Energizer 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2004 Annual Report 33

respectively, which vest over a seven- and nine-year period, respectively,

to a group of officers and key employees. The weighted-average fair

value for restricted stock equivalents granted in 2004, 2003 and 2002

was $38.77, $28.52 and $18.97, respectively.

Under the terms of the Plan, option shares and prices, and restricted

stock and stock equivalent awards, are adjusted in conjunction with

stock splits and other recapitalizations so that the holder is in the same

economic position before and after these equity transactions.

The Company also permits deferrals of bonus and salary and, for directors,

retainers and fees, under the terms of its Deferred Compensation Plan.

Under this plan, employees or directors deferring amounts into the

Energizer Common Stock Unit Fund are credited with a number of stock

equivalents based on the fair value of ENR stock at the time of deferral.

In addition, the participants were credited with an additional number of

stock equivalents, equal to 25% for employees and 33 1/3% for direc-

tors, of the amount deferred. This additional company match vests

immediately for directors and three years from the date of initial crediting

for employees. Amounts deferred into the Energizer Common Stock Unit

Fund, and vested company matching deferrals, may be transferred to

other investment options offered under the plan. At the time of termina-

tion of employment, or for directors, at the time of termination of service

on the Board, or at such other time for distribution which may be elected

in advance by the participant, the number of equivalents then credited

to the participant’s account is determined and then an amount in cash

equal to the fair value of an equivalent number of shares of ENR stock

is paid to the participant.

Had the provisions of SFAS 123 been applied, the Company’s net earn-

ings and earnings per share would have been reduced to the pro forma

amounts indicated in Note 2. The weighted-average fair value of options

granted in fiscal 2004, 2003 and 2002 was $14.81, $9.37 and

$9.65 per option, respectively. This was estimated at the grant date

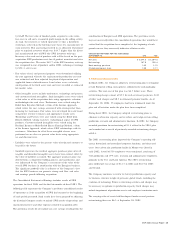

using the Black-Scholes option-pricing model with the following weighted-

average assumptions:

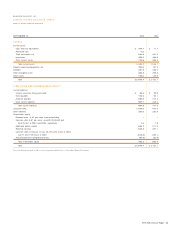

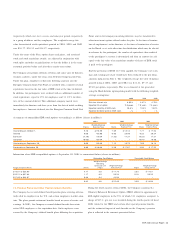

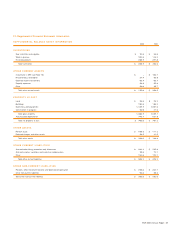

2004 2003 2002

Risk-free interest rate 3.92% 3.47% 4.70%

Expected life of option 7.5 years 7.5 years 7.5 years

Expected volatility of ENR stock 19.4% 19.5% 19.0%

Expected dividend yield on ENR stock – % – % – %

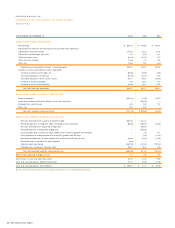

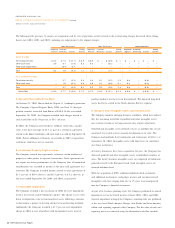

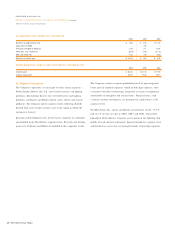

A summary of nonqualified ENR stock options outstanding is as follows (shares in millions):

2004 2003 2002

Weighted-Average Weighted-Average Weighted-Average

Shares Exercise Price Shares Exercise Price Shares Exercise Price

Outstanding on October 1, 7.12 $ 19.75 7.69 $ 18.14 7.71 $ 17.54

Granted 0.68 43.98 0.95 28.99 0.52 26.34

Exercised (1.15) 18.04 (1.52) 17.37 (0.52) 17.31

Cancelled (0.03) 26.04 – – (0.02) 19.80

Outstanding on September 30, 6.62 22.49 7.12 19.75 7.69 18.14

Exercisable on September 30, 3.99 $ 18.08 3.36 $ 17.67 3.04 $ 17.52

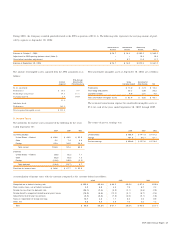

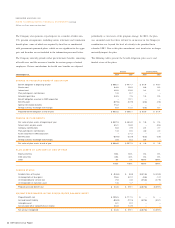

Information about ENR nonqualified options at September 30, 2004 is summarized below (shares in millions):

Outstanding Stock Options Exercisable Stock Options

Weighted-Average

Remaining

Contractual Life Weighted-Average Weighted-Average

Range of Exercise Prices Shares (Years) Exercise Price Shares Exercise Price

$16.81 to $25.05 4.77 5.8 $ 17.76 3.83 $ 17.61

$25.21 to $37.84 1.17 8.5 29.33 0.16 29.25

$37.85 to $44.67 0.68 9.4 43.98 – –

6.62 6.6 $ 22.49 3.99 $ 18.08

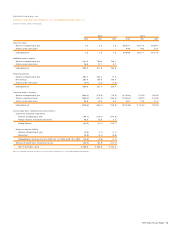

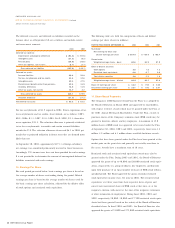

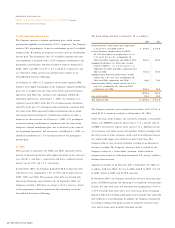

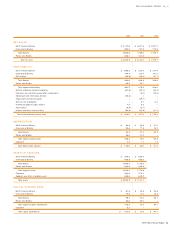

12. Pension Plans and Other Postretirement Benefits

The Company has several defined benefit pension plans covering substan-

tially all of its employees in the U.S. and certain employees in other coun-

tries. The plans provide retirement benefits based on years of service and

earnings. In 2003, the Company assumed defined benefits for certain

active SWS employees at the acquisition date. Such employees were

covered by the Company’s defined benefit plans following the acquisition.

During the fourth quarter of fiscal 2004, the Company announced a

Voluntary Enhanced Retirement Option (VERO) offered to approximately

600 eligible employees in the U.S. of which 321 employees accepted. A

charge of $15.2, pre-tax, was recorded during the fourth quarter of fiscal

2004 related to the VERO and certain other special pension benefits,

and the estimated impact of such benefits on the Company’s pension

plan is reflected in the amounts presented below.