Dish Network 2013 Annual Report Download - page 72

Download and view the complete annual report

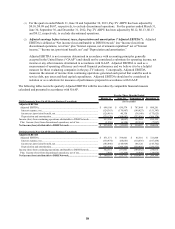

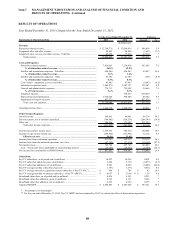

Please find page 72 of the 2013 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

62

62

Discontinued Operations - Blockbuster

On April 26, 2011, we completed the Blockbuster Acquisition. Blockbuster primarily offered movies and video

games for sale and rental through multiple distribution channels such as retail stores, by-mail, digital devices, the

blockbuster.com website and the BLOCKBUSTER On Demand® service. Since the Blockbuster Acquisition, we

continually evaluated the impact of certain factors, among others, competitive pressures, the ability of significantly

fewer company-owned domestic retail stores to continue to support corporate administrative costs, and other issues

impacting the store-level financial performance of our company-owned domestic retail stores. Certain factors,

among others, previously led us to close a significant number of company-owned domestic retail stores during 2012

and 2013. On November 6, 2013, we announced that Blockbuster would close all of its remaining company-owned

domestic retail stores and discontinue the Blockbuster by-mail DVD service. As of December 31, 2013,

Blockbuster had ceased all material operations. Accordingly, our Consolidated Balance Sheets, Statements of

Operations and Comprehensive Income (Loss) and Consolidated Statements of Cash Flows have been recast to

present Blockbuster as discontinued operations for all periods presented and the amounts presented in our Notes to

the Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K relate only to our continuing

operations, unless otherwise noted.

During the third quarter 2013, we determined that our Blockbuster operations in Mexico (“Blockbuster Mexico”)

were “held for sale.” As a result, we recorded pre-tax impairment charges of $19 million related to exiting the

business, which was recorded in “Income (loss) from discontinued operations, net of tax” on our Consolidated

Statements of Operations and Comprehensive Income (Loss) for the year ended December 31, 2013. On January

14, 2014, we completed the sale of Blockbuster Mexico.

On January 16, 2013, Blockbuster Entertainment Limited and Blockbuster GB Limited, our Blockbuster operating

subsidiaries in the United Kingdom, entered into administration proceedings in the United Kingdom (the

“Administration”). As a result of the Administration, we wrote down the assets of all our Blockbuster UK

subsidiaries to their estimated net realizable value on our Consolidated Balance Sheets as of December 31, 2012. In

total, we recorded charges of approximately $46 million on a pre-tax basis related to the Administration, which was

recorded in “Income (loss) from discontinued operations, net of tax” on our Consolidated Statements of Operations

and Comprehensive Income (Loss) for the year ended December 31, 2012.

Wireless Spectrum

In 2008, we paid $712 million to acquire certain 700 MHz wireless spectrum licenses, which were granted to us by

the FCC in February 2009 subject to certain interim and final build-out requirements. On March 2, 2012, the FCC

approved the transfer of 40 MHz of AWS-4 wireless spectrum licenses held by DBSD North America and TerreStar

to us. On March 9, 2012, we completed the DBSD Transaction and the TerreStar Transaction, pursuant to which we

acquired, among other things, certain satellite assets and wireless spectrum licenses held by DBSD North America

and TerreStar. The total consideration to acquire the DBSD North America and TerreStar assets was approximately

$2.860 billion. The financial results of DBSD North America and TerreStar are included in our results beginning

March 9, 2012.

We generated $2 million and $1 million of revenue for the years ended December 31, 2013 and 2012, respectively,

from our wireless segment. In addition, we incurred operating losses of $591 million and $64 million for the years

ended December 31, 2013 and 2012, respectively. Operating losses for the year ended December 31, 2013 included

a $438 million impairment charge for the T2 and D1 satellites, $53 million of additional depreciation expense

related to the accelerated depreciable lives of certain assets designed to support the TerreStar MSS business, which

ceased operations during the second quarter 2013, $48 million of deprecation expense and $34 million of legal and

financial advisory fees related to our proposed mergers and acquisitions. See Note 8 in the Notes to the

Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K for further information.

We incur general and administrative expenses associated with certain satellite operations and regulatory compliance

matters from our wireless spectrum assets. We also incur depreciation and amortization expenses associated with

certain assets of DBSD North America and TerreStar. As we review our options for the commercialization of this

wireless spectrum, we may incur significant additional expenses and may have to make significant investments

related to, among other things, research and development, wireless testing and wireless network infrastructure.