Energizer 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

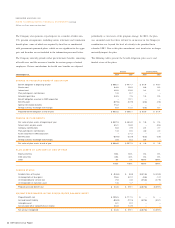

by GAAP. The fair value of finished goods acquired is sales value,

less costs to sell and a reasonable profit margin on the selling activity.

As such, the inventory is valued equivalent to what a distributor

would pay, rather than the historical cost basis of a manufacturer of

such inventory. This accounting resulted in an allocation of purchase

price to acquired inventory which was $89.7 higher than the histor-

ical manufactured cost of SWS (the SWS inventory write-up).

Inventory value and cost of products sold will be based on the post-

acquisition SWS production costs for all product manufactured after

the acquisition date. The entire $89.7 of the SWS inventory write-up

was recognized in cost of products sold in 2003, reducing net earnings

by $58.3, after taxes.

•Fair values of real and personal property were determined utilizing

the cost approach whereby the replacement/reproduction cost new

was estimated and then adjusted for physical depreciation and

applicable forms of obsolescence. Land values were a relatively

small portion of the fixed asset total and were recorded at estimated

fair market value.

•Other intangible assets include tradenames, technology and patents,

and customer-related intangibles. Such intangible assets were valued

at fair value as of the acquisition date using appropriate valuation

methodologies for each class. Tradenames were valued using the

Relief from Royalties Method, a form of the Income Approach,

which values the cost savings associated with owning rather than

licensing the tradename. Fair values were developed for each brand

using future revenue estimates and appropriate royalty rates.

Technology and Patents were also valued using the Relief from

Royalty Method, valuing each key technological aspect of SWS

products. Customer-related intangibles were valued using the

Residual Income or Multi-Period Excess Earnings Method, a form

of the Income Approach, which values SWS' relationships with its

customers. Valuations for all of these intangible classes were

performed on an after-tax, present value basis using appropriate

tax and discount rates.

•Liabilities were valued at the present value of estimated amounts to

be paid in the future.

•Goodwill represents the residual aggregate purchase price after all

tangible and identified intangible assets have been valued, offset by

the value of liabilities assumed. The aggregate purchase price was

derived from a competitive bidding process and negotiations and

was influenced by the Company’s assessment of the value of the

overall SWS business in combination with the Energizer business.

The significant goodwill value is reflective of the Company’s view

that the SWS business can generate strong cash flow, and sales

and earnings growth following acquisition.

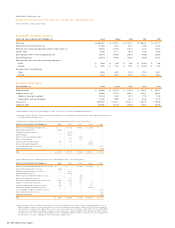

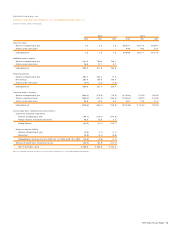

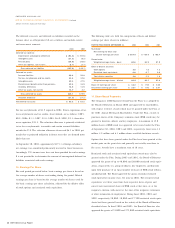

The Consolidated Statement of Earnings includes results of SWS

operations for fiscal 2004 and the final six months of fiscal 2003. The

following table represents the Company’s pro forma consolidated results

of operations as if the acquisition of SWS had occurred at the beginning

of each period presented. Such results have been prepared by adjusting

the historical Company results to include SWS results of operations and

incremental interest and other expenses related to acquisition debt.

The pro forma results do not include any cost savings resulting from the

combination of Energizer and SWS operations. The pro forma results

may not necessarily reflect the consolidated operations that would have

existed had the acquisition been completed at the beginning of such

periods nor are they necessarily indicative of future results.

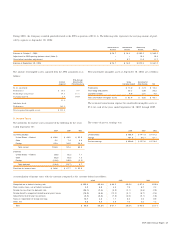

UNAUDITED PRO FORMA FOR THE YEAR ENDED

SEPTEMBER 30, 2003 2002

Net sales $ 2,544.5 $ 2,364.8

Net earnings 167.9 195.4

Basic earnings per share 1.95 2.15

Diluted earnings per share 1.90 2.11

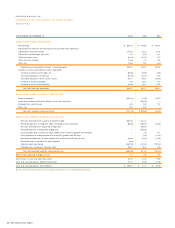

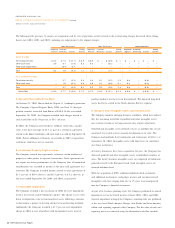

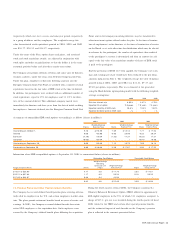

4. Restructuring Activities

In March 2002, the Company adopted a restructuring plan to reorganize

certain European selling, management, administrative and packaging

activities. The total cost of this plan was $6.7 before taxes. These

restructuring charges consist of $5.2 for cash severance payments, $1.0

of other cash charges and $0.5 in enhanced pension benefits. As of

September 30, 2004, 55 employees had been terminated under the

plan and all activities under the plan have been completed.

During fiscal 2001, the Company adopted restructuring plans to

eliminate carbon zinc capacity and to reduce and realign certain selling,

production, research and administrative functions. In 2002, the Company

recorded provisions for restructuring of $1.4 related to the 2001 plan

and recorded net reversals of previously recorded restructuring charges

of $0.4.

The 2001 restructuring plans improved the Company’s operating effi-

ciency, downsized and centralized corporate functions, and decreased

costs. One carbon zinc production facility in Mexico was closed in

early 2002. A total of 539 employees were terminated, consisting of

340 production and 199 sales, research and administrative employees,

primarily in the U.S. and Latin America. The 2001 restructuring

plan yielded pre-tax savings of $14.3 in 2002 and $16.5 in 2003

and beyond.

The Company continues to review its battery production capacity and

its business structure in light of pervasive global trends, including the

evolution of technology. Future restructuring activities and charges may

be necessary to optimize its production capacity. Such charges may

include impairment of production assets and employee termination costs.

The carrying value of assets held for disposal under several previous

restructuring plans was $6.3 at September 30, 2004.

ENR 2004 Annual Report 29