Energizer 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity and Capital Resources

In 2004, cash flow from operations totaled $485.7, an increase of

$43.6 from 2003. The increase is due to higher “operating cash flow

before changes in working capital” of $164.5, partially offset by lower

conversion of working capital items to cash. The 2003 cash flow

reflects an unusually large change in inventory balance as described

below, accounting for the decline in 2004.

Cash flow from operations totaled $442.1 in 2003, an increase of $236.0

from 2002 operating cash flows of $206.1. The increase is due to cash

generated from working capital changes of $201.9 compared to cash

outflows for working capital in 2002 of $53.7, partially offset by lower

cash flow from earnings before working capital changes. The most signifi-

cant working capital changes were: 1) a $148.0 reduction in inventory,

reflecting the conversion of high cost acquired SWS inventory to lower cost

SWS inventory manufactured after acquisition as well as other inventory

reductions; and 2) a $136.2 cash flow improvement in other current

assets, primarily related to the level of sales of accounts receivable by the

Company’s non-consolidated SPE; partially offset by 3) unfavorable cash

flow from increases in accounts receivable in 2003. Cash flow from oper-

ations before changes in working capital were $240.2 in 2003 compared

to $259.8 in 2002. The decrease was mainly due to lower net earnings

caused by the $58.3 after-tax SWS inventory write-up discussed previously,

partially offset by higher earnings for the remainder of the business.

Working capital was $468.8 and $515.6 at September 30, 2004 and

2003, respectively. Working capital components were influenced by the

special purpose entity accounting previously discussed, but with no net

impact on total working capital. Apart from such accounting impact,

working capital changes reflect higher cash and accounts receivable,

more than offset by higher other accrued liabilities. Capital expenditures

totaled $121.4, $73.0 and $40.7 in 2004, 2003 and 2002, respec-

tively. These expenditures were funded by cash flow from operations.

Capital expenditures increased in 2004 as a result of increases for bat-

tery production projects, inclusion of SWS for a full year and corporate

expenditures. The increase in 2003 is primarily attributable to the SWS

acquisition. See Note 22 of the Consolidated Financial Statements for

capital expenditures by segment. Capital expenditures of approximately

$112.0 are anticipated in 2005. Such expenditures are expected to be

financed with funds generated from operations.

Total long-term debt outstanding, including current maturities,

was $1,079.6 at September 30, 2003. The Company maintains total

committed debt facilities of $1,239.0, of which $155.8 remained

available as of September 30, 2004.

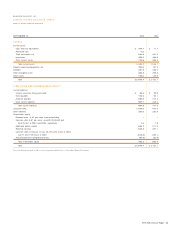

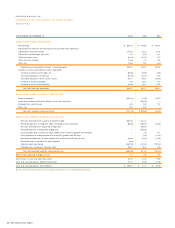

A summary of the Company’s significant contractual obligations at

September 30, 2004 is shown below. See Note 20 to the Consolidated

Financial Statements for discussion of loan guarantees.

LESS MORE

THAN 1-3 3-5 THAN 5

TOTAL 1 YEAR YEARS YEARS YEARS

Long-term debt,

including current

maturities $ 1,079.6 $ 20.0 $ 354.6 $ 135.0 $ 570.0

Notes payable 162.3 162.3–––

Operating leases 67.0 15.7 22.5 16.5 12.3

Total $ 1,308.9 $ 198.0 $ 377.1 $ 151.5 $ 582.3

In November 2004, the Company entered into two new financing agree-

ments. A $300.0 long-term debt financing was completed, with maturities

of three, five and seven years and with fixed rates ranging from 3.44% to

4.38%. Proceeds from these notes were used to pay down all existing long-

term debt in the revolving credit facility and to partially retire short-term debt

within the secured financing. In addition, the Company renegotiated its

existing revolving credit facility in order to extend the maturity to five

years and to realize more favorable borrowing spreads. As a result of the

new financing arrangement, available committed debt facilities increased by

$300.0 to $1,539.0.

Under the terms of the Company’s debt facilities, the ratio of the Company’s

total indebtedness to its Earnings Before Interest, Taxes, Depreciation and

Amortization (EBITDA) (as defined by the facility agreement and pro forma

in the current year) cannot be greater than 3.5 to 1, and the ratio of its

current year pro forma EBIT to total interest expense must exceed 3 to 1.

The Company’s ratio of total indebtedness to its pro forma EBITDA was

2.4 to 1, and the ratio of its pro forma EBIT to total interest expense was

13.0 to 1 as of September 30, 2004. Additional restrictive covenants

exist under current debt facilities. Failure to comply with the above

ratios or other covenants could result in acceleration of maturity, which

could trigger cross defaults on other borrowings. The Company believes

that covenant violations resulting in acceleration of maturity is unlikely.

The Company’s fixed rate debt is callable by the Company, subject to a

“make whole” premium, which would be required to the extent the under-

lying benchmark U.S. treasury yield has declined since issuance.

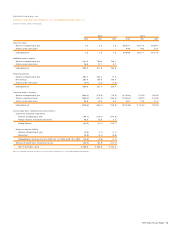

The Company purchased shares of its common stock under various Board

of Director approved repurchase plans as follows (shares in millions):

FI SCAL YEAR SHARES COST

2004 13.4 $ 546.7

2003 5.0 $ 131.4

2002 3.8 $ 103.3

2001 3.8 $ 79.6

ENR 2004 Annual Report 15