Energizer 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2004 Annual Report 13

pro forma SWS results for the six months ended September 30, 2002.

Segment profit excludes the SWS inventory write-up, which is discussed

in further detail in Note 3 to the Consolidated Financial Statements.

For the year ended September 30, 2004, sales increased $123.1, or

17%, as incremental sales of Intuition and QUATTRO and $52.4 of

favorable currency were partially offset by anticipated declines in other

product lines. QUATTRO and Intuition combined contributed almost

$275 of net sales in 2004, an increase of more than $150.

Segment profit for the year increased $28.8, or 51%, to $85.7, with

currency impacts accounting for $15.7 of the improvement. Absent

currencies, higher sales and lower product costs resulted in increased

gross margin of $83.7, which was partially offset by significantly higher

advertising and promotion expense, and to a lesser extent, higher selling

expenses in support of the new brands.

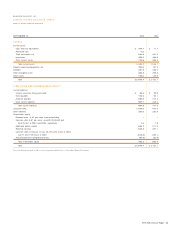

SIX MONTHS ENDED SEPTEMBER 30, 2003 2002 PRO FORMA

Net sales $ 433.0 $ 322.2

Segment profit $ 40.1 $ 26.0

For the six months ended September 30, 2003, Razors and Blades

sales were $433.0, an increase of $110.8 compared to the same period

last year, with nearly all of the increase from incremental sales of the

new Intuition and QUATTRO products, much of which represents retail

pipeline fill. For existing products, favorable currency translation of

$21.0 was nearly offset by declines in existing product sales in countries

where new products were launched.

Segment profit for the six months ended September 30, 2003, was

$40.1, an increase of $14.1 on higher sales and favorable currency

impacts of $3.4, partially offset by significantly higher advertising,

promotion, selling and marketing expense in support of Intuition and,

to a lesser extent, QUATTRO.

During the latter half of September 2003, SWS had significant pipeline fill

for QUATTRO and relatively low advertising and promotion expense as the

majority of the QUATTRO media campaign did not begin until October.

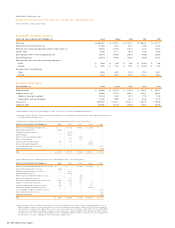

General Corporate and Other Expenses

Corporate and other expenses increased $31.3 for the year, primarily

reflecting higher legal, integration and business realignment costs, and

higher management and administrative costs following the SWS acquisi-

tion. Integration costs of $17.9 in 2004 and $6.3 in 2003 are reflected

in corporate and general expenses. Major integration activities have been

completed as of September 30, 2004. Annual integration savings are

projected at approximately $18 for 2005, of which approximately $13

was realized in 2004 and is reflected in segment results. Legal expense

increased $11.7 reflecting the impact of litigation costs in a number of

lawsuits, primarily related to intellectual property matters.

General corporate and other expenses increased $14.7 in 2003 reflecting

costs of integrating the SWS business of $6.3, as well as lower pension

income and higher management, legal and project expenses, partially offset

by lower compensation costs related to incentive plans and stock price.

As a percent of sales, general corporate and other expenses were 2.9%

in 2004, 2.2% in 2003 and 2.0% in 2002. The increase in 2004 is

driven mainly by the integration and legal expenses discussed above.

Restructuring Charges

In March 2002, the Company adopted a restructuring plan to reorganize

certain European selling, management, administrative and packaging

activities. The total cost of this plan was $6.7 before taxes. These restruc-

turing charges consist of $5.2 for cash severance payments, $1.0 of other

cash charges and $0.5 in enhanced pension benefits. As of September 30,

2004, 55 employees had been terminated under the plan and all activi-

ties under the plan have been completed. The 2002 restructuring plan

yielded pre-tax savings of $2.5 in 2003 and $4.5 annually thereafter.

During fiscal 2001, the Company adopted restructuring plans to eliminate

carbon zinc capacity and to reduce and realign certain selling, production,

research and administrative functions. In 2002, the Company recorded

provisions for restructuring of $1.4 related to the 2001 plan and recorded

net reversals of previously recorded restructuring charges of $0.4.

The 2001 restructuring plans improved the Company’s operating

efficiency, downsized and centralized corporate functions, and decreased

costs. One carbon zinc production facility in Mexico was closed in early

2002. A total of 539 employees were terminated, consisting of 340

production and 199 sales, research and administrative employees,

primarily in the U.S. and South and Central America. The 2001 restruc-

turing plan yielded pre-tax savings of $14.3 in 2002 and $16.5 in

2003 and beyond.

The Company continues to review its battery production capacity and

its business structure in light of pervasive global trends, including the

evolution of technology. Future restructuring activities and charges may

be necessary to optimize its production capacity. Such charges may

include impairment of production assets and employee termination costs.

See Note 4 to the Consolidated Financial Statements for a table that pres-

ents, by major cost component and by year of provision, activity related to

the restructuring charges discussed above during fiscal years 2004, 2003

and 2002 including any adjustments to the original charges.