Energizer 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2004 Annual Report

28

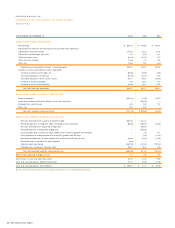

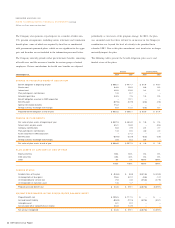

net periodic benefit cost and contributions made and expected to be

made for defined benefit pension plans and other defined benefit postre-

tirement plans. The Company adopted SFAS 132 in 2004 and has

included the additional disclosures required in Note 12.

On December 8, 2003, the Medicare Prescription Drug, Improvement

and Modernization Act of 2003 (the Act) became law in the U.S. The

Act introduces a prescription drug benefit under Medicare, as well as a

federal subsidy to sponsors of retiree health care benefit plans that pro-

vide retiree benefits in certain circumstances. FASB Staff Position 106-2

(FSP 106-2), “Accounting and Disclosure Requirements Related to the

Medicare Prescription Drug, Improvement and Modernization Act of

2003,” issued in May 2004, requires measurement of the accumulated

postretirement benefit obligation (APBO) and net periodic postretirement

benefit cost (NPPBC) to reflect the effects of the Act. FSP 106-2 was

adopted by the Company in the fourth quarter of fiscal 2004 and did

not have a material effect on the Company’s financial statements.

Note 12 contains disclosures related to FSP 106-2.

The FASB issued an amendment of SFAS 128, “Earnings Per Share,” in

December 2003. This statement amends the computational guidance of

SFAS 128 for calculating the number of incremental shares included in

diluted shares when applying the treasury stock method, eliminates the

provision of SFAS 128 that allows the presumption that certain contracts

that may be settled in cash or shares will be settled in shares and

requires that shares to be issued upon conversion of a mandatorily

convertible security be included, in the computation of basic EPS from

the date that conversion becomes mandatory. This statement is effective

for the Company in the first quarter of fiscal 2005.

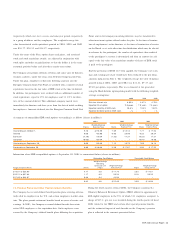

3. Acquisition of SWS

On March 28, 2003, the Company acquired the worldwide Schick-

Wilkinson Sword (SWS) business from Pfizer, Inc. for $930 plus acquisi-

tion costs and subject to adjustment based on acquired working capital

level. The final purchase price and acquisition costs totaled $975.8.

A $550.0 bridge loan together with existing available credit facilities

and cash were used to fund the acquisition. In 2003, the Company refi-

nanced the bridge loan into longer term financing.

SWS is the second largest manufacturer and marketer of men’s and women’s

wet shave products in the world, and its products were marketed in over 80

countries at the time of the acquisition. Its primary markets are the U.S.

and Canada, Japan and the larger countries of Western Europe.

The Company views the wet shave products category as attractive within

the consumer products industry due to the limited number of manufac-

turers, the high degree of consumer loyalty and the ability to improve

pricing through innovation. The Company believes SWS has high-quality

products, a defensible market position and the opportunity to grow sales

and margins. The SWS business is compatible with the Company’s

business in terms of common customers, distribution channels and

geographic presence, which should provide opportunities to leverage the

Company’s marketing expertise, business organization and scale globally.

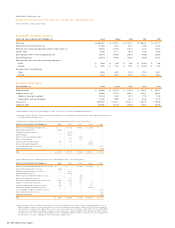

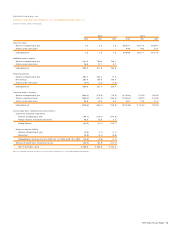

The following reflects the assets and liabilities acquired by the Company

in the SWS acquisition. Such asset and liability amounts are based on

management’s best estimates using valuation methods described below

as of September 30, 2003 and reflect the working capital adjustments

required by the acquisition agreement.

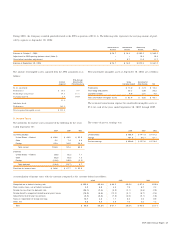

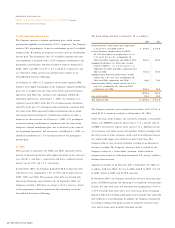

Acquired SWS Assets and Liabilities at March 28, 2003

Cash $ 14.9

Receivables 139.4

Inventories 201.9

Other current assets 50.0

Total current assets 406.2

Property, plant and equipment 247.0

Goodwill 281.6

Other intangible assets 233.4

Other assets 6.6

Total assets acquired 1,174.8

Accounts payable 47.7

Other current liabilities 88.5

Total current liabilities 136.2

Other liabilities 62.8

Total liabilities 199.0

Net assets acquired $ 975.8

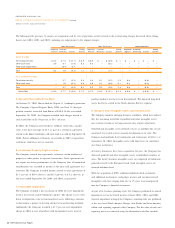

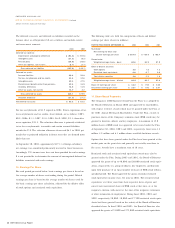

The valuation reflected in the table above was revised in 2004 after

final settlement of purchase price and adjustments thereto with the

seller and final allocation of intangible assets by country. The final

allocation of intangible asset value did not change the total assigned

value, but did change the amount allocated to specific countries.

Because of varying local tax treatment of goodwill and intangible assets,

such allocations impacted the required level of related deferred taxes.

The net result of all adjustments made in 2004 was to increase good-

will by $19.3 with a corresponding net increase in tax liabilities.

Assets and liabilities in the table above were valued as follows:

•Accounts receivable were valued at fair market value, which reflects

an estimate for uncollectible accounts.

•SWS inventory acquired is reflected in the table above and in the

Company’s historical financial statements at fair value, as required

ENERGI ZER HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCI AL STATEMENTS Continued

(Dollars in millions, except per share data)