Energizer 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2004 Annual Report

12

Statements. The Company evaluates segment profitability based on

operating profit before general corporate expenses, which include legal

expenses, costs associated with most restructuring, integration or

business realignment, amortization of intangibles and unusual items.

Financial items, such as interest income and expense, are managed on

a global basis at the corporate level.

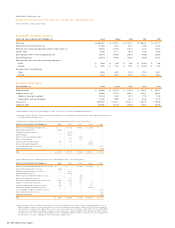

North America Battery

2004 2003 2002

Net sales $ 1,117.6 $ 1,041.9 $ 1,021.2

Segment profit $ 298.2 $ 283.5 $ 274.8

For the year ended September 30, 2004, sales increased $75.7, or 7%,

primarily due to higher volume and favorable Canadian currency transla-

tion of $7.7. The impact of four major hurricanes in 2004 contributed

approximately $40 of sales compared to approximately $18 incremental

sales volume in 2003 related to a major hurricane and the East Coast

blackout. Apart from event-driven volume and currency impact, sales

volume grew approximately $46, or 4.5%, primarily against 2003 results

which were dampened by reductions in retail inventory levels. Adjusting

for events and retail inventory reductions last year, alkaline sales were

relatively flat in 2004, while the remainder of Energizer’s major product

lines experienced double-digit growth. Overall pricing and product mix

were slightly unfavorable for the year, as category pricing and promotional

stability continued throughout the year, but minor unfavorable mix was

experienced due to consumer demand shifting to larger pack sizes.

Segment profit increased $14.7, or 5%, with currency accounting for

$4.3 of the improvement. Incremental gross margin from higher sales of

$30.7 and currency impact was partially offset by higher SG&A, adver-

tising and promotion, and product costs.

Net sales in 2003 increased $20.7, or 2%, versus 2002 on higher

volume, much of which is attributable to previously mentioned hurricane

and blackout, partially offset by unfavorable pricing and product mix.

Small cell size alkaline volume decreased 5% for the year reflecting reduc-

tions in aggregate retail inventory, partially offset by consumption growth.

Large alkaline cell size and lighting products volume increased 10% and

26%, respectively; these products are most affected by hurricanes,

power outages and public safety concerns. Additionally, the remainder of

Energizer’s major product lines experienced double-digit growth in 2003.

Pricing in 2003 was unfavorable as a result of steep promotional dis-

counting early in the year and a midyear reduction in list prices on key

products in response to competition. Promotional intensity in the category

began to abate in the latter half of fiscal 2003, buffering the list price

reduction. Additionally, Energizer experienced an unfavorable product

mix in 2003 as the greatest sales growth was in the lowest margin

products while the most profitable products experienced declines. As a

result of these factors, gross margin for the year decreased $12.3, or

3%, in spite of the sales increase. Segment profit increased $8.7 in

2003, as the absence of a $15.0 write-off of Kmart pre-bankruptcy

accounts receivable in 2002 and lower overhead spending were partially

offset by lower gross margin.

International Battery

2004 2003 2002

Net sales $ 827.0 $ 757.6 $ 718.5

Segment profit $ 147.7 $ 122.4 $ 101.3

For the year ended September 30, 2004, net sales increased $69.4, or

9%, on favorable currency impacts of $51.6 and contributions of higher

sales volume of $28.7, partially offset by unfavorable pricing and product

mix, primarily in Europe. Segment profit increased $25.3 for the year,

including a $26.6 favorable impact from currencies. Absent currencies,

segment profit decreased $1.3 as a $6.1 gross margin contribution from

higher sales was offset by higher selling, advertising and promotion, and

general and administrative expenses.

International Battery net sales increased $39.1, or 5%, in 2003 on

favorable currency translation of $31.0 as well as favorable pricing, pri-

marily in South America, and higher alkaline sales volume, partially off-

set by lower carbon zinc volume. Retail alkaline sales volume increased

4% while carbon zinc volume decreased 5%. Segment profit increased

$21.1, or 21%, with favorable currency accounting for $17.3 of the

improvement. Absent currency impacts, segment profit increased $3.8,

or 4%, reflecting favorable pricing and product mix, primarily in South

America, and lower product cost. These favorable factors were partially

offset by a 35% increase in advertising and promotion expense for the

International Battery segment reflecting increased investments in our

brand franchises as economic conditions improved in several key regions.

Razors and Blades

2004 2003 PRO FORMA

Net sales $ 868.1 $ 745.0

Segment profit $ 85.7 $ 56.9

The Company’s acquisition of SWS was completed on March 28, 2003;

therefore, SWS is not included in the attached historical financial state-

ments prior to this date. The comparison of September 30, 2004

amounts are versus pro forma SWS results for year ended September

30, 2003. The comparison of September 30, 2003 amounts are versus

ENERGI ZER HOLDINGS, INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION Continued

(Dollars in millions, except per share and percentage data)