Energizer 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2004 Annual Report 11

Current year net earnings include the following items, stated on an

after-tax basis: income tax benefits related to prior year losses and

adjustments to prior year tax accruals of $24.7 and special termination

pension benefits of $9.6. Fiscal 2003 net earnings included the following

on an after-tax basis: expense associated with the write-up of inventory

purchased in the SWS acquisition (SWS inventory write-up) of $58.3, a

charge of early payment of long-term debt of $12.4, gain on the sale of

property of $5.7, intellectual property rights income of $5.2 and tax

benefits of $19.2 related to prior year losses and adjustments to prior

year tax accruals. Fiscal 2002 net earnings included the following after-

tax items: accounts receivable write-off associated with the bankruptcy of

Kmart of $9.3, provisions for restructuring and related costs of $7.8, tax

benefits related to prior year losses and adjustments to prior year tax

accruals of $11.8 and a gain on the sale of property of $5.0.

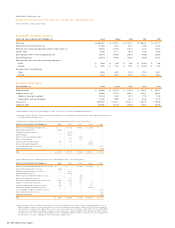

Operating Results

Net Sales

Net sales increased $580.2, or 26%, in 2004 compared to 2003 and

increased $492.8, or 28%, in 2003 compared to 2002, primarily because

the inclusion of SWS sales for a full year in 2004 and six months in 2003

following the midyear acquisition. Battery sales increased $145.1 in 2004

on higher volume and favorable currency translation impacts of $59.3.

Battery sales increased $59.8 in 2003 compared to 2002 on favorable

currency translation, and volume increases contributed $35.7 and $33.7,

respectively, partially offset by unfavorable pricing and product mix.

Gross Margin

Gross margin dollars increased $450.4 in 2004 and $182.4 in 2003,

primarily due to the SWS acquisition. Gross margin percentage was 50.1%

of sales in 2004 compared to 42.9% in 2003, the latter percentage

including a four percentage point reduction due to expense related to the

SWS inventory write-up (see Note 3 to the Consolidated Financial

Statements). Absent the SWS inventory write-up, gross margin for 2003

would have been 46.9% compared to 44.6% in 2002. The increase in

gross margin percentage in both years is primarily due to the relatively

higher margins of the SWS business versus the battery business. See

Segment Results for a discussion of gross margin in each operating segment.

Selling, General and Administrative

Selling, general and administrative expense (SG&A) increased $159.3

in 2004 and $68.1 in 2003 primarily due to the SWS acquisition.

Additionally, the 2004 increase reflects the impact of higher currency

rates of $21.9, special termination benefits of $15.2 and higher

battery overhead spending of $14.6. Selling, general and administrative

expenses were 19.3%, 17.1% and 18.1% of sales in 2004, 2003 and

2002, respectively. The increased percentage in 2004 is primarily due

to special termination benefits discussed above, higher legal expenses

and integration associated with the SWS acquisition, and the inclusion

of SWS for a full year, which has a higher SG&A percentage than the

rate for the remainder of the Company.

Advertising and Promotion

Advertising and promotion (A&P) expense increased $152.3 in 2004

and $126.5 in 2003, compared to the year immediately preceding.

The A&P expense change in 2004 and 2003 above would have

decreased by $56.6 and $57.2, respectively, had SWS been included in

2003 and 2002. The remainder of the increases reflects significantly

higher SWS spending, currency translation impacts, increases in the

International Battery segment and, in 2004, an increase in North

America Battery. A&P expense was 14.3%, 11.2% and 7.2% of sales

for 2004, 2003 and 2002, respectively. Had SWS been included for

the full year in 2003 and 2002, such percentages would have been

12.1% and 10.1% for 2003 and 2002, respectively. The increased

percentages in 2004 and 2003 reflect the factors discussed above, as

well as the increased proportion of razor and blade sales, which have

a generally higher A&P percentage than the battery business.

Research and Development

Research and development expense was $74.0 in 2004, $51.5 in 2003

and $37.1 in 2002. The increase in 2004 and 2003 is primarily due to

the SWS acquisition. Additionally, the 2004 increase includes a $4.2

asset impairment charge related to a discontinued technology develop-

ment initiative. As a percent of sales, research and development expense

was 2.6% in 2004, 2.3% in 2003 and 2.1% in 2002. Inclusion of SWS

results for a full year in 2003 and 2002 would have resulted in research

and development expense of 2.6% and 2.7%, respectively, of sales.

Segment Results

The Company’s operations are managed via three major segments – North

America Battery (the U.S. and Canada batteries and lighting products),

International Battery (rest of world battery and lighting products) and

Razors and Blades (global razors, blades and related products). The

Company reports segment results reflecting all profit derived from each

outside customer sale in the region in which the customer is located.

Research and development costs for the battery segments are combined

and included in the Total Battery segment results. Research and develop-

ment costs for Razors and Blades are included in that segment’s results.

This structure is the basis for the Company’s reportable operating

segment information presented in Note 22 to the Consolidated Financial