Dish Network 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

81

81

Other

We are also vulnerable to fraud, particularly in the acquisition of new subscribers. While we are addressing the

impact of subscriber fraud through a number of actions, there can be no assurance that we will not continue to

experience fraud, which could impact our subscriber growth and churn. Sustained economic weakness may create

greater incentive for signal theft and subscriber fraud, which could lead to higher subscriber churn and reduced

revenue.

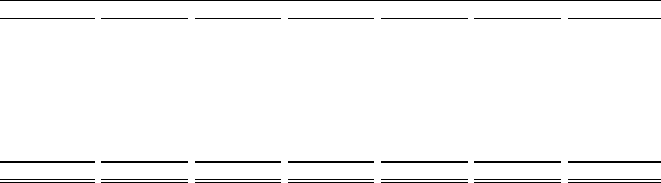

Obligations and Future Capital Requirements

Contractual Obligations and Off-Balance Sheet Arrangements

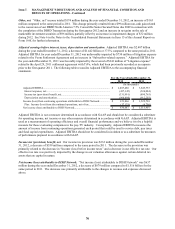

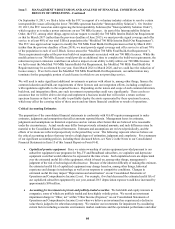

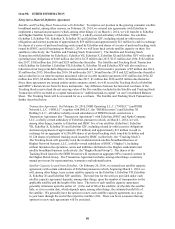

As of December 31, 2013, future maturities of our long-term debt, capital lease and contractual obligations are

summarized as follows:

Total 2014 2015 2016 2017 2018 Thereafter

Long-term debt obligations......................................................... 13,430,769$ 1,007,851$ 758,232$ 1,506,742$ 906,975$ 1,207,269$ 8,043,700$

Capital lease obligations.............................................................. 220,115 27,042 27,372 30,058 32,993 36,175 66,475

Interest expense on long-term......................................................

debt and capital lease obligations............................................. 4,740,541 839,650 742,084 656,798 600,634 530,523 1,370,852

Satellite-related obligations......................................................... 1,957,898 386,086 335,625 230,138 225,464 225,246 555,339

Operating lease obligations from continuing operations............. 179,355 45,868 36,205 31,792 15,150 8,438 41,902

Purchase obligations ................................................................... 3,051,767 1,858,654 444,657 322,254 165,059 136,059 125,084

Total............................................................................................ 23,580,445$ 4,165,151$ 2,344,175$ 2,777,782$ 1,946,275$ 2,143,710$ 10,203,352$

Payments due by period

(In thousands)

In certain circumstances the dates on which we are obligated to make these payments could be delayed. These

amounts will increase to the extent we procure insurance for our satellites or contract for the construction, launch or

lease of additional satellites.

On February 20, 2014, we entered into agreements with EchoStar to implement a transaction pursuant to which,

among other things: (i) on March 1, 2014, we will transfer to EchoStar and Hughes Satellite Systems Corporation

(“HSSC”), a wholly-owned subsidiary of EchoStar, five satellites (EchoStar I, EchoStar VII, EchoStar X, EchoStar

XI and EchoStar XIV, including related in-orbit incentive obligations and interest payments of approximately $59

million) and approximately $11 million in cash in exchange for shares of a series of preferred tracking stock issued

by EchoStar and shares of a series of preferred tracking stock issued by HSSC; and (ii) beginning on March 1, 2014,

we will lease back certain satellite capacity on these five satellites (collectively, the “Satellite and Tracking Stock

Transaction”). The Satellite and Tracking Stock Transaction with EchoStar for EchoStar I, EchoStar VII, EchoStar

X, EchoStar XI and EchoStar XIV will result in operating lease obligations of $148 million due 2014, $175 million

due 2015, $123 million due 2016, $102 million due 2017, $102 million due 2018 and $329 million due thereafter.

These obligations are not included in the table above. The Satellite and Tracking Stock Transaction with EchoStar

for EchoStar I, EchoStar VII, EchoStar X, EchoStar XI and EchoStar XIV will also result in a reduction of our long-

term debt obligations associated with our in-orbit incentive payments of $5 million due 2014, $5 million due 2015,

$4 million due 2016, $4 million due 2017, $4 million due 2018 and $22 million due thereafter and a reduction in our

interest expense associated with our in-orbit incentive payments of $3 million due 2014, $2 million due 2015, $2

million due 2016, $2 million due 2017, $1 million due 2018 and $5 million due thereafter. See Note 21 in the Notes

to our Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K for further discussion of

our Subsequent Events.

In addition, the table above does not include $151 million of liabilities associated with unrecognized tax benefits that

were accrued, as discussed in Note 12 in the Notes to our Consolidated Financial Statements in Item 15 of this Annual

Report on Form 10-K, and are included on our Consolidated Balance Sheets as of December 31, 2013. We do not

expect any portion of this amount to be paid or settled within the next twelve months.