The Company has interest rate risk with respect to interest expense on

variable rate debt. At September 30, 2004 and 2003, the Company had

$866.9 and $624.7 variable rate debt outstanding, respectively. The book

value of the Company’s variable rate debt approximates fair value. A hypo-

thetical 10% adverse change in all interest rates would have had an annual

unfavorable impact of $2.4 and $1.3 in 2004 and 2003, respectively, on

the Company’s earnings before taxes and cash flows, based upon these

year-end debt levels. The primary interest rate exposures on variable

rate debt are short-term rates in the U.S. and certain Asian countries.

Foreign Currency Exchange Rates

The Company employs a foreign currency hedging strategy which focuses

on mitigating potential losses in earnings or cash flows on foreign currency

transactions, which primarily consist of anticipated intercompany purchase

transactions and intercompany borrowings. External purchase transactions

and intercompany dividends and service fees with foreign currency risk

are also hedged from time to time. The primary currencies to which the

Company’s foreign affiliates are exposed include the U.S. dollar, the

euro, the yen and the British pound.

The Company’s hedging strategy involves the use of natural hedging

techniques, where possible, such as the offsetting or netting of like

foreign currency cash flows. Where natural hedging techniques are not

possible, foreign currency derivatives with a duration of generally one

year or less may be used, including forward exchange contracts, pur-

chased put and call options, and zero-cost option collars. The Company

policy allows foreign currency derivatives to be used only for identifiable

foreign currency exposures and, therefore, the Company does not enter

into foreign currency contracts for trading purposes where the sole

objective is to generate profits. The Company has not designated any

financial instruments as hedges for accounting purposes in the three

years ended September 30, 2004.

Market risk of foreign currency derivatives is the potential loss in fair value

of net currency positions for outstanding foreign currency contracts at fiscal

year-end, resulting from a hypothetical 10% adverse change in all foreign

currency exchange rates. Market risk does not include foreign currency

derivatives that hedge existing balance sheet exposures, as any losses on

these contracts would be fully offset by exchange gains on the underlying

exposures for which the contracts are designated as hedges. Accordingly,

the market risk of the Company’s foreign currency derivatives at

September 30, 2004 and 2003 amounts to $5.7 and $1.7, respectively.

The Company generally views its investments in foreign subsidiaries

with a functional currency other than the U.S. dollar as long-term. As a

result, the Company does not generally hedge these net investments.

Capital structuring techniques are used to manage the net investment in

foreign currencies as necessary. Additionally, the Company attempts to

limit its U.S. dollar net monetary liabilities in countries with unstable

currencies. In March 2002, the Company contributed $8.4 of capital to

its Argentine subsidiary sufficient to repay all U.S. dollar liabilities in

order to mitigate exposure to currency exchange losses.

Stock Price

A portion of the Company’s deferred compensation liabilities is based on

the Company’s stock price and is subject to market risk. The Company